Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

CFPB penalties in 2023 approach $4B

Friday, Feb. 16, 2024, 10:34 AM

SubPrime Auto Finance News Staff

The Consumer Financial Protection Bureau recently recapped the monetary impact the regulator made through its enforcement actions and other moves last year. In 2023, the CFPB said it filed 29 enforcement actions and resolved through final orders with six previously ... [Read More]

S&P Global Ratings projects second straight year of record auto securitizations

Thursday, Feb. 15, 2024, 10:38 AM

SubPrime Auto Finance News Staff

S&P Global Ratings is projecting the auto securitization market to grow this year after setting a record in 2023. Analysts explained this week that pent-up demand for vehicles drove new-car sales 13% higher year-over-year to 15.5 million units in 2023, ... [Read More]

Agenda for NARS 2024 now available

Wednesday, Feb. 14, 2024, 12:01 PM

SubPrime Auto Finance News Staff

The American Recovery Association released its agenda for the 2024 North American Repossessors Summit, which is scheduled for April 11-12 in Orlando, Fla. Along with the annual golf tournament and silent auction to raise money for the Repo Alliance Lobbyist ... [Read More]

PODCAST: Reviewing FTC’s past & present with Terry O’Loughlin of Reynolds and Reynolds

Wednesday, Feb. 14, 2024, 11:20 AM

SubPrime Auto Finance News Staff

For this episode of the Auto Remarketing Podcast recorded in Las Vegas at this year’s Vehicle Finance Conference hosted by the American Financial Services Association, we share another visit with one of the industry’s great historians: Terry O’Loughlin, who is ... [Read More]

Launcher & Scienaptic AI look to boost credit access & underwriting via partnership

Wednesday, Feb. 14, 2024, 11:19 AM

SubPrime Auto Finance News Staff

This week, Launcher and Scienaptic AI announced their full integration for mutual auto finance clients to make more advanced underwriting decisions. The companies said they’re able to achieve that objective by incorporating artificial intelligence-powered underwriting signals within Launcher’s appTRAKER Loan ... [Read More]

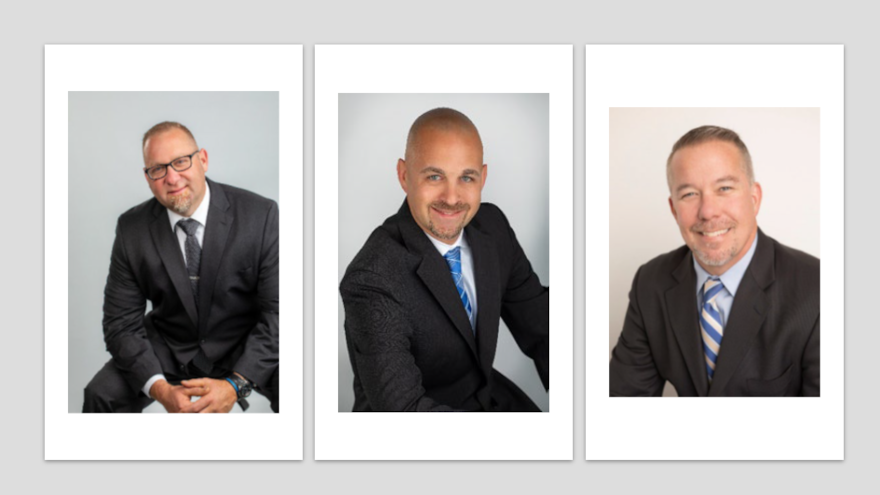

ARS promotes 3 executives after CEO’s passing

Tuesday, Feb. 13, 2024, 11:30 AM

SubPrime Auto Finance News Staff

The Patrick K. Willis Co., which does business as American Recovery Service (ARS), had to make three executive changes this week following the passing of Peter Willingham, who was chief executive officer since 2010. Taking over as CEO is Dave ... [Read More]

Primeritus continues revamp by naming new CEO

Tuesday, Feb. 13, 2024, 09:31 AM

Nick Zulovich, Senior Editor

The professional connection of Jennifer Turnage and Steve Norwood dates to 2005 when Norwood co-founded Consolidated Asset Recovery Systems (CARS) and Turnage served as chief financial officer of the company for seven years. Primeritus Financial Services acquired CARS in 2019 ... [Read More]

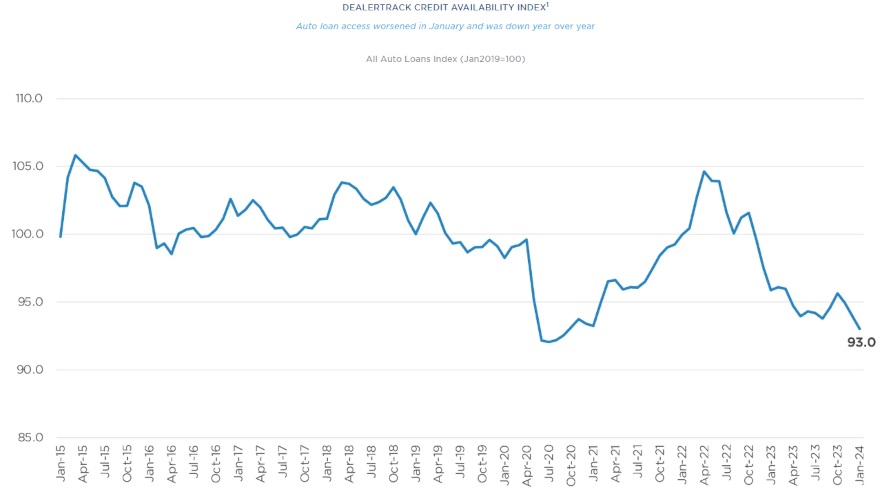

Dealertrack Credit Availability Index dips to lowest point in more than 3 years

Monday, Feb. 12, 2024, 10:27 AM

SubPrime Auto Finance News Staff

It was pretty chilly throughout much of the country in January, especially at finance companies based on the newest Dealertrack Credit Availability Index. Cox Automotive reported on Monday that the index reading declined to 93.0 in January. That’s 3% below ... [Read More]

PODCAST: More insight into near- & non-prime financing with Open Lending

Monday, Feb. 12, 2024, 10:25 AM

SubPrime Auto Finance News Staff

Just before last month’s Vehicle Finance Conference hosted by the American Financial Services Association, Open Lending released initial findings from its newest study on vehicle accessibility and automotive financing perceptions among near- and non-prime consumers. Open Lending senior vice president ... [Read More]

Fitch discusses softening used-car prices & auto ABS performance

Friday, Feb. 9, 2024, 10:17 AM

SubPrime Auto Finance News Staff

This week, Fitch Ratings offered its expectations for the securitization market in relation to the gradual softening of used-car prices. Fitch supported its assertions by citing a variety of data points from Black Book, Edmunds and federal officials about how ... [Read More]

X