Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Crédito Real USA Finance gains new Mexican ownership

Friday, Apr. 21, 2023, 10:29 AM

SubPrime Auto Finance News Staff

Crédito Real USA Finance (CRUSAFin) — whose roots stem from AFS Acceptance that began originating subprime auto financing with independent dealerships more than 15 years ago — gained new ownership this week. Bepensa Capital announced through a news release that ... [Read More]

Advanced Dealer Solutions taps Osborne as GM

Friday, Apr. 21, 2023, 10:29 AM

SubPrime Auto Finance News Staff

This week, Advanced Dealer Solutions welcomed Bruce Osborne as general manager, bringing three decades of experience serving the F&I industry in a variety of roles since making his start in automotive retail. The full-service, dealer development agency focused on automotive, ... [Read More]

FTC extends public comment period involving proposed rule over noncompete clauses

Monday, Apr. 17, 2023, 11:44 AM

SubPrime Auto Finance News Staff

Perhaps in part because of concerns raised by the National Independent Automobile Dealers Association, U.S. Chamber of Commerce and dozens of other associations, the Federal Trade Commission is allowing for more time to receive information regarding its proposed rule to ... [Read More]

23 awards given during ARA Convention & NARS 2023

Thursday, Apr. 13, 2023, 04:30 PM

SubPrime Auto Finance News Staff

Last week’s repossession industry events hosted by the American Recovery Association included the awarding of 23 honors by the organization as well as DRN. First during ARA’s 59th annual convention, the association gave the following honors: Key Award Marcus Potter ... [Read More]

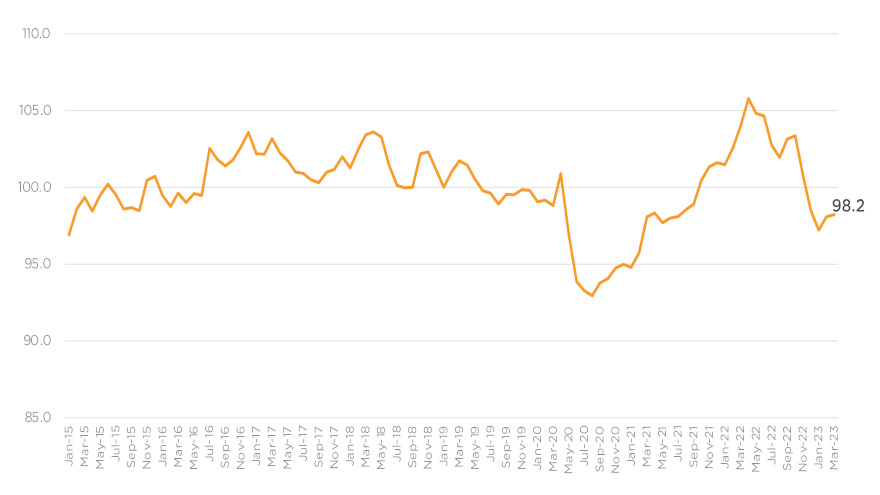

While auto credit loosened in March, deeper details tell different stories

Thursday, Apr. 13, 2023, 10:56 AM

SubPrime Auto Finance News Staff

Along with examining the employment scene, Cox Automotive tried to decipher how easily dealerships could get contracts bought in March by their networks of finance companies. According to the Dealertrack Credit Availability Index, access to auto credit loosened slightly in ... [Read More]

Allied Solutions forges partnership with MANTL

Wednesday, Apr. 12, 2023, 12:00 PM

Nick Zulovich

Allied Solutions added to its portfolio of industry partnerships last week. The providers of insurance, financing, risk management and data-enabled products announced a new relationship with MANTL, a leading provider of account origination solutions for banks and credit unions. Allied ... [Read More]

Equifax, Experian & TransUnion remove medical collections debt under $500 on credit reports

Tuesday, Apr. 11, 2023, 10:22 AM

SubPrime Auto Finance News Staff

In a move that could influence auto finance underwriting, Equifax, Experian and TransUnion jointly announced on Tuesday that medical collection debt with an initial reported balance of less than $500 has been removed from U.S. consumer credit reports. With this ... [Read More]

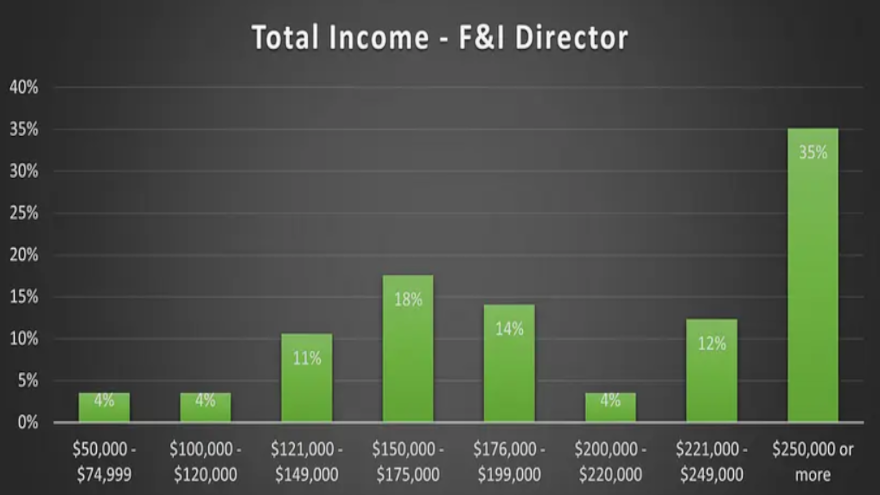

F&I survey shows majority of managers earn total income of at least $250K

Tuesday, Apr. 4, 2023, 04:39 PM

SubPrime Auto Finance News Staff

Want to make major money at a dealership? Be a successful F&I director. According to the 2023 survey of F&I managers and directors orchestrated by Finance Manager Training, 35% of professionals who participated earned total income of $250,000 or more. ... [Read More]

Sunbit expands pay-over-time solutions to F&I departments

Tuesday, Apr. 4, 2023, 04:38 PM

SubPrime Auto Finance News Staff

Sunbit recently announced that it has expanded its footprint within auto dealerships, now offering its technology to power pay-over-time solutions to F&I departments. The company building financial technology for everyday expenses explained that this expansion will allow F&I departments to ... [Read More]

CFPB releases new policy statement about abusive conduct

Tuesday, Apr. 4, 2023, 10:42 AM

SubPrime Auto Finance News Staff

The Consumer Financial Protection Bureau (CFPB) is looking to clarify what constitutes abusive conduct in consumer financial markets. On Monday, the bureau issued a policy statement that the regulator said explains the legal prohibition of that abusive conduct and summarizes ... [Read More]

X