Three ABS observers all arrive at two conclusions about current auto-finance market

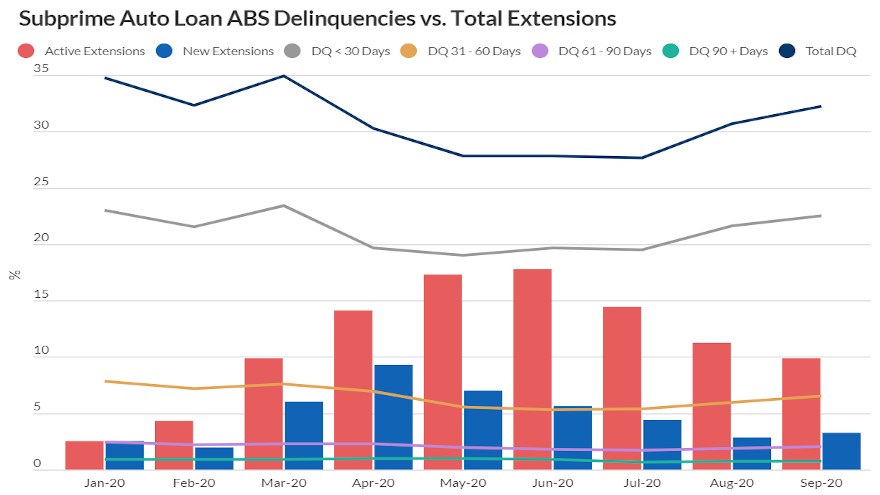

Chart courtesy of Fitch Ratings

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

NEW YORK –

Fitch Ratings, Kroll Bond Rating Agency (KBRA) and S&P Global Ratings each offered perspectives on the securitization market this week.

After sharing metrics their analysts gathered, each firm pointed to two trends moving in opposite directions. All three highlighted how contract modifications are declining and as a result, delinquencies are climbing with the expectation for potential acceleration coming in 2021.

The rundown received by SubPrime Auto Finance News began with S&P Global Ratings publishing its look at the U.S. auto loan asset-backed securities (ABS) sector’s performance for September.

S&P Global Ratings said U.S. prime auto loan ABS performance strengthened in September, with losses declining to an eight-year low due to an extremely strong recovery rate of nearly 80%. Analysts noticed that extensions also decreased for the fifth straight month in this credit space.

Meanwhile, S&P Global Ratings indicated recovery rates started to normalize for subprime paper, causing losses to increase from its lowest recorded level in August. Analysts added this segment reported higher extensions for the first time in five months.

S&P Global Ratings shared more context when the firm elaborated about particular vintages.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Prime and subprime static pool data indicate that the 2018 and 2019 vintages are currently performing in line with or better than the 2017 vintage,” analysts said in their report. “However, caution is warranted because losses associated with previously extended loans won't appear for several months.

“Additionally, the federal government’s pandemic emergency unemployment compensation, providing an additional 13 weeks of unemployment assistance over what the states offer, is set to expire at year end,” they went on to say.

Update from KBRA

The latest report from KBRA included information from October data.

The firm said early stage delinquencies in the KBRA Prime Auto Loan Index rose 2 basis points month-over-month to 0.91% in October, while late-stage delinquencies remained unchanged at 0.37%.

Furthermore, analysts determined early and late-stage delinquencies in the KBRA Non-Prime Auto Loan Index climbed to 6.76% and 3.86%, respectively, in October. Those readings represented rises of 39 basis points and 10 basis points compared to the previous month.

But KBRA pointed out both delinquency metrics remained “meaningfully” lower on a year-over-year basis, adding that annualized net loss rates are at their lowest levels in years. Analysts explained those findings arrived as a result of a “strong” used-vehicle market and low delinquency rates throughout the spring and summer months.

“Further stimulus, which at this point is uncertain, and a continuing labor market recovery could help soften the blow, but we still expect seasonal trends and the end of payment holidays for many borrowers to push delinquency rates higher (as observed in the past two months) into year end, leading to elevated charge-off rates and annualized net losses in 2021,” KBRA analysts said in their newest report.

KBRA went on to mention an analysis of October’s asset-level disclosures showed mixed credit metrics during the September collection period.

Analysts discovered the percentage of prime and non-prime contract holders who went from 30-days delinquent to current increased to 33.9% and 28.9%, respectively. Those moves marked jumps of 46 basis points and 151 basis points versus the previous month, which in both cases were slightly below their pre-pandemic levels, according to KBRA.

The firm also found that the percentage of prime contract holders who rolled from 60 days or more past due to charge-off fell to 12.5% in October, declining 98 basis points month-over-month.

However, analysts added the non-prime roll rate into charge-off jumped 99 basis points to 19.1%. “But this was still well below pre-pandemic levels,” they said.

Views from Fitch Ratings

Fitch Ratings began its update by projecting a “moderate” increase in delinquencies, particularly for subprime auto ABS because of expiring contract extensions and other forms of payment relief that surged this spring and summer.

“We have not observed a meaningful increase in delinquencies given vehicle utility and priority of auto loan debt repayment during the pandemic, but additional federal stimulus is uncertain and unemployment remains materially elevated,” Fitch Ratings said.

“Slow economic growth over the next few months as a result of additional pandemic-related lockdowns may lead to another increase in extension take rates that masks true delinquency levels,” analysts continued.

The firm noted that the average of new extension requests across Fitch-rated prime and subprime auto loan ABS pools peaked in April at 5.7% and 9.8%, respectively. But Fitch said they have subsequently declined to 0.7% and 3.1% in September.

“Prime extension requests are only slightly elevated from pre-pandemic levels and continue to trend downward, but subprime extension requests began to tick back up in September,” analysts said.

Despite having an active extension, Fitch calculated that an average of 23.4% of prime contract holders and 20.6% of subprime contract are current with their payments, and an additional 19.9% of prime customers and 10.4% of subprime customers have made a partial payment.

Given the unprecedented widespread use of payment extensions, Fitch explained how it arrived at these readings.

The firm said it began using contract-level data to analyze the less than 30-day delinquency buckets in conjunction with extension take rates.

“This can serve as an early warning indicator of potential deterioration in securitized pools and provide further insight to what is provided in the monthly servicer report,” analysts said.

With all of the accommodations in play and an updated tracking strategy, Fitch recapped what they discovered with regard to delinquency rates, with the most pronounced movements being seen in early stage delinquency buckets.

Fitch said the less than 30-day delinquency category averaged 6.0% for prime ABS and 22.3% in subprime pools through the first two months of 2020, but dropped to a low of 5.0% and 19.0%, respectively, in the spring.

“As extensions began to expire, the less than 30-day delinquency bucket trended back up toward pre-pandemic levels, indicating the benefit from stimulus and extensions is fading, and struggling borrowers may again be under pressure,” analysts said.

“We expect a moderate increase in delinquencies, particularly for subprime ABS, given continued high unemployment rates and in the absence of additional federal aid,” analysts continued. “However, delinquencies are not expected to reach levels seen during the prior recession.

At the height of that recession in December 2008, Fitch recollected that 60-day prime delinquencies peaked at 0.9% and subprime at 5.0%. As of September, Fitch pointed out 60-day prime delinquencies stood at 0.2% and at 3.8% for subprime auto ABS pools.

Fitch closed its latest update by trying to crystalize its 2021 forecast, setting an expectation for limited impact on auto loan ABS ratings moving into the new year.

“Our base case credit loss proxies reflect a through-the-cycle rating approach, include a loss cushion and are not expected cases,” analysts said.

“Fitch uses stressed recessionary 2008-2009 loss levels along with more recent vintage performance to derive auto loan ABS base case cumulative net loss proxies,” they continued. “Therefore, we believe there is sufficient cushion to protect against potential negative performance trends.”

To account for contract performance during the pandemic, Fitch explained its approach for both new transaction analysis and surveillance more heavily weights the poorer performing 2008-2009 recessionary vintages.

Analysts said this choice resulted in roughly a 10% to 20% increase in Fitch’s cumulative net loss proxies from pre-pandemic levels, depending on issuer-specific performance and other items such as amortization observed in outstanding prime and subprime transactions.