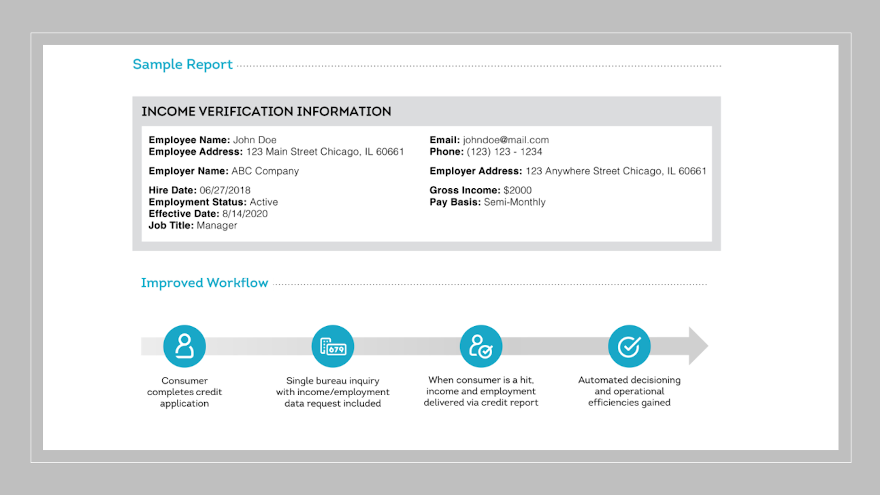

TransUnion blends income & employment verification into credit report

Images courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

CHICAGO –

Perhaps nowadays more than ever, risk decisions are based on consumer income and employment information to grasp a potential retail installment contract holder’s ability to pay

This week, TransUnion rolled out a new seamless and real-time service to provide finance companies and other businesses access to verified income and employment data so underwriters have a more complete picture of their potential customer.

For the first time, TransUnion said this income and employment verification can be seen directly within the credit report. The company explained this capability can remove unnecessary overhead of separate integration efforts and related costs and improve the consumer experience.

“The economic downturn and rising unemployment mean that financial institutions and other organizations are seeking a more complete picture of the consumer as part of their acquisition and risk mitigation strategies,” TransUnion chief global solutions officer Tim Martin said in a news release.

“The current process is cumbersome as consumers often have to provide their own data, or lenders subscribe to separate processes — which could prohibit or slow consumers from accessing credit products and offers. TransUnion income and employment verification provides a much-needed alternative that improves the overall consumer experience,” Martin continued.

TransUnion noted that its income and employment verification is initially launching in collaboration with one of the leading payroll providers in the U.S., which will provide immediate access to tens of millions of active employment records.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The company pointed out that data is updated every pay cycle to supply the most recent view of a consumer’s employment status and income.

Martin added that this rollout marks TransUnion’s entrance into the income and employment verification market and is the first phase of a suite of solutions that will meet the evolving needs of both lenders and consumers.

“This launch demonstrates TransUnion’s commitment to developing innovative solutions that provide consumers access to the credit and services they need and deserve,” Martin said.

For more information on TransUnion’s income and employment verification, go to this website.