Subprime auto financing on Fitch watch list for possible deterioration

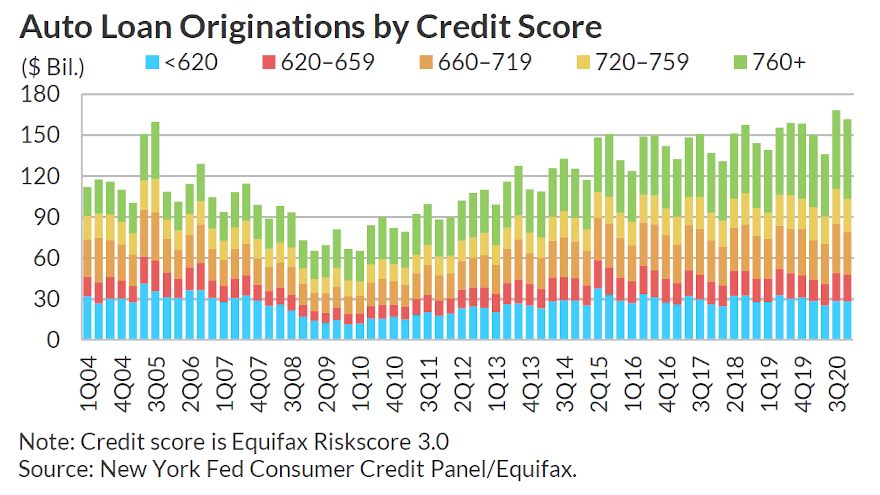

Chart courtesy of Fitch Ratings.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

NEW YORK –

Fitch Ratings pinpointed subprime auto financing as one of five areas to watch should consumer indicators deteriorate; especially as federal assistance winds down and accommodations by finance companies expire.

Analysts made that assertion in a report shared with SubPrime Auto Finance News on Friday. Along with subprime auto financing, Fitch Ratings also mentioned certain segments of student loans, retail credit cards, unsecured consumer lending and mortgages to low- to moderate-income borrowers as the other credit segment the firm plans to monitor closely.

Fitch Ratings acknowledged that the most recent $1.9 trillion federal stimulus package provides substantial aid that will boost household income, specifically for lower- and middle-income individuals.

Among other measures, analysts recapped that the American Rescue Plan includes:

— One-time stimulus checks of $1,400 to individuals making less than $75,000

— Extends $300 enhanced unemployment benefits until Sept. 6

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

— Makes $10,000 of unemployment benefits tax free

— Grants fully refundable child tax credits

— Increases healthcare subsidies for those buying healthcare plans offered pursuant to the Affordable Care Act.

According to the Fitch Rating report, the Tax Policy Center estimated that the major tax provisions in the American Rescue Plan will lift after-tax income of the lowest income quintile by 20.4% and those in the second lowest quintile by 9.3%. However, Fitch Ratings pointed out that this boost in income is temporary, as the credits only apply for 2021.

“While the recent round of coronavirus stimulus will undoubtedly provide immediate financial boost to the U.S. consumers, particularly at the lower income levels, the long-term effects may not look as promising given a significant labor market dislocation due to the pandemic,” analysts said.

“We expect that as aid runs out and forbearance expires, weaker borrower loan performance is expected to worsen from current levels of strong performance,” they continued. “There will be an increase in defaults for those who may have been already struggling pre-pandemic and those with longer-term job loss.”

Fitch Ratings also touched on another element that’s impacting how it plans to monitor subprime auto financing and other credit products, noting that ABS asset performance has benefitted from credit tightening.

“Since the onset of the pandemic, many traditional lenders have pulled back from higher-risk lending and tightened their underwriting standards by raising minimum credit scores and down payment requirements,” analysts said. “This has restricted access to credit for many individuals with weaker credit profiles and lower incomes, as well as those who may have lost their jobs.”