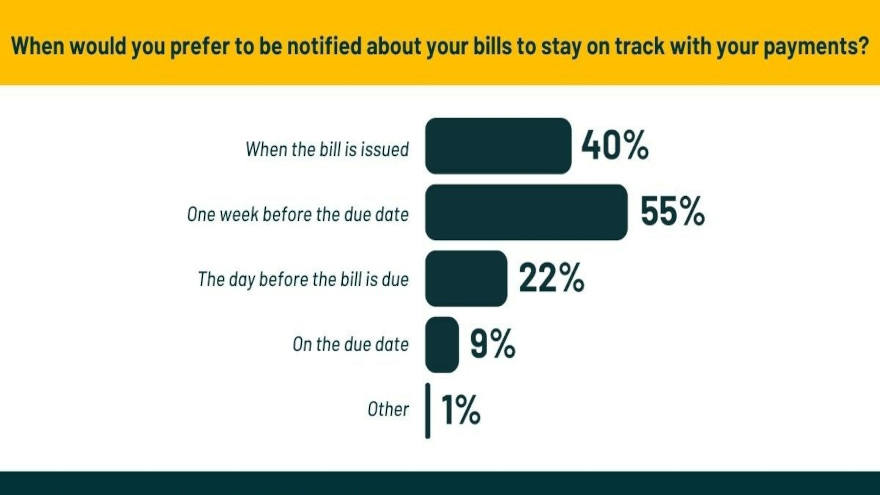

Survey: 55% of Americans want to be notified 1 week before bills are due

Consumers want earlier and more frequent reminders about upcoming bills. Chart courtesy of Lexop.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Here’s more evidence that staying in communication with your customers could help keep payments coming and potentially keep your auto finance portfolio healthier.

Lexop said a recent survey of more than 1,100 American consumers who were late in paying their bills revealed how simple improvements to the billing and collections process could significantly reduce delinquency rates and motivate past-due customers to self-cure.

The findings are from “Behind on Bills: A 2023 Survey of Overdue US Consumers,” conducted in February by Lexop to explore past-due consumer behavior, identify payment patterns and show how businesses could better assist their customers.

For 44% of respondents, keeping up with bills was the top financial priority of 2023, with 25% prioritizing paying down debt.

Lexop found that this financial strain on consumers is evident when considering the impact of a delayed or missed paycheck, with 43% having to dip into their savings to make ends meet and 36% not having enough money to cover their bills.

“Businesses must consider their customers’ financial realities when issuing bills and be proactive in providing alternative ways for them to manage payments, such as offering custom payment arrangements,” Lexop said in a news release distributed that contained the study findings.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Interestingly, Lexop said 60% of respondents reported that non-monetary reasons were causing them to fall behind on their bills.

The majority (30%) forgot to pay the invoice, with others noting invoice errors (10%), expired pre-authorized payment methods (8%), not having access to bills (7%), or not receiving them at all (5%) cited as the most common reasons.

“The non-financial reasons for being late highlight the importance of providing customers with timely reminders and addressing process-related issues contributing to late payments,” Lexop said.

When asked about their ideal notification schedule, 55% of respondents wanted a reminder one week before a bill is due; and another 22% wanted an additional reminder the day before the due date.

The survey also found that 85% of overdue consumers paid within 30 days of the due date, and an overwhelming 60% paid their late bills within the first week.

“This finding is significant for businesses, as it suggests that they could easily improve cash flow and reduce the number of late payments by leveraging digital tools to send more frequent automated reminders to their customers,” Lexop said.

Lastly, 73% of respondents said that a simplified digital experience would make paying their late bills easier, including more reminders sent via SMS and email, a streamlined online payment process, and one-click payment links.

Notably, only 10% said traditional tactics like letters and collection calls are helpful.

Lexop CEO and co-founder Amir Tajkarimi said companies looking to improve their collection rates must prioritize technology investments to meet consumer expectations for a simplified, self-serve digital payment experience.

“Collecting doesn’t have to be complicated. It all comes down to getting the attention of your past-due customer and making it easy for them to pay,” Tajkarimi said. “Now more than ever, businesses must be proactive to succeed in their collections efforts.

“Technology is a great way to get ahead of the curve, making it easy to provide digital payment options, automate timely reminders, and offer flexible payment arrangements,” Tajkarimi went on to say.