A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

6 top executive moves at APCO Holdings

Tuesday, Feb. 24, 2026, 10:08 AM

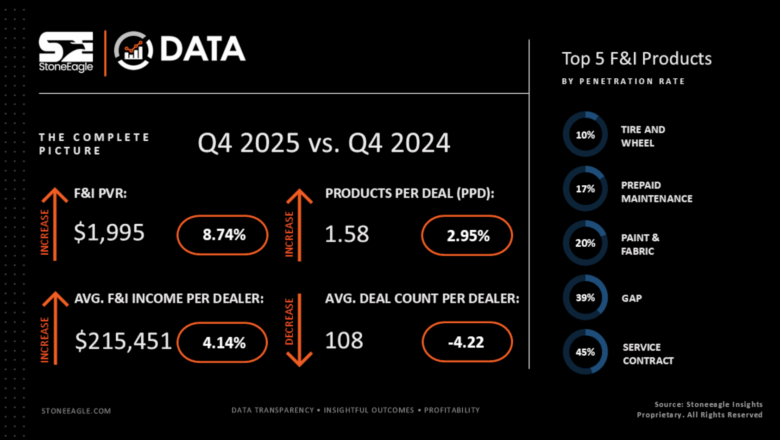

StoneEagle: PVR record in November among Q4 performances generated by dealer F&I departments

Wednesday, Feb. 25, 2026, 09:53 AM

CarMax & DOJ settle allegations of repossessing vehicles of active servicemembers

Wednesday, Feb. 25, 2026, 12:52 PM

More insight into fraud at dealerships with Experian’s Jim Maguire

Experian senior director for automotive Jim Maguire made another appearance on the Auto Remarketing Podcast to recap findings from the company’s latest dealer survey that examined the impact of fraud at dealerships. Maguire then touched on the balance dealers and ... Listen Here

Thursday, Feb. 26, 2026, 03:55 PM

Cox Automotive on guiding the modern car buyer

One of the keynote presentations from Used Car Week 2025 featured Micah Tindor and Elizabeth Stegall of Cox Automotive for a session titled, “Guiding the Modern Buyer with Trust, Tech & Smarter Trade-Ins.” Valuable study findings and dealership recommendations now ... Listen Here

Tuesday, Feb. 17, 2026, 05:17 PM

Kevin Roberts of CarGurus on 2026 Used-Car Market

Kevin Roberts, who is director of economic and market intelligence at CarGurus, is back on the show to talk about the hot start to 2026 for the retail used-car market. Roberts and Cherokee Media Group senior editor Joe Overby discuss ... Listen Here

Monday, Feb. 16, 2026, 07:18 PM

Wolters Kluwer Names Senior Attorney for Indirect Lending

Thursday, Jan. 28, 2010, 12:00 AM

Nick Zulovich

MINNEAPOLIS — Wolters Kluwer Financial Services announced Wednesday that it has named a senior attorney for its indirect lending business unit, which provides compliance tools and services to marine, RV and dealerships, and the lenders that serve them. Serving in this ... [Read More]

Huntington’s Finance & Dealer Group Doubles Market Share

Thursday, Jan. 28, 2010, 12:00 AM

Nick Zulovich

COLUMBUS, Ohio — Huntington Bancshares Finance & Dealer Services Group was the announced today that it is the No. 1 lender in Ohio for the fourth quarter of 2009. Huntington's share of loans for financing the sales of new and used ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

OPENLANE, ARA Reach Deal to Move Repo Units Online

Tuesday, Jan. 26, 2010, 12:00 AM

Nick Zulovich

REDWOOD CITY, Calif. — In an effort to help lenders save costs, OPENLANE and the American Recovery Association recently created a program to sell repossessed vehicles online. The centerpiece of the remarketing program is providing recovery agents the chance to auction vehicles online for ... [Read More]

RouteOne Completes Integration with Regional Acceptance

Tuesday, Jan. 26, 2010, 12:00 AM

Nick Zulovich

FARMINGTON HILLS, Mich. — RouteOne recently completed an integration to process credit applications electronically for a North Carolina-based lender. Dealers who conduct lender services through Regional Acceptance Corp. can now use RouteOne's platform for a reduced fee. Regional Acceptance is a wholly ... [Read More]

Credit Acceptance Announces Pricing of Senior Secured Notes

Tuesday, Jan. 26, 2010, 12:00 AM

Nick Zulovich

SOUTHFIELD, Mich. — While Credit Acceptance announced last week that it intended to offer $225 million of first priority senior secured notes due in 2017, the company came back out this week saying that it has priced $250 million of these ... [Read More]

First Investors Financial Services Now Adding Dealers, Expanding Originations

Tuesday, Jan. 26, 2010, 12:00 AM

Nick Zulovich

HOUSTON — After being cautious amidst the turmoil of the economy, First Investors Financial Services' chairman and chief executive officer told SubPrime Auto Finance News on Monday that his company is growing again, including expanding both originations and dealer base. While ... [Read More]

Compli Names New President, CEO

Thursday, Jan. 21, 2010, 12:00 AM

Nick Zulovich

PORTLAND, Ore. — Compli, a provider of work force and compliance management software, recently elevated one of its top executives into the role of president and chief executive officer. Now serving in the position is Lon Leneve, who previously was president ... [Read More]

CNW: CARS Buyers’ Remorse Drives up Late Payments, More

Thursday, Jan. 21, 2010, 12:00 AM

Nick Zulovich

BANDON, Ore. — Apparently, CNW Research discovered in October that there was already a "fair amount" of buyers' remorse related to Cash for Clunkers purchases. Since that period, the remorse level has continued to climb. More specifically, back in October, more ... [Read More]

Chase Appoints New Manager for a Calif. Custom Finance Center

Thursday, Jan. 21, 2010, 12:00 AM

Nick Zulovich

SACRAMENTO, Calif. — Chase recently named the manager of its Custom Auto Finance Center located northeast of the California state capital. Taking on this position is Phil Gouran, who will oversee the work facilitated at 2220 Douglas Blvd. in Roseville. Chase ... [Read More]

Santander Taps VINtek for Expanded Services

Thursday, Jan. 21, 2010, 12:00 AM

Nick Zulovich

PHILADELPHIA — VINtek announced this week that it has struck a deal with Santander Consumer USA to manage vehicle titles for the company's recently expanded portfolio. Officials explained that a one of the reasons for this deal is Santander's recent acquisition ... [Read More]

X