TransUnion introduces new tool to assess consumers with limited credit histories

Graphic courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Despite a strong employment picture, TransUnion acknowledged some consumers are still struggling financially due to elevated inflation and higher than normal interest rates.

TransUnion also pointed out that the lowest income households — ones earning less than $50,000 — face another challenge, with only 35% indicating they have sufficient access to credit and lending products.

To provide finance companies and lenders with a clearer picture of thin- or no- file consumers — including those who may not be gaining sufficient access to credit — TransUnion on Wednesday introduced the TruVision Alternative Bank Risk Score.

This score includes checking and banking data applicable to the short-term lending space and can be used to enhance clients’ existing underwriting scores.

TransUnion explained this tool can offer a more holistic view of a consumer’s financial behavior and enhances the accuracy of credit risk decisions.

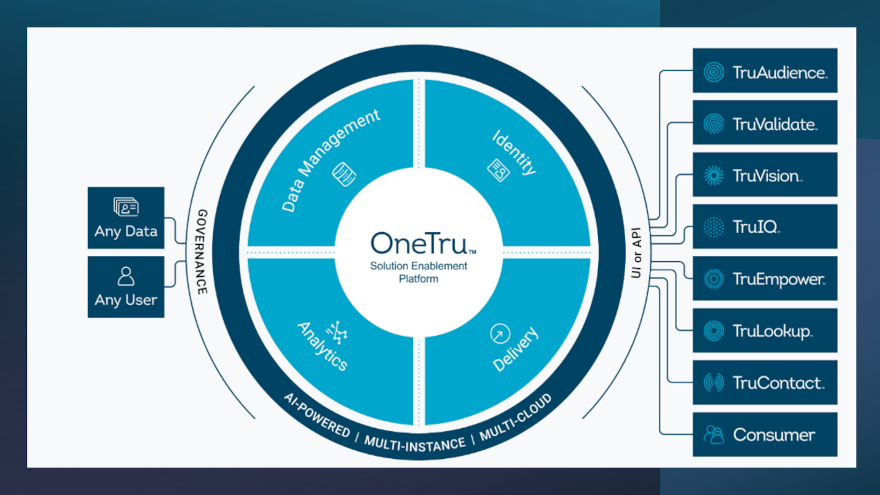

The TruVision Alternative Bank Risk Score is enabled by TransUnion’s OneTru solution enablement platform, which now houses the company’s short-term lending data.

TransUnion said this solution can evaluate a consumer’s banking activities to assist in predicting their future financial behavior, particularly their likelihood of defaulting on loans or other credit obligations.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The score can complement the existing suite of tools that TransUnion already provides to clients to help them in determining credit risk.

TransUnion said it can be used with existing risk scores or as a standalone tool for underwriting.

“The addition of the TruVision Alternative Bank Risk Score to TransUnion’s existing Alternative Lending suite of credit risk scores offers lenders a deeper look at potential borrowers who may otherwise have no, or very limited, credit history, as well as subprime borrowers,” said Liz Pagel, senior vice president of consumer lending at TransUnion.

“It can aid in improving the predictive power of risk models, helping to identify potential risks that might be missed when relying on a single data source,” Pagel continued in a news release.

In addition to helping clients make more informed decisions, TransUnion said this score can potentially offer some consumers with limited credit histories an alternate pathway to credit, by providing a more comprehensive view of their financial behavior, identifying those creditworthy consumers who may lack a traditional credit history but demonstrate responsible banking behavior.

A recent report from the Federal Deposit Insurance Corporation (FDIC) revealed that one in six households had no mainstream credit, and this percentage was significantly higher among lower-income households, those with a lower educational ceiling, and minority households.

The report also indicated that those households without mainstream credit likely did not have a credit score with credit bureaus, making it that much harder to obtain credit moving forward.

TransUnion’s Q4 2024 Consumer Pulse found that lower-income consumer households have a much more difficult time accessing credit.

“TransUnion has long provided lenders with access to a wide range of tools, resources, and data with which informed lending decisions can be made,” said Jason Laky, executive vice president and head of financial services at TransUnion.

“In this increasingly complex economic environment, many consumers, lower income or otherwise, are seeking credit with limited or non-existent traditional credit histories. The use of a broad suite of alternative credit data tools offers lenders a new and important tool in assessing risk among these consumers,” Laky went on to say.

Lower Income Households Do Not Feel They Have Sufficient Access to Credit and Lending Products

| Low (<$50K) | Medium ($50-99K) | High ($100k+) | |

| Have Sufficient Access | 35% | 64% | 80% |

| Neither Agree nor Disagree | 31% | 21% | 11% |

| Do Not Have Sufficient Access | 34% | 15% | 8% |

Source: TransUnion.

For more details, go to this website.