Revamped JD Power Consumer Financing Satisfaction Study focuses on ‘financially vulnerable’

Charts courtesy of J.D. Power.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Beyond the rankings of finance companies for how they met consumer expectations, a focal point of the J.D. Power 2024 U.S. Consumer Financing Satisfaction Study was what analysts classified as “financially vulnerable.”

J.D. Power measures the financial health of any consumer as a metric combining their spending/savings ratio, creditworthiness and safety net items like insurance coverage. Analysts place consumers on a continuum from healthy to vulnerable.

With that trend in mind, J.D. Power reported the number of consumers characterized as financially vulnerable has increased 11 percentage points since 2021 while the number of financially healthy customers has decreased 13 percentage points. Within the group of financially vulnerable customers, just a single percent of them say they can cover six months of living expenses.

And J.D. Power said these consumers are finding the acquisition of a new vehicle particularly challenging, especially since the average new-vehicle retail transaction price now at $44,467 and average new-vehicle financing interest rates still hovering near 20-year highs.

Acknowledging many auto financing customers are coming away from the application process with a dose of “sticker shock,” here’s what Patrick Roosenberg suggested. He’s the senior director of automotive finance intelligence at J.D. Power.

“Auto lenders really need to tailor their offerings for the realities of the current market and recognize that a large portion of their customers may face some very real challenges managing their finances,” Roosenberg said in a news release.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Lenders need to ensure that their digital bill-pay tools encompass a wide range of options, such as extensions, due date changes, personalized financial planning/budgeting tools and one-on-one advice to help consumers plan for the future,” he added.

Which finance companies do well in those departments?

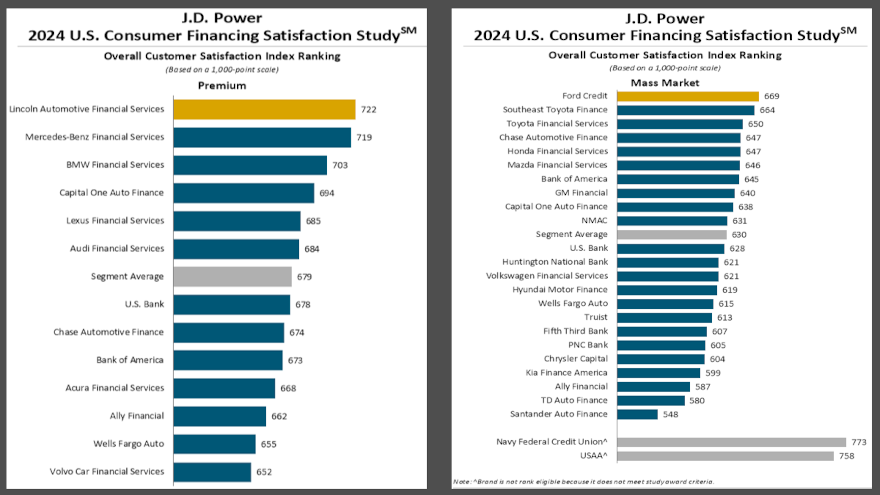

According to the study rankings, Lincoln Automotive Financial Services placed highest in customer satisfaction among premium lenders, with a score of 722 (on a 1,000-point scale). Mercedes-Benz Financial Services (719) ranked second, and BMW Financial Services (703) came in third.

Ford Credit ranked highest among mass market lenders with a score of 669. Southeast Toyota Finance (664) came in second and Toyota Financial Services (650) placed third.

J.D. Power said the U.S. Consumer Financing Satisfaction Study was redesigned for 2024, so scores are not comparable year-over-year with previous studies.

The study measures overall auto financing customer satisfaction across eight core dimensions (in order of importance):

—Level of trust with provider

—Loan/lease offering met needs

—Experience managing my loan/lease

—Keeps me informed about my loan/lease

—Experience obtaining loan/lease

—Makes it easy to do business with

—Digital channels

—People

This year’s study was fielded from last November through August and is based on responses from 11,071 customers who financed a new or used vehicle through an installment sales contract or lease within the past three years.