Report: Value consumers get for GAP coverage continues to rise

Graphic courtesy of AmTrust Financial Services

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

NEW YORK –

A report compiled by AmTrust Financial Services showed how much value consumers are getting from F&I products, especially guaranteed asset protection (GAP) coverage as well as owners who operate their vehicles where weather and road conditions are poor.

The AmTrust 2020 Extended Auto Warranty Advisor identified common trends for extended warranties and claim payouts based on more than 2.4 million auto warranty claims totaling approximately $1.5 billion across all major vehicle manufacturers over the five-year period from 2015 to 2019.

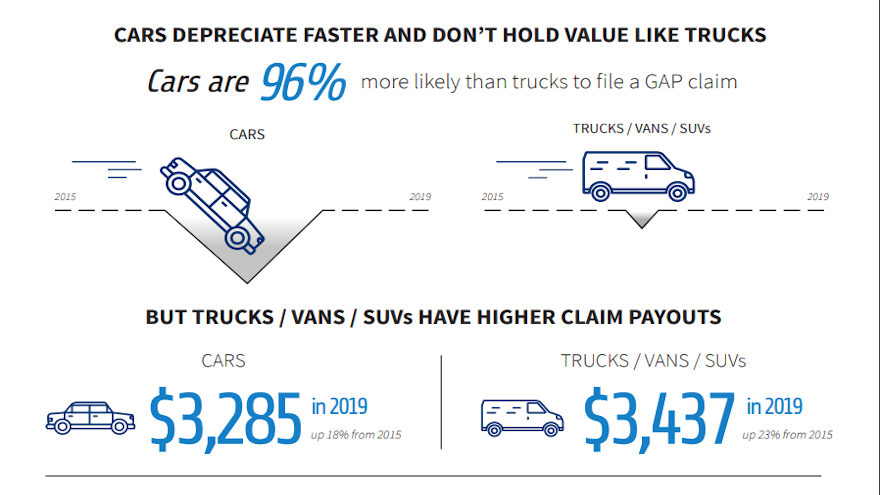

The global specialty property and casualty insurer and leading underwriter of extended warranties discovered car owners are almost twice as likely as van, truck or SUV owners to file a GAP claim — a 96% higher frequency of a claim to be exact. AmTrust noted that one of the leading reasons for this trend is that vans, trucks, and SUVs, on average, are holding more value, depreciating less than cars and leading to less total losses.

However, once GAP claims are filed, AmTrust determined the claim payout for a van, truck or SUV ($3,437 in 2019) is slightly higher than for a car ($3,285 in 2019) due to a higher average price for a van, truck, or SUV versus a car.

AmTrust reiterated that GAP coverage can help consumers protect their investment from the moment they drive off the lot. GAP protects the driver in cases where primary auto insurance carriers deem a vehicle “totaled” or stolen and there is a “GAP” between the amount the owner owes on financing or leases and what the vehicle is worth.

“Analyzing five years of data has given us new insights into what vehicle owners need to consider when evaluating whether they need all forms of extended auto warranty,” said Bruce Saulnier, president of AmTrust Specialty Risk, a division of AmTrust Financial.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“GAP average claim payouts are rising and more vehicle owners are getting value from these policies,” Saulnier continued in a news release.

AmTrust also analyzed vehicle service contract (VSC) claims across the U.S. by region — Northeast, Midwest, South and West.

The report showed claim payouts in the Midwest increased by 94% over the five-year period. The largest increase in claim payouts was related to windshield protection offerings, with claims increasing by 79% from 2015 to 2019.

Although the Northeast had by far the lowest average windshield claim payouts at $368, AmTrust pointed out this region had the highest costs for the repair and replacement of wheels covered by tire and wheel protection offerings, with an average claim payout of $321. The company suggested that this reading likely reflects winter weather conditions that create and worsen potholes and other bad road conditions.

The AmTrust 2020 Extended Auto Warranty Advisor also found that claims for repairs on new cars are lower than for used cars — $947 versus $1,169 in 2019. As vehicles age, report orchestrated acknowledged the likelihood of a major component breakdown such as engine or transmission increases, causing the average claim payouts of used cars to exceed new vehicles.

“Whether or not to purchase an auto extended warranty can be a challenging decision for consumers,” Saulnier said. “Our analysis of 2.4 million claims provides quantitative proof that GAP is needed now more than ever for borrowers taking out loans greater than their cars are worth and that the continued rise in vehicle repair costs over the last five years prove that auto extended warranties protect against out of pocket costs.

“There are also regional differences in claim frequency and repair costs for different components that should also be considered,” he continued.

“We hope our inaugural study of claims paid provides good insight for consumers, dealers and administrators on the value of these important protections,” Saulnier concluded.

The complete report can be downloaded here.