Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

CFPB, FTC & White House intensify pursuit to eliminate ‘junk fees’

Friday, Oct. 13, 2023, 11:49 AM

SubPrime Auto Finance News Staff

The campaign to prohibit what the regulators are continuing to call “junk fees” intensified again this week as the Biden administration, the Federal Trade Commission and the Consumer Financial Protection Bureau all made moves associated with the topic. First, the ... [Read More]

CFPB revisits ancillary product refunds in special edition of Supervisory Highlights

Thursday, Oct. 12, 2023, 11:33 AM

SubPrime Auto Finance News Staff

The Consumer Financial Protection Bureau (CFPB) released a special edition of its Supervisory Highlights this week. A portion focused on a topic that industry experts such as Allied Solutions cautioned finance companies about navigating carefully. The report delved into ancillary ... [Read More]

NAF Association adds executive retreat for 2024

Wednesday, Oct. 11, 2023, 11:20 AM

SubPrime Auto Finance News Staff

The National Automotive Finance Association plans to host two major industry events in 2024. Along with its Non-Prime Auto Financing Conference in June, the NAF Association announced details of second gathering. The organization said the 2024 Auto Finance C-Suite Retreat ... [Read More]

Details of new awards program from Open Lending

Wednesday, Oct. 11, 2023, 11:14 AM

SubPrime Auto Finance News Staff

Following up from its recent Executive Lending Roundtable, Open Lending announced the launch of what the provider of contract analytics, risk-based pricing, risk modeling and default insurance called the Open Lending Economic Vehicle Accessibility Awards (EVAAs). The company said this ... [Read More]

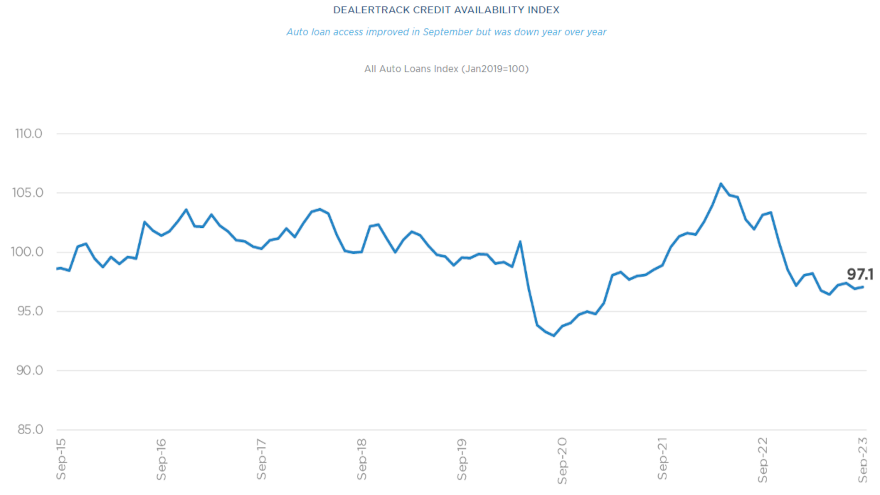

Even with slight improvement in September, auto credit availability remains tight

Tuesday, Oct. 10, 2023, 10:38 AM

SubPrime Auto Finance News Staff

The Dealertrack Credit Availability Index for September showed some slight improvement, as Cox Automotive reported on Tuesday that credit access was made more accessible. But compared to this time last year or before the pandemic, it’s still a challenge in ... [Read More]

StoneEagle reveals CTO transition

Monday, Oct. 9, 2023, 11:25 AM

SubPrime Auto Finance News Staff

Last week, StoneEagle announced the transition of its chief technology officer, as Gary Peek will take on the role from Chris Tynes, who has been with the provider of F&I and service metrics reporting, menu sales tools, an F&I product ... [Read More]

Dealer eProcess to host webinar about 5 ways to leverage credit prequalification

Friday, Oct. 6, 2023, 10:27 AM

SubPrime Auto Finance News Staff

Dealer eProcess said that understanding how to leverage credit prequalification is crucial for maximizing your dealership’s success. So the comprehensive website and digital marketing solution recruited CreditMiner vice president of strategic partnerships Ken Luna to host an education webinar about ... [Read More]

FTC joins CFPB in seeking reversal of appeals court decision involving FCRA

Thursday, Oct. 5, 2023, 09:53 AM

SubPrime Auto Finance News Staff

Last week, the Federal Trade Commission joined the Consumer Financial Protection Bureau in filing an amicus brief in the U.S. Court of Appeals for the Second Circuit. The agencies urging reversal of a district court decision that said they say ... [Read More]

ARA now accepting nominations for 9 industry awards

Wednesday, Oct. 4, 2023, 12:30 PM

SubPrime Auto Finance News Staff

The American Recovery Association is deep into its planning for the 2024 North American Repossessors Summit, which is scheduled for April 11-12 in Orlando, Fla. Through Halloween, ARA is accepting nominations for nine awards that will be given during NARS. ... [Read More]

Lucas Oil & Dealer Advantage Group roll out 2 F&I programs

Wednesday, Oct. 4, 2023, 12:27 PM

SubPrime Auto Finance News Staff

This week, Lucas Oil announced a new partnership with Dealer Advantage Group to offer two new exclusive Lucas Oil-branded F&I programs to dealerships. The company highlighted Lucas Oil Paint & Interior Program and Lucas Oil Engine for Life Program, available ... [Read More]

X