Your service drive is filled with loyal customers who trust your dealership and are physically in your store, yet most...

Read More

AFSA offers 8 recommendations to smooth CFPB complaint database issues

Friday, Mar. 6, 2026, 09:39 AM

Experian: Subprime financing originated during a Q4 climbs to highest level in four years

Thursday, Mar. 5, 2026, 11:06 AM

Used Car Summit’s auto finance roundtable to foster conversations about collections, risk management & more

Wednesday, Mar. 4, 2026, 02:44 PM

Automotive Intelligence Award Honoree: Patrick Manzi of NADA

Our conversations with the 2026 Automotive Intelligence Award winners continue with Patrick Manzi, who is the chief economist at the National Automobile Dealers Association. Manzi , who got his first subscription to Car and Driver in his early teens, talks ... Listen Here

Friday, Mar. 6, 2026, 07:55 PM

Automotive Intelligence Award Honoree: Jessica Caldwell of Edmunds

Our conversations with the 2026 Automotive Intelligence Award winners begin with Jessica Caldwell, who is head of insights at Edmunds. Caldwell talks with Auto Remarketing senior editor Joe Overby about her journey going from working at automakers on the product ... Listen Here

Wednesday, Mar. 4, 2026, 09:18 PM

NCM & WOCAN Spotlight Emerging Dealership Leader

Ashley Cavazos, who is president of the Women of Color Automotive Network and a consultant, instructor and 20 group moderator at NCM Associates, joins the show, along with Colby Sturdivant, new-car manager at Freedom Honda Sumter in South Carolina. WOCAN ... Listen Here

Wednesday, Mar. 4, 2026, 07:35 PM

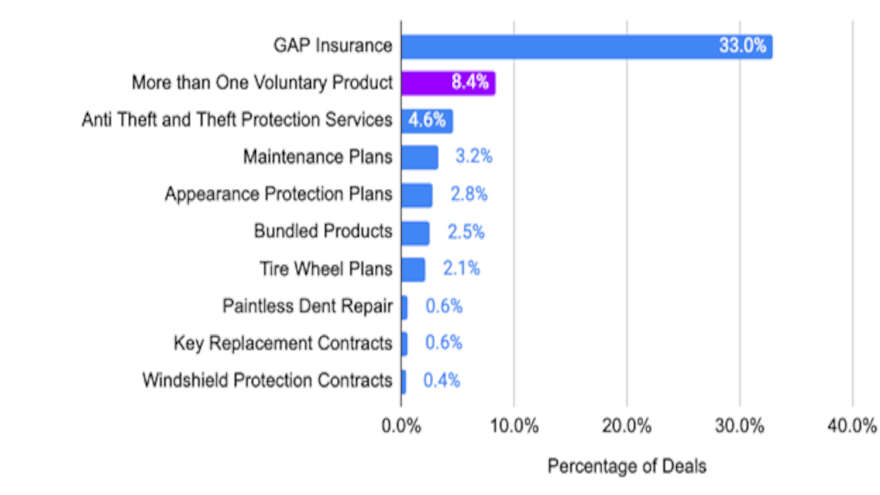

COMMENTARY: New Informed.IQ research reveals age & gender differences in vehicle add-on purchases

Tuesday, Nov. 28, 2023, 10:13 AM

Tom Oscherwitz, Informed.IQ

When consumers purchase cars at an auto dealer, they often buy supplemental products and services called voluntary protection products (VPPs). These provide additional coverage and protection for certain vehicle components or services not covered by or beyond the manufacturer’s original ... [Read More]

Open Lending now part of CUNA as associate business member

Monday, Nov. 27, 2023, 11:10 AM

SubPrime Auto Finance News Staff

Open Lending recently joined the Credit Union National Association (CUNA) as an associate business member. As a CUNA member, the provider of risk analytics solutions for financial institutions said it will elevate the credit union movement through industry advocacy and ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

The Dealer’s Guide to Smarter GPS Tracking

A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

FTC sending next installment of consumer payments from $8.8M Napleton settlement

Monday, Nov. 27, 2023, 11:09 AM

SubPrime Auto Finance News Staff

Last week, the Federal Trade Commission said it began to send a second round of payments totaling more than $857,000 to consumers who were harmed by Illinois-based Napleton Automotive Group’s “junk fees” and discriminatory practices. The FTC and the state ... [Read More]

PODCAST: Gauging client mood with Allied Solutions

Wednesday, Nov. 22, 2023, 10:39 AM

SubPrime Auto Finance News Staff

Allied Solutions executive vice president and chief growth officer Mark Bugalski spent some of his time during Used Car Week for this episode of the Auto Remarketing Podcast. Bugalski responded when asked to describe the beverage company clients might be ... [Read More]

PODCAST: Talking ‘junk fees’ with Hudson Cook’s Patty Covington

Wednesday, Nov. 22, 2023, 10:39 AM

SubPrime Auto Finance News Staff

Hudson Cook partner Patty Covington is embarking on a new series with the Auto Remarketing Podcast, discussing compliance and other matters associated with auto finance. A former Women in Auto Finance honoree, Covington tackles a topic that’s been a lightning ... [Read More]

PODCAST: 1-on-1 with Rockwood Recovery owner Jennifer Liagre

Wednesday, Nov. 22, 2023, 10:35 AM

SubPrime Auto Finance News Staff

Jennifer Liagre, owner of Michigan-based Rockwood Recovery and one of this year’s Women in Collections and Recoveries honorees, spent some time for this episode of the Auto Remarketing Podcast immediately after being on stage with other award winners at Used ... [Read More]

Experts spot negative auto-finance readings not seen in 17 years

Tuesday, Nov. 21, 2023, 10:29 AM

SubPrime Auto Finance News Staff

For the first time in the history of Used Car Week, the workshops and panel discussions focused on repossessions were some of the highest-attended portions of the entire event, which unfolded earlier this month. In some instances, demand for repo ... [Read More]

CFPB hits Toyota Motor Credit with $60M penalty for refund & credit reporting misconduct

Monday, Nov. 20, 2023, 11:13 AM

SubPrime Auto Finance News Staff

The Consumer Financial Protection Bureau (CFPB) made serious allegations against Toyota Motor Credit Corp., and ordered the captive on Monday to pay $60 million in consumer redress and penalties. The bureau said Toyota Motor Credit received these penalties for operating ... [Read More]

Tekion & Service Payment Plan partner to boost dealer success in F&I

Friday, Nov. 17, 2023, 10:38 AM

SubPrime Auto Finance News Staff

Tekion wants to make F&I easier for dealerships to complete while generating more potential profit. This week, the provider of a cloud-native platform serving the entire automotive ecosystem, announced a partnership with Service Payment Plan (SPP), a provider of 0% ... [Read More]

Allied Solutions’ latest partnership to help credit unions in capital markets

Friday, Nov. 17, 2023, 10:37 AM

SubPrime Auto Finance News Staff

This week, Allied Solutions further expanded its industry relationships and portfolio of growth-focused solutions for credit unions. The latest partnership is with Rhyze Solutions, a newly formed credit union service organization (CUSO) to support lending and capital market operations. Allied ... [Read More]

X