AFSA offers 8 recommendations to smooth CFPB complaint database issues

Friday, Mar. 6, 2026, 09:39 AM

Experian: Subprime financing originated during a Q4 climbs to highest level in four years

Thursday, Mar. 5, 2026, 11:06 AM

Used Car Summit’s auto finance roundtable to foster conversations about collections, risk management & more

Wednesday, Mar. 4, 2026, 02:44 PM

Automotive Intelligence Award Honoree: Patrick Manzi of NADA

Our conversations with the 2026 Automotive Intelligence Award winners continue with Patrick Manzi, who is the chief economist at the National Automobile Dealers Association. Manzi , who got his first subscription to Car and Driver in his early teens, talks ... Listen Here

Friday, Mar. 6, 2026, 07:55 PM

Automotive Intelligence Award Honoree: Jessica Caldwell of Edmunds

Our conversations with the 2026 Automotive Intelligence Award winners begin with Jessica Caldwell, who is head of insights at Edmunds. Caldwell talks with Auto Remarketing senior editor Joe Overby about her journey going from working at automakers on the product ... Listen Here

Wednesday, Mar. 4, 2026, 09:18 PM

NCM & WOCAN Spotlight Emerging Dealership Leader

Ashley Cavazos, who is president of the Women of Color Automotive Network and a consultant, instructor and 20 group moderator at NCM Associates, joins the show, along with Colby Sturdivant, new-car manager at Freedom Honda Sumter in South Carolina. WOCAN ... Listen Here

Wednesday, Mar. 4, 2026, 07:35 PM

Weltman, Weinberg & Reis adds 5 attorneys to Chicago office, donates to Feeding America network

Wednesday, Nov. 26, 2025, 01:48 PM

SubPrime Auto Finance News Staff

Along with making donations to local food banks and pantries in the Feeding America network, Weltman, Weinberg & Reis Co., added to its stable of legal professionals at its Chicago office. This month, the firm welcomed five new attorneys: Tresina ... [Read More]

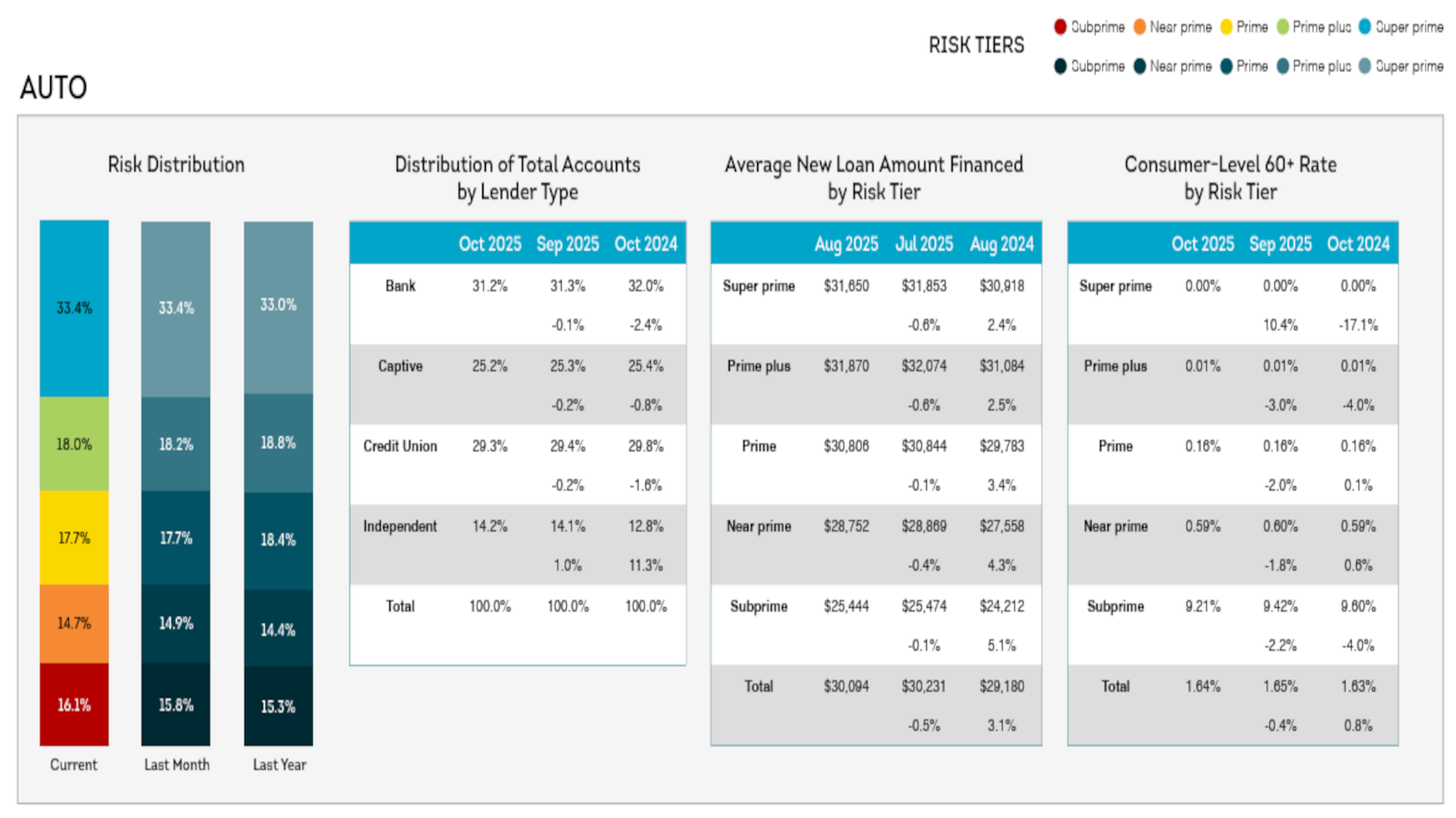

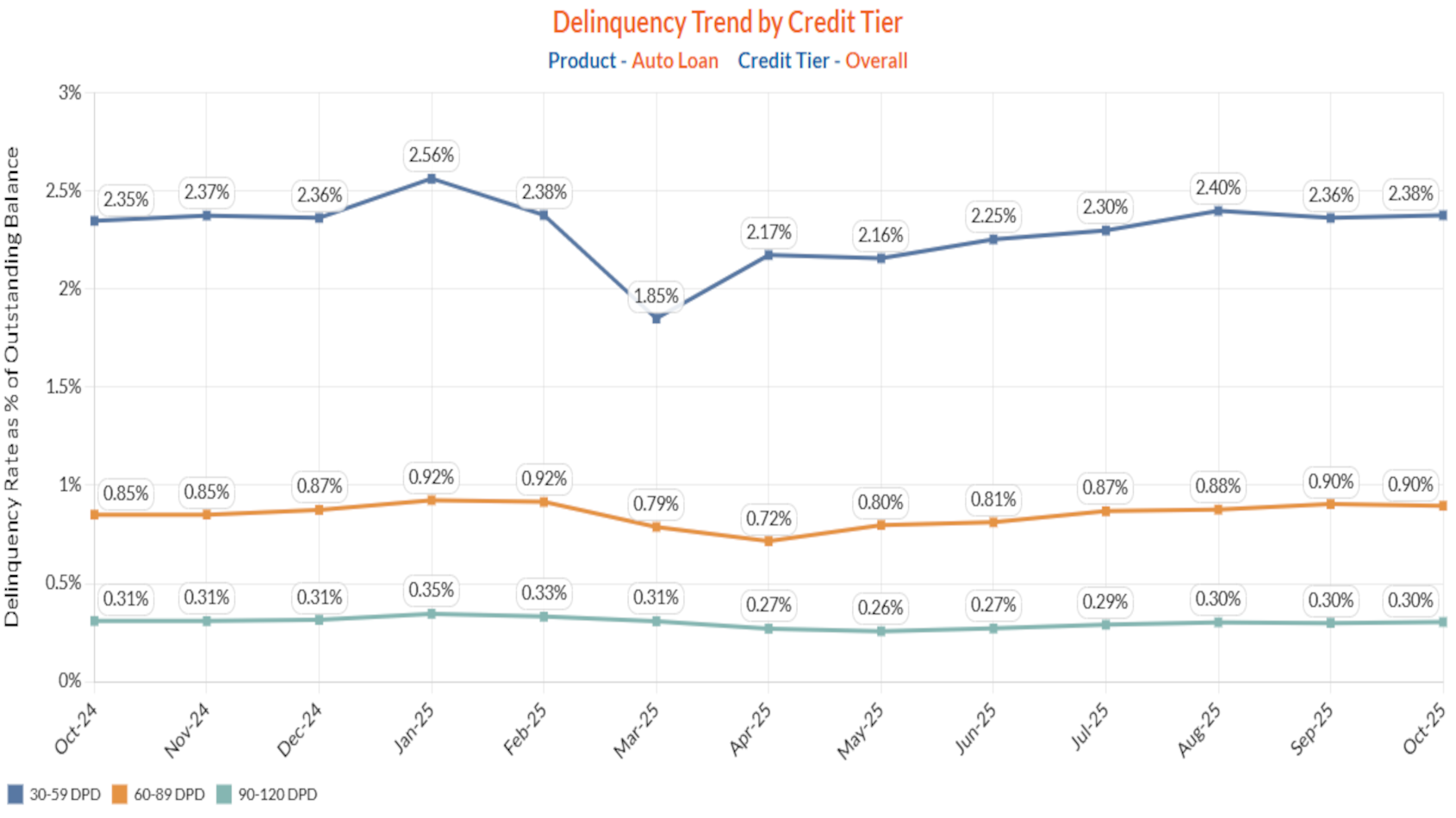

Auto snippets from TransUnion’s October 2025 Credit Industry Snapshot

Wednesday, Nov. 26, 2025, 10:07 AM

SubPrime Auto Finance News Staff

Are auto-finance providers taking on more risk or are there simply more consumers who fall into the subprime credit tier? Here some more data to consider. As Cox Automotive’s information showed credit access improved a bit in October, TransUnion’s October ... [Read More]

October data from Cox Automotive & VantageScore shows expanded credit access but growing delinquency

Tuesday, Nov. 25, 2025, 10:21 AM

SubPrime Auto Finance News Staff

You can make your own judgements about the state of the credit market based on October data from Cox Automotive and VantageScore. In October, Cox Automotive reported, the Dealertrack Credit Availability Index resumed its upward trend of improved credit access ... [Read More]

InterVest to acquire Flagship Credit Acceptance with Landy set to be CEO

Monday, Nov. 24, 2025, 10:40 AM

SubPrime Auto Finance News Staff

The next chapter in Jim Landy’s career in auto finance will arrive through another acquisition involving a lender and an investment firm. Last week, Flagship Credit Acceptance announced that affiliates of InterVest Capital Partners, a New York-based specialty finance investment ... [Read More]

PAR hires Dave Baker as vice president

Friday, Nov. 14, 2025, 01:26 PM

SubPrime Auto Finance News Staff

OPENLANE subsidiary PAR has a new vice president — someone familiar to the repossession and recovery industries. Coming aboard with three decades of experience spanning corporate operations, law enforcement, and compliance management is Dave Baker, who will serve as the ... [Read More]

Equifax launches new anti-money laundering solutions to help banks, credit unions & financial services companies

Friday, Nov. 14, 2025, 10:16 AM

Nick Zulovich

Equifax doesn’t want financial services firms and related industries to land in trouble for not meeting anti-money laundering (AML) mandates. So on Friday, Equifax introduced new AML compliance solutions designed to ease the burden of regulatory compliance by flagging potential ... [Read More]

TransUnion trying to clean up credit washing with new fraud detection solution

Friday, Nov. 14, 2025, 10:16 AM

SubPrime Auto Finance News Staff

TransUnion is trying to help the financial services industry clean up the proliferation of credit washing that’s impacting auto finance and beyond. To combat credit washing — the practice of removing legitimate, accurate and non-obsolete credit data from credit profiles ... [Read More]

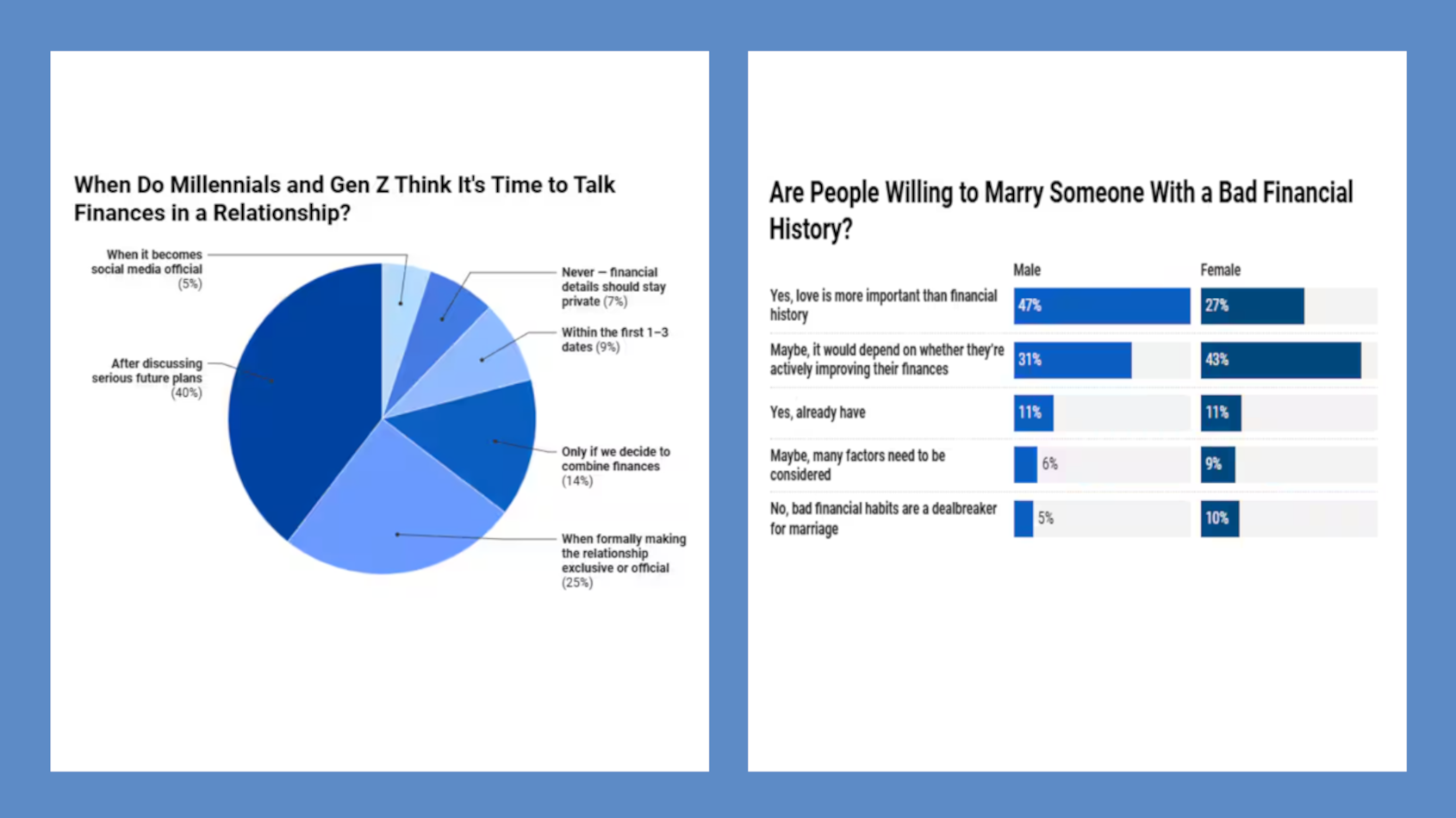

Credit One Bank survey asks, ‘Would you date someone with bad credit?’

Thursday, Nov. 13, 2025, 10:15 AM

SubPrime Auto Finance News Staff

Being in the subprime credit tier not only can make it more difficult to secure auto financing, but it might make it more challenging to have a personal relationship, too. In a new nationwide survey of 1,000 young adults, Credit ... [Read More]

Multiple discussions about repossessions & recoveries on deck for Used Car Week

Wednesday, Nov. 12, 2025, 12:54 PM

SubPrime Auto Finance News Staff

Repossessions and recoveries will be one of the main topics covered during Used Car Week, which begins on Monday at the Red Rock Resort in Las Vegas. In fact, the first session of the entire event is a discussion with ... [Read More]

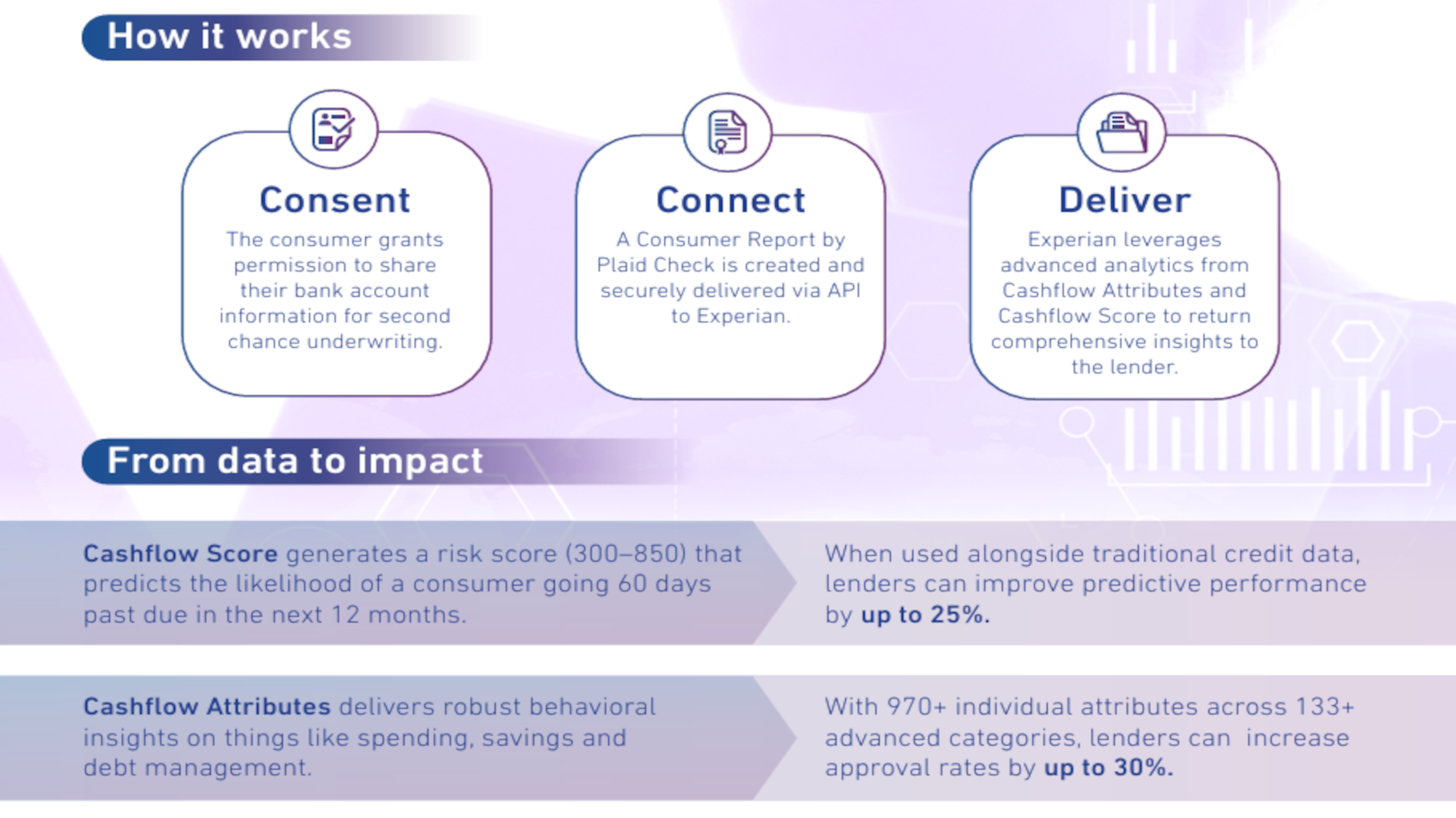

Experian launches new tool to combine credit, cash flow & alternative data into single score

Wednesday, Nov. 12, 2025, 11:48 AM

SubPrime Auto Finance News Staff

This week, Experian rolled out what the company said is the most advanced credit decisioning model it has ever released, marking a “positive milestone in Experian’s mission to help increase fair access to credit.” The company highlighted the Experian Credit ... [Read More]

X