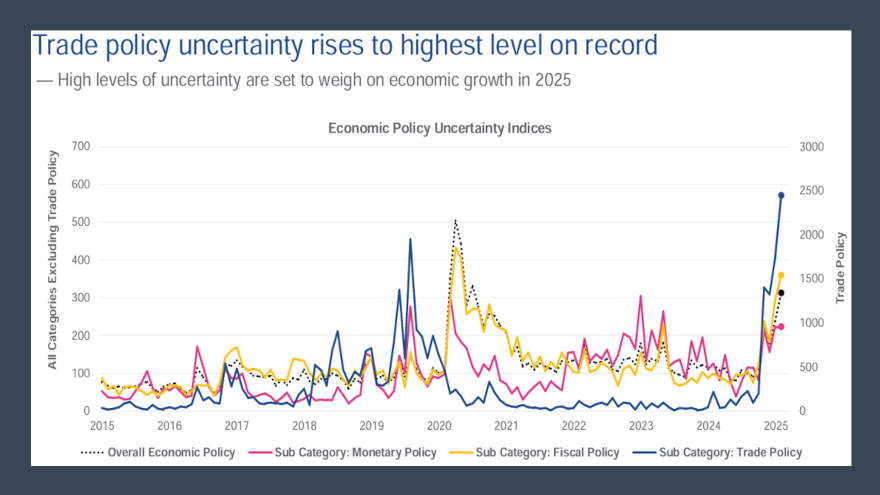

Tariff implementation eroding consumer confidence & credit predictors

Chart courtesy of Experian's Lending Conditions Chartbook, Q1 2025.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

A fact sheet posted on the White House website late Wednesday connected with the administration imposing a 25% tariff on imports of automobiles and certain automobile parts contained this bullet point: a 2024 study on the effects of President Trump’s tariffs in his first term found that they “strengthened the U.S. economy.”

But a major reading of consumer confidence as well as perspectives from automotive and economic experts leading into that tariff decision tell a different story.

The Conference Board reported on Tuesday that the Consumer Confidence Index fell by 7.2 points in March to 92.9.

The Present Situation Index — based on consumers’ assessment of current business and labor market conditions — decreased 3.6 points to 134.5.

And the Expectations Index — based on consumers’ short-term outlook for income, business, and labor market conditions — dropped 9.6 points to 65.2, the lowest level in 12 years and well below the threshold of 80 that usually signals a recession ahead.

The Conference Board noted the cutoff date for preliminary results of these data points was March 19.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Consumer confidence declined for a fourth consecutive month in March, falling below the relatively narrow range that had prevailed since 2022,” said Stephanie Guichard, senior economist at The Conference Board. “Of the index’s five components, only consumers’ assessment of present labor market conditions improved, albeit slightly. Views of current business conditions weakened to close to neutral.

“Consumers’ expectations were especially gloomy, with pessimism about future business conditions deepening and confidence about future employment prospects falling to a 12-year low,” Guichard continued in a news release. “Meanwhile, consumers’ optimism about future income — which had held up quite strongly in the past few months — largely vanished, suggesting worries about the economy and labor market have started to spread into consumers’ assessments of their personal situations.”

Researchers indicated that March’s fall in confidence was driven by consumers over 55 years old and, to a lesser extent, those between 35 and 55 years old.

By contrast, the Conference Board noticed confidence rose slightly among consumers under 35, as an uptick in their assessments of the present situation more than offset gloomier expectations.

The decline was also broad-based across income groups, with the only exception being households earning more than $125,000 a year, according to the Conference Board.

“Likely in response to recent market volatility, consumers turned negative about the stock market for the first time since the end of 2023,” Guichard said. “In March, only 37.4% expected stock prices to rise over the year ahead — down nearly 10 percentage points from February and 20 percentage points from the high reached in November 2024.

“On the flip side, 44.5% expected stock prices to decline (up 11 percentage points from February and over 22 percentage points more than November 2024),” she continued. “Meanwhile, average 12-month inflation expectations rose again — from 5.8% in February to 6.2% in March — as consumers remained concerned about high prices for key household staples like eggs and the impact of tariffs.”

Impact on credit conditions & recession expectations

Just before the White House made its tariff announcement, S&P Global Ratings updated its projected impact on the overall credit market.

In a report titled, Credit Conditions North America Q2 2025: Uncertainty Prevails, S&P Global Ratings said amplified policy uncertainty, and accompanying near-term market volatility, pose a risk to an environment of favorable credit conditions for North American borrowers.

As a result, S&P Global Ratings now sees a 25% probability of a U.S. recession starting in the next 12 months, although its base case is for a slowdown to below-trend growth.

Analysts explained that the prospect of tariff-fueled inflation is also muddying the waters for Fed monetary policy. S&P Global Ratings now forecasts one rate cut late in the year, as demand weakness outweighs inflationary pressures.

S&P Global Ratings added that its top risks to credit conditions include:

—The possibility that tariffs will reignite inflation and threaten credit quality

—Escalating geopolitical tensions, which could impede trade and investment

—Interest rates remaining high, thus underpinning burdensome borrowing costs

—The potential for the U.S. and Canada to suffer sharper-than-expected economic downturns

—More severe commercial real estate losses, exacerbated by depressed asset values and cash flows, amid elevated financing costs

“Higher tariffs are a top concern for many corporate borrowers we rate, given they would likely lift input prices at a time when companies are grappling with already-elevated costs and a diminished ability to pass them through to customers and consumers,” said David Tesher, S&P Global Ratings’ head of North America credit research. “Key U.S. sectors to watch include autos, metals and mining, tech, oil and gas, capital goods, chemicals, consumer products and retail, pharma and health care, and utilities and power.”

Insight from auto observers

While speaking mostly about the new-car market, Cox Automotive senior economist Charlie Chesbrough offered this perspective on Wednesday.

“Vehicle sales are expected to finish near February’s pace,” Chesbrough said, “but there is a risk we could see a more disappointing finish. What March sales will likely confirm is that the post-election ‘Trump bump’ that our market enjoyed at the end of last year is likely fading, as concern among consumers regarding the future of tariffs and the economy — a new economic uncertainty — is holding back the market.”

Edmunds head of insights Jessica Caldwell pointed to the direction potential car buyers might go next.

“As new-car prices rise, more shoppers will look to the used market for relief, but there’s limited availability, especially for near-new models due to the sharp drop-off in lease volume during the pandemic. This combination of factors is likely to drive up used-car prices again. Dealers will need to be particularly mindful when evaluating trade-ins and managing inventory,” Caldwell said.

“There may be long-term benefits, but many consumers are focused on the near-term,” Caldwell continued. “Tariffs could encourage increased investment in U.S.-based manufacturing (a trend already signaled by automakers such as Hyundai). Over time, this may contribute to a more resilient and locally rooted auto industry. However, those potential benefits will take time to materialize. For consumers navigating higher prices in the short term, the promise of future gains may feel distant — at least for now.”

Ivan Drury, Edmunds’ director of insights, added these thoughts associated with individuals who might come to your showroom or apply for financing.

“Looking ahead, the newly announced 25% tariffs on imported vehicles add another layer of difficulty for shoppers already facing high prices and interest rates,” Drury said. “Shoppers should expect increased competition on dealer lots as news of the tariffs will likely fuel short-term demand from buyers trying to lock in deals before potential price hikes.

“If you’re planning to buy soon, it’s worth starting your search now. Once tariffs take effect, discounts will be harder to come by and, if spending a bit more today gets you the car you really want, it could save you money in the long run,” he went on to say.