TransUnion: 62% of US adults earn money via gig economy

Chart courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Your underwriting department might be seeing more applicants who list their primary sources of income coming through services such as Uber or DoorDash.

TransUnion wanted to get more clarity about these workers to help finance companies and other service providers.

While consumers have grown accustomed to on-demand services, like ridesharing and food delivery, they are also increasingly open to participating in the gig economy as workers, according to new TransUnion research.

TransUnion said more than half of U.S. adults (62%) now earn money working for one or more gig platforms

Across generations, over one-third (37%) reported gig work as a primary source of income. Millennials lead this group with more than half (55%) leveraging gig work as their primary employment and income source.

These findings and more are available in the TransUnion Fall 2024 US Gig Economy Report.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“The gig economy has earned a strong reputation among workers as a reliable source of income that allows for unparalleled flexibility,” said Tracey Lazos, senior director of TransUnion’s gig economy business. “Our research indicates that this trend is likely to continue as more seek a primary or supplementary income from gig work.”

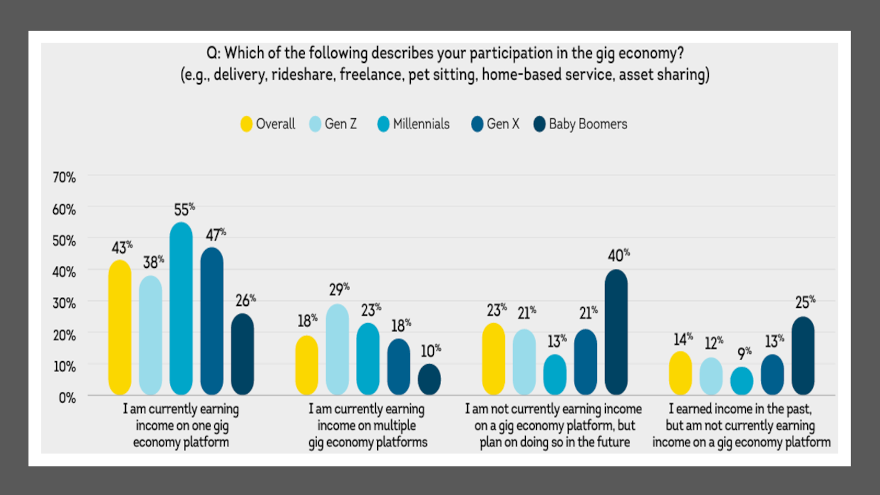

According to the report, millennials are the leading generation of gig workers, with 78% currently earning income from one or more gig platforms. Gen Z and Gen X workers followed closely behind, at 67% and 65%, respectively.

Just 36% of Baby Boomers reported earning from one or more platforms; however, 40% indicated they plan to engage in gig work in the future.

More than half of respondents reported their household finances were better than planned, and work satisfaction on gig platforms was generally high, with 64% of respondents saying they were somewhat or very satisfied.

When deciding what type of work to engage in, TransUnion found that flexibility (47%) and skillset match (39%) were the leading factors. The top three types of gig work were driving for a ride sharing service (23%), freelancing for a digital or online service (19%), and driving for a restaurant delivery service (19%).

“The sense of acceptance from one’s social circle is also important to how people feel about themselves as professionals,” Lazos said in a news release. “That the report found a quarter of gig workers started because it was recommended by friends or family members indicates that gig work has a growing sense of legitimacy as a profession.”

TransUnion indicated 60% of gig workers participate to supplement their income, and, predictably, two-thirds report earnings less than $2,500 per month.

However, 36% of millennials and 21% of Gen Z workers — those most likely to use gig economy work as a primary source of income — report earnings more than $5,000 per month, according to TransUnion.

The report found most gig earners plan to either maintain or increase their involvement in the gig economy.

Researchers said more than one-third (35%) of Gen Z workers indicated a plan to increase their work levels on gig platforms, either through increased hours or engaging with a greater number of platforms. Millennials were close behind, with 31% saying they plan to do the same.

TransUnion pointed out only 8% of earners plan to stop working and acquire a full-time job, an indication that factors such as convenience and skillset alignment are driving more individuals to treat the gig economy as their primary workplace in place of more traditional employment.

Researchers explained the possibility for gig platforms to gain a greater share of the workforce creates an imperative for them to consider services and incentives to attract and retain workers.

The survey proposed several potential services platforms could offer workers and found the most desirable options were identity protection, financial education, and supplementary insurance coverage.

TransUnion added seasonality is also an important consideration for attracting new workers.

While 45% of earners say they work year-round, researchers noticed younger respondents reported a much higher likelihood to take on extra gig work during specific seasons — such as summer and winter — indicating a spike in gig work outside of the school year.

Older earners, by contrast, are much more likely to work on an as-needed basis for extra income, according to TransUnion.

“Gig workers already enjoy a flexible work experience that allows them to earn what they want, when they want, and how they want,” Lazos said.

“By introducing services that also help them feel more empowered and able to meet long-term goals, platforms can provide a comprehensive offering that attracts workers who will create great customer experiences — while boosting worker retention,” Lazos went on to say.