TransUnion: Gen Z using credit more than millennial counterparts at same age

Charts courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The title of a project TransUnion released on Thursday at its 2024 Financial Services Summit (attended by nearly 300 global financial services executives) might have given some frightening flashbacks of struggles with algebra.

The new TransUnion study — Solving for Z — explored credit usage by today’s Gen Z consumers and compared it to similarly aged millennials one decade ago.

For this endeavor and not to stir the debate about the value of algebra, TransUnion defined the Gen Z generation as individuals born between 1995 and 2012, and the millennial generation as people born between 1980 and 1994.

The study found that both Gen Z and millennial borrowers faced early challenges in their credit journeys. TransUnion reported 75% of surveyed Gen Z consumers said they had their finances negatively impacted by the pandemic-induced recession, while 60% of millennials said the global financial crisis had negatively impacted them.

However, TransUnion pointed out that today’s Gen Z consumers have also faced an additional challenge — a rapid rise in inflation.

“Gen Z consumers have seen their finances significantly impacted by the pandemic and its aftermath, even more so than the challenges faced by millennials as a result of the Global Financial Crisis,” said Michele Raneri, vice president and head of U.S. research and consulting at TransUnion.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“This likely has played a key role in the shifting priorities of Gen Z consumers, both in the types of credit they are seeking, and the way they are using that credit once they gain access to it,” Raneri continued in a news release.

The study featured an analysis of TransUnion credit bureau data along with interviews of Gen Z consumers who were between the ages of 22 and 24 in December about their use of credit.

Also, the study conducted a survey of nearly 1,200 millennial consumers who were between the ages of 22 and 24 in December 2013. That group was asked about their credit usage during that time 10 years prior.

After conducting those interviews, the results showed that Gen Z borrowers are opening more credit lines and have both higher debt levels and delinquency rates compared to millennials at the same age.

Yet, TransUnion discovered Gen Z borrowers also are performing in a similar manner to younger generations of the past in comparison to older generations (i.e. younger generations typically have higher delinquency rates as a group than older ones).

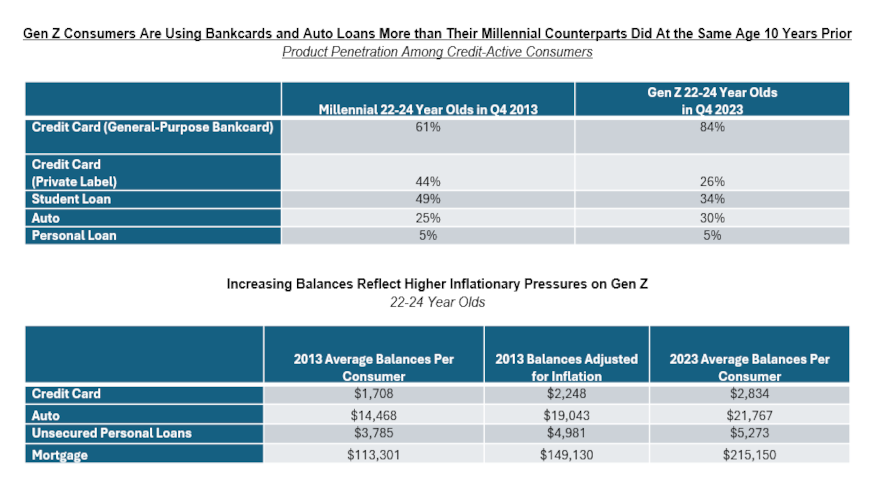

Furthermore, the study revealed that 84% of credit-active Gen Z consumers had at least one credit card (bank card) as of Q4 2023. This is significantly higher than the 61% of credit-active millennials who had at least one card 10 years prior.

This finding comes as nearly 36% of Gen Z consumers ranked credit cards as the most useful credit product, up from 29% of millennials a decade ago, according to TransUnion.

In other survey components, TransUnion explained the increase in card usage among Gen Z consumers is not necessarily unique to this demographic, as consumers as a whole have been using credit cards more to manage the significant and enduring growth in inflation over the past decade, particularly in recent years.

Since Q4 2013, TransUnion said the consumer price index has cumulatively risen 32%, driving many consumers to use their credit cards as a financial backstop to help with increasing costs.

Also, a recent TransUnion report found that due to this increased usage, the total credit card balance held by U.S. consumers tipped past $1 trillion for the first time in 2023.

In addition to rising credit card balances, experts said higher prices have contributed to higher balances among Gen Z consumers across other credit products, including auto financing, which is up 14% in 2023 as compared to the inflation-adjusted 2013 average balances.

“It’s no surprise that in this economic climate, one in which the cost of living is significantly higher relative to a decade ago, younger consumers are increasingly turning to credit products to bridge their financial needs,” said Jason Laky, executive vice president and head of financial services at TransUnion. “This is a demographic that is younger and newer to the workforce and accordingly, is likely commanding a lower salary at an earlier point in their career.

“As long as inflation remains elevated and the cost of goods remains so as well, balances across products such as credit cards, personal loans, and auto are likely to continue to grow,” Laky continued in the news release.

TransUnion went on to mention that the financial pressures brought on by inflation likely are a driving factor in the performance of today’s Gen Z consumers as compared to the millennial group a decade prior.

In the 24 months following origination of a new account, TransUnion indicated that Gen Z saw higher consumer-level delinquency rates for auto and credit card — and in particular for personal loans — with nearly 10% more Gen Z borrowers 60 or more days past due compared to millennials 10 years earlier.

At the same time, experts pointed out that Gen Z consumers are not unique in experiencing greater financial challenges today.

For all borrowers in 2023, TransUnion said consumer-level delinquency rates were higher than seen in 2013 across numerous credit products, including bankcards and auto financing.

However, the rise seen among younger 22- to 24-year-old consumers, who are early in their credit journeys, warrants ongoing monitoring, according to TransUnion.

“The performance of the youngest Gen Z borrowers is down across a number of credit products as compared to Millennials of the same age 10 years earlier,” said Charlie Wise, senior vice president and head of global research and consulting at TransUnion. “While inflation and interest rates remain elevated, Gen Z consumers need to be particularly cautious in how they use and manage their available credit, given the relative youth of their credit profiles and lack of a robust historical track record.

“Establishing a foundation of strong credit performance will be important as this emerging segment looks to expand their credit wallets to meet their future needs,” Wise went on to say.

To learn more details about the TransUnion study, Solving for Z, go to this website.