A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

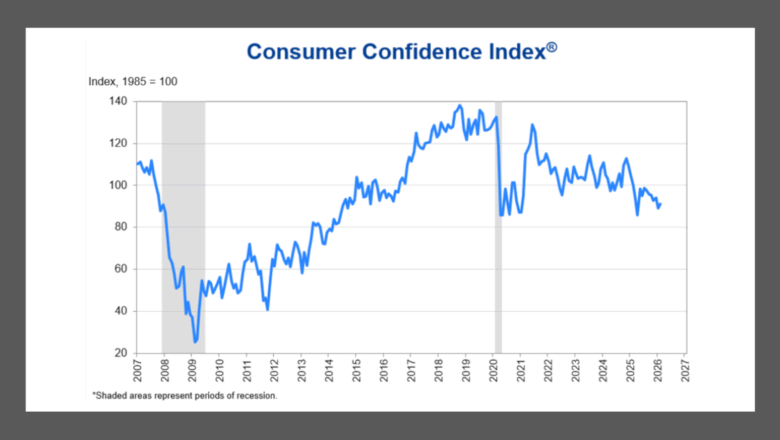

More mixed views of consumer confidence create added headwinds for vehicle purchase plans

Tuesday, Mar. 3, 2026, 10:30 AM

Fed’s Bowman outlines path to ‘tailored’ supervision

Friday, Feb. 27, 2026, 10:44 AM

Agora Data & Figure Technologies to launch first blockchain-based auto loan platform for real-world assets

Monday, Mar. 2, 2026, 10:33 AM

Dealer/consultant Luke Godwin discusses issues and opportunities facing dealers today

Luke Godwin has his finger on the pulse of the independent used-car dealer. For starters, he’s a dealer himself as owner of Godwin Motors in Columbia, S.C. He’s also a consultant working with independent dealers and a frequent speaker at ... Listen Here

Monday, Mar. 2, 2026, 10:07 PM

More insight into fraud at dealerships with Experian’s Jim Maguire

Experian senior director for automotive Jim Maguire made another appearance on the Auto Remarketing Podcast to recap findings from the company’s latest dealer survey that examined the impact of fraud at dealerships. Maguire then touched on the balance dealers and ... Listen Here

Thursday, Feb. 26, 2026, 03:55 PM

Cox Automotive on guiding the modern car buyer

One of the keynote presentations from Used Car Week 2025 featured Micah Tindor and Elizabeth Stegall of Cox Automotive for a session titled, “Guiding the Modern Buyer with Trust, Tech & Smarter Trade-Ins.” Valuable study findings and dealership recommendations now ... Listen Here

Tuesday, Feb. 17, 2026, 05:17 PM

Mint Leasing Management Expects Stronger Second Half

Tuesday, Aug. 25, 2009, 12:00 AM

Nick Zulovich

HOUSTON — For the second quarter of this year, Mint Leasing, a subprime leasing company, reported that its ability to generate revenues from new leases was "greatly restricted" by the lack of available financing. Company officials indicated that its line of ... [Read More]

A New Lender Offers Prestige Credit Commitment

Tuesday, Aug. 25, 2009, 12:00 AM

Nick Zulovich

SALT LAKE CITY — Prestige Financial Services announced on Monday that a new lender has joined with Wells Fargo Preferred Capital and Bank of America Business Capital as institutions on its line of credit. The new company to join the credit ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

ABI: Annual Bankruptcy Filings to Surge Past 1.4 Million

Tuesday, Aug. 25, 2009, 12:00 AM

Nick Zulovich

ALEXANDRIA, Va. — The total number of U.S. bankruptcies filed during the first six months climbed 36 percent over the same period in 2008, according to the American Bankruptcy Institute. Total filings reached 711,550 during the first half of the calendar ... [Read More]

Ford Credit Celebrates 50 Years

Thursday, Aug. 20, 2009, 12:00 AM

Nick Zulovich

DEARBORN, Mich. — In 1960, Ford Motor Credit Co. financed its first vehicle, a 1960 Mercury Monterey located in Indianapolis. Back then, the company only had around 12 employees with one mission — to support Ford, its dealers and customers. Today, the ... [Read More]

SubPrime Auto Finance News Offers Updated Lender Directory

Thursday, Aug. 20, 2009, 12:00 AM

Nick Zulovich

CARY, N.C. — As many lenders continue to maintain tighter underwriting and higher credit standards, hundreds if not thousands of dealers throughout the country continue to seek out new lender relationships to fill the gap, or they elect to enter the ... [Read More]

J.D. Byrider Hires New VP of Franchise Development

Thursday, Aug. 20, 2009, 12:00 AM

Nick Zulovich

CARMEL, Ind. — J.D. Byrider has hired a new vice president to run the company's franchise development. Taking on the position is Michael Pearce. He will be responsible for increasing the number of locations by licensing new franchisees to J.D. Byrider's ... [Read More]

UPDATED: GM to Immediately Provide Dealers with CARS Advances

Thursday, Aug. 20, 2009, 12:00 AM

Nick Zulovich

DETROIT — While many dealers are halting CARS deals due to the government's slow approval and reimbursement, General Motors thinks it may have found a solution to keep dealers in Cash for Clunkers business. The automaker announced today that it will ... [Read More]

Economic Conditions Cause Rise of New Repossession Trends

Tuesday, Aug. 18, 2009, 12:00 AM

Nick Zulovich

RALEIGH, N.C. — The challenges of the current economy have most industries reeling as they experience a decrease in activity. However, the repossession industry is experiencing the exact opposite. Activity is at an all-time high. That's because tough economic conditions call ... [Read More]

Fed Extends TALF, Reviews Trends in Credit Markets

Tuesday, Aug. 18, 2009, 12:00 AM

Nick Zulovich

WASHINGTON, D.C. — On Monday, the Federal Reserve Board and the Treasury Department announced that they have approved an extension in the Term Asset-Backed Securities Loan Facility. However, officials indicated that they do not foresee any additions to the types of ... [Read More]

Vehicle Acceptance Opens New Location

Tuesday, Aug. 18, 2009, 12:00 AM

Nick Zulovich

DALLAS — Vehicle Acceptance Corp. announced the addition of its newest branch office in Indianapolis, Ind. "This latest expansion of the nationwide subprime finance company is a strong indication of the healthy and growing buy-here, pay-here marketplace in the region," according ... [Read More]

X