Report: Annual car insurance premiums to surge past $2,100, setting another record

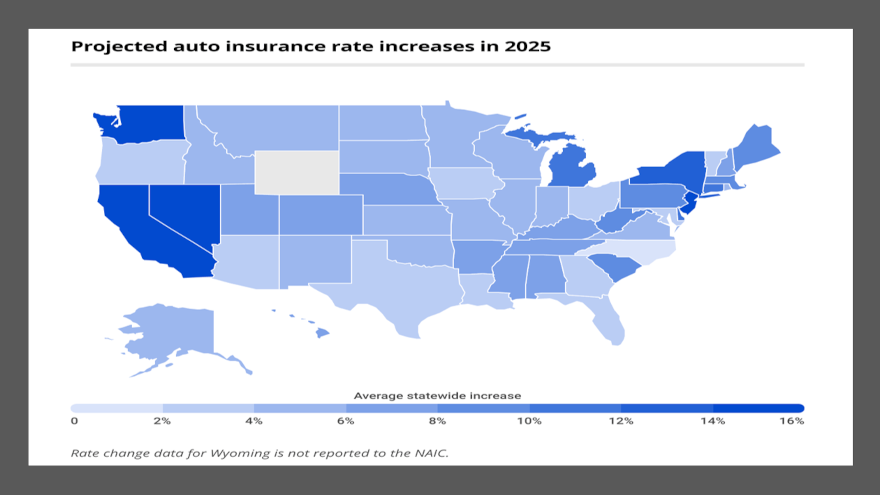

Chart from the State of Auto Insurance in 2025 report published by ValuePenguin.com, a LendingTree company.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Rising costs highlighted in the State of Auto Insurance in 2025 report published by ValuePenguin.com, a LendingTree company, showed the customers currently in your portfolio and applicants seeking auto financing might continue to be stretched financially.

While premiums on average are rising for the seventh straight year, the report indicated drivers should expect to see smaller increases in comparison to last year’s reported 16.5% rate increase.

Despite a slowdown in rate increases, ValuePenguin.com determined the average cost of auto insurance for 2025 is expected to reach a record high of $2,101 annually.

In 2024, many drivers reported that their auto insurance rates rose significantly more than the rate hikes announced by auto insurers, according to Divya Sangameshwar, an insurance expert at ValuePenguin.com.

“Insurers raised rates by an average of 16.5% in 2024, but an analysis by the Bureau of Labor Statistics showed that Americans were paying 19% more for auto insurance on average vs the prior year,” Sangameshwar said in a news release.

“The discrepancy is likely due to driver-led factors like new car purchases, traffic tickets, changing credit scores, or changes in coverage,” Sangameshwar continued. “Although rates aren’t expected to increase as steeply in 2025 compared to 2024, rates are still trending upward, and as a result, auto insurance payments will still be a financial strain for some in the new year.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

ValuePenguin.com offered four other auto insurance rate predictions including:

—Auto insurers will raise premiums by an average of 7.5% in 2025 — with the biggest rate hikes expected from American Family, All State and Liberty Mutual. Drivers in New Jersey, Washington and California will see their auto insurance premiums rise by over 15% in 2025 — the biggest jump in the country.

—The average cost of full coverage car insurance in 2025 will exceed the $2000 mark to touch $2,101 per year. Nevada ($3,216 per year) and Florida ($3,264 per year) will overtake Michigan ($3156 per year) to become the most expensive state for auto insurance in 2025.

—Drivers with traffic violations will see their premiums jump 53% on average in 2025, with drivers in North Carolina facing the stiffest financial penalties — an increase of 146% for traffic violations and dangerous driving.

—Insuring electric vehicles is getting cheaper in 2025, but insurance for new EVs will still be 23% higher than new gasoline-powered cars. However, insurance premiums for Electric cars made by legacy manufacturers like Ford and Volkswagen are 25% less expensive than insurance premiums for cars manufactured by EV-only companies in 2025 — with Rivian’s RV-1, and Tesla’s Cybertruck emerging as the most expensive cars to insure.

Will rate hikes continue to slow down in 2026 and beyond?

According to Sangameshwar, “If things continue the way they are right now — yes.

“However, if President Donald Trump goes forward with his plan to impose tariffs on imported goods, insurance rate hikes could speed up again,” Sangameshwar continued. “In fact, 60% of replacement car parts are imported from other countries like China. Higher costs for parts could mean higher repair prices and more expensive claims, which will result in a bigger rate hike in 2026 and beyond.”

The entire State of Auto Insurance in 2025 report from ValuePenguin.com can be found here.