Q3 closes with improved credit availability

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

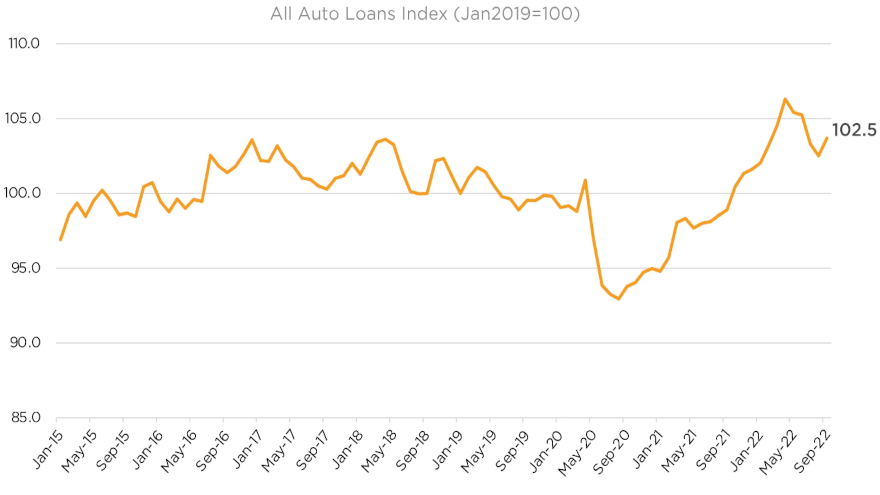

Sales might have softened in September, but Cox Automotive indicated credit for auto financing improved as the third quarter closed.

According to the newest Dealertrack Credit Availability Index released this week, access to auto credit expanded in September for the first time in five months.

Cox Automotive detailed in a Data Point that the index increased 1.1% to 103.7 in September, reflecting that auto credit was easier to get in the month compared to August.

Analysts explained that the improved access meant conditions were looser than before July. With the increase in September, Cox Automotive said access was looser by 4.8% year-over-year.

And compared to February 2020, access was looser by 4.5%, according to the index update included in the Data Point.

“The trends in credit availability factors were mixed in September, but consumers benefited from the largest moves in yield spreads narrowing and subprime share increasing,” analysts said. “The average yield spread on auto loans narrowed, so rates consumers saw on auto loans were more attractive in September relative to bond yields.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“The average auto loan rate increased by 40 basis points in September compared to August, while the five-year U.S. Treasury increased by 66 basis points, resulting in a narrower average observed yield spread,” they added.

“The subprime share increased to 11.7% in September from a low of 11.3% in August. The share of auto loans with negative equity also increased slightly in September, which also benefited consumers,” analysts went on to say.

“Working against consumers in September, the approval rate fell, the share of loans with longer terms declined and the down payment share increased,” analysts added.

Cox Automotive reiterated each Dealertrack Auto Credit Availability Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity and down payments.

The index is baselined to January 2019 to provide a view of how credit access shifts over time.

Analysts also included a look at other readings that can help decipher how the credit market is behaving in conjunction with their latest index update

Cox Automotive pointed out that the Conference Board Consumer Confidence Index increased by 4.2% in September.

“Both underlying measures of present situation and expectations saw gains, but expectations improved the most,” analysts said. “Plans to purchase a vehicle in the next six months increased and were up year-over-year,” analysts said.

Cox Automotive mentioned the sentiment index from the University of Michigan ticked up in September, too, inching up 0.7%, with only views of current conditions improving.

“Both the Conference Board and Michigan data sets do not include survey data representing the entire month, and sentiment weakened in the final days of the month,” analysts said.

“Morning Consult’s timelier daily Index of Consumer Sentiment declined in September with moves down in most of the last 14 days of the month. That index ended down 0.7% for the month, though it had been improving earlier in the month,” analysts went on to say.