Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

GDS Link & Carleton partner to enhance calculations & decisioning

Friday, Jan. 26, 2024, 11:18 AM

SubPrime Auto Finance News Staff

GDS Link announced a strategic partnership with Carleton this week. The potential benefits derive from integrating Carleton’s financial calculations, CarletonCalcs, and lending document generation software, CarletonDocs, within GDS Link’s credit risk decisioning solutions. CarletonCalcs is a suite of configurable payment ... [Read More]

Credit Acceptance promotes long-time exec to CFO

Friday, Jan. 26, 2024, 11:17 AM

SubPrime Auto Finance News Staff

On Thursday, Credit Acceptance announced the promotion of Jay Martin to chief financial officer, a move that had become effective two days earlier. Martin joined Credit Acceptance in 2003, serving in a variety of “increasingly challenging” roles throughout his tenure. ... [Read More]

Santander study reinforces value of vehicle access

Thursday, Jan. 25, 2024, 11:36 AM

SubPrime Auto Finance News Staff

Santander Holdings USA recently announced findings from a new survey that shows middle-income American consumers were feeling optimistic in the fourth quarter, with 70% of respondents believing they are on the right track toward achieving financial prosperity and 80% believing ... [Read More]

SAFCO adds Colombian finance company as strategic partner

Wednesday, Jan. 24, 2024, 12:01 PM

SubPrime Auto Finance News Staff

Southern Auto Finance Co. (SAFCO) is adding some international support to its operation that focuses on the subprime auto finance market. Last week, SAFCO announced that Colombia-based Finanzauto has acquired a minority equity stake in the company. SAFCO said this ... [Read More]

Surveys: Optimism improving, but inflation & recession concerns remain

Tuesday, Jan. 23, 2024, 10:47 AM

SubPrime Auto Finance News Staff

With nearly a month of 2024 already in the books, experts are still trying to ascertain what might be ahead this year. While consumer sentiment is improving, top executives and finance companies still remain a bit guarded, especially when a ... [Read More]

DriveSmart Warranty gives trip to Daytona to winners of online racing campaign

Monday, Jan. 22, 2024, 11:22 AM

SubPrime Auto Finance News Staff

DriveSmart Warranty waved the checkered flag and online race winners will be going all the way to Daytona. On Friday, the administrator of vehicle protection services announced contestant Tucker Minter and streamer Casey Kirwan were the grand prize winners of ... [Read More]

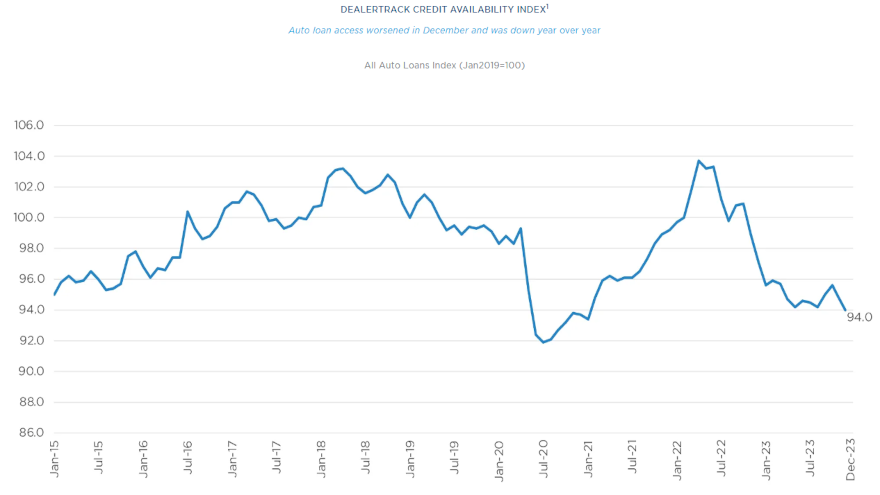

Credit availability closes 2023 on notable slide

Monday, Jan. 22, 2024, 11:21 AM

SubPrime Auto Finance News Staff

Evidently finance companies weren’t in much of a giving mood this holiday season since credit availability deteriorated in December, according to the Dealertrack Auto Credit Availability Index. Cox Automotive reported that index declined in November and dropped another 0.9% to ... [Read More]

New FTC rule delayed by dealer activity in federal appeals court

Friday, Jan. 19, 2024, 10:22 AM

SubPrime Auto Finance News Staff

Dealers will get their time in court. Late on Thursday, the Federal Trade Commission issued an order postponing the effective date of the Combating Auto Retail Scams (CARS) Rule while a legal challenge against the rule is pending from the ... [Read More]

COMMENTARY: Why lenders should leverage the power of multi-channel digital communications

Thursday, Jan. 18, 2024, 10:38 AM

Andres Huertas, Conecta Marketing Group

Digital marketing of lending products is an area that not only has bigger regulatory compliance — CFPB, FCC, states, you name it — but also bigger scrutiny from companies like Google and Facebook. (They even have a unique set of ... [Read More]

USED CAR WEEK 2023 PODCAST: Boosting repo percentages via compliance

Wednesday, Jan. 17, 2024, 12:54 PM

SubPrime Auto Finance News Staff

We continue our series on the Auto Remarketing Podcast highlighting some of the panels and presentations from Used Car Week 2023. This episode features a presentation and discussion with Holly Balogh and Stamatis Ferarolis of RISC titled, “Improve Repossession Percentages ... [Read More]

X