Study shows 64% of consumers live paycheck to paycheck

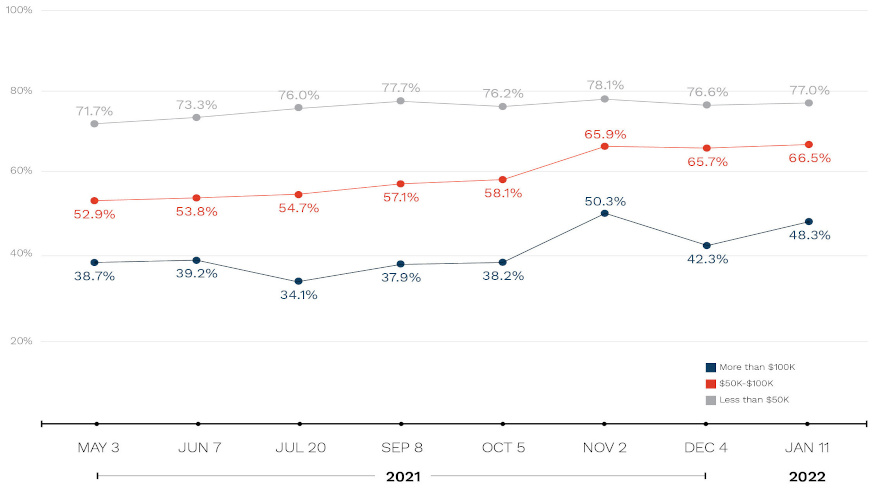

This chart shows consumers who live paycheck to paycheck, by annual income and compared over time. Chart courtesy of LendingClub.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

With inflation weighing on their minds, too, more evidence arrived on Thursday that shows that individuals who might need subprime auto financing aren’t necessarily on the lowest end of the income spectrum.

The number of consumers living paycheck to paycheck has increased steadily since April and stood at 64% in January — 12 percentage points higher than April 2021 — with a 3% jump in just a month between December and January.

New data also showed that 48% of consumers earning more than $100,000 per year reported living paycheck to paycheck in January — up from 42% in December. This number has fluctuated since May, when it was 39%, before reaching a high of 50% in November.

All of those metrics are courtesy of LendingClub, which on Thursday released the its seventh edition of the Reality Check: Paycheck-To-Paycheck research series, conducted in partnership with PYMNTS.com. The project examines why consumers across different income brackets are living paycheck to paycheck and what they see as the most prominent stressors on their finances.

The research indicated the share of those individuals who earn between $50,000 and $100,000 who report living paycheck to paycheck is also on the rise.

In May, LendingClub said 53% of these middle-income consumers lived paycheck to paycheck. In January, 67% reported living paycheck to paycheck — up from 66% in December.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

However, PYMNTS’ research showed that just 12% of consumers who earn more than $100,000 reported living paycheck to paycheck and struggled to pay their bills in January. But this rate is significantly higher among those earning $50,000 to $100,000 per year (19%) and those earning less than $50,000 (34%).

“The ranks of paycheck-to-paycheck consumers who struggle to pay their monthly bills have seen little fluctuation,” experts said.

But when an emergency arises, the dynamics can quickly change, according to this new research.

LendingClub and PYMNTS discovered that among consumers who earn more than $100,000, 23% who live paycheck-to-paycheck and are struggling to pay their bills say they would not be able to pay a $400 emergency expense.

Experts then noted this share of consumers that would not be able to pay such an emergency expense understandably increases among middle- and low-income consumers who live paycheck-to-paycheck and are struggling to pay their bills.

They said 52% of those who earn less than $50,000 and 38% of those earning $50,000 to $100,000 said they would not be able to pay a $400 expense.

Among consumers earning more than $100,000 who live paycheck to paycheck and are struggling to pay their bills, the research indicated 33% would use a credit card to cover an emergency expense and pay it off over time, while 20% would use a credit card and pay it off in full.

High-income consumers who live paycheck to paycheck but are not struggling to pay their bills are more likely to use a credit card and pay it in full (23%), and less likely to use a credit card and pay it over time (21%), according to the research.

“With inflation up 7.5% in the last 12 months, consumers of all income brackets are struggling to find a way to make ends meet,” said Anuj Nayar, financial health officer at LendingClub, which mentioned the New Reality Check: The Paycheck-To-Paycheck Series is based on a census-balanced survey of 2,633 complete responses from U.S. consumers conducted from Jan. 11 to Jan. 18, as well as an analysis of other economic data.

To view the full report, go to this website.

More about inflation impact

Speaking of inflation, TransUnion offered some insight on that subject.

Two in three Americans (64%) report being extremely or very concerned about inflation, according to TransUnion’s latest Consumer Pulse study.

The credit bureau’s study released this week also showed nine in 10 (93%) expressed that they are at least slightly concerned.

The results stemming from the Feb. 7-15 survey of 2,949 adults arrived after the Consumer Price Index — a measure of inflation — experienced its largest 12-month increase in 40 years at the end January.

TransUnion indicated 62% consumers say they are going to make changes to their purchasing behavior because of inflation. Of this group, 45% say they are going to decrease discretionary spending.

In addition to inflation, TransUnion mentioned grocery availability, new COVID-19 variants, product availability and rising interest rates rank as the top five concerns for Americans in 2022.

While these rankings hold true for most generations, analysts said Gen Z is the only outlier with inflation ranked first, followed by COVID-19 variants, access to healthcare, grocery availability and rising interest rates.

Overall, in the next three months, TransUnion said more households reported plans to reduce rather than increase discretionary spending on dining out, travel and entertainment (37%), large purchases such as appliances and vehicles (30%) and retail shopping for clothing, electronics and durable goods (30%).

At the same time, TransUnion noted that households plan to increase spending on paying bills and loans such as utilities and credit cards (34%), medical care (27%) and retirement funds/investing (26%).

“It’s clear that inflation is impacting the way consumers spend their money. However, our findings show clear signs that many consumers are taking measures that will set them up for future success, such as paying down loans or increasing their investments,” said Charlie Wise, senior vice president and head of global research and consulting for TransUnion.

“Despite inflation and other worries such as rising interest rates and supply chain woes, consumers are performing relatively well. Consumer credit performance continues to be strong and unemployment rates remain low,” Wise continued.

TransUnion pointed out that a sign that inflation hasn’t fully muted consumer optimism: most Americans (81%) reported that household income increased or stayed the same in the past three months compared to just 19% who experienced a decrease.

And 91% expect household income to stay the same or increase in the next 12 months, according to TransUnion.

The Consumer Pulse study also found that consumers seeking to take control of their financial future look for credit information regularly. Most Americans (64%) believe monitoring credit is important and 63% report monitoring their credit at least monthly.

TransUnion mentioned Americans appear aware of the impact different data has on their credit score.

In fact, 44% of people believe their credit score would increase if businesses used information not found on a standard credit report, like rental payments, short-term loan payments and buy now, pay later loans, TransUnion said.

“While there's no direct link between inflation and a person's credit score, rising interest rates could increase total loan costs. Plus, rising prices of goods could mean consumers are more reliant on credit products for their bills and day-to-day spending,” said Margaret Poe, head of consumer credit education at TransUnion.

“When inflation increases, the usual advice for healthy credit holds: Make sure to keep your balances as low as you can and do your best to make your payments on time. If at any point you think you're at risk of missing a payment, contact your lender as soon as you can to explain your situation,” Poe went on to say.