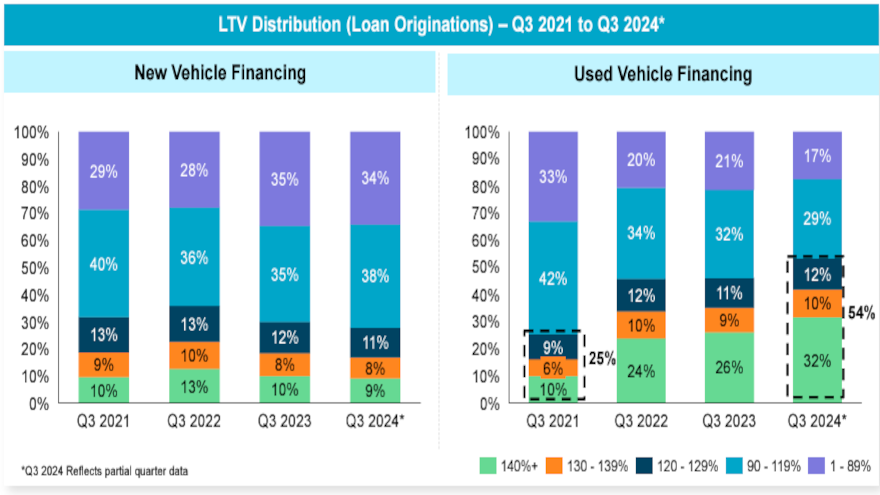

TransUnion: LTVs above 120% for used cars have doubled in past 3 years

Charts courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Along with taking an overall look at monthly payments and delinquency, the auto portion of the Q3 2024 Quarterly Credit Industry Insights Report (CIIR) from TransUnion detailed a metric that might illustrate the callbacks, dialogue and negotiations that dealerships and finance companies are having to get some car buyers into a contract agreeable for all three parties.

TransUnion reported on Tuesday that the share of used-vehicle originations with a starting loan-to-value (LTV) reading above 120% has more than doubled during the last three years, jumping from 25% to 54%.

While affordability remains a challenge, TransUnion said monthly car payments have stabilized after a sustained period of escalation.

In Q3, analysts found the average monthly new car payment increased by 0.3% to $745. This follows a two-year period from Q3 2021 through Q3 2023 in which new-car retail prices increased by nearly 5%.

TransUnion noticed monthly payments for used vehicles softened year-over-year from $534 to $526.

Analysts went on to mention originations remain well below historical norms, coming in at 6.4 million in Q2, which is up slightly year-over-year terms.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Satyan Merchant, senior vice president and automotive and mortgage business leader at TransUnion, explained that it remains to be seen if the recent interest rate reduction will spur some of those waiting on the sidelines to head over to a dealership.

TransUnion added that leasing continues to gain traction after pandemic-era lows.

In Q3, analysts said leasing accounted for 25% of registrations, up from 17% two years ago.

And finally, as some finance companies are experiencing, TransUnion indicated delinquencies continued to tick up. However, the overall rate of growth continues to slow.

Analysts found that serious consumer-level delinquency rates — contracts that are 60 days or more past due — stood at 1.6% in Q3.

“Despite originations remaining low relative to historical norms, there’s much to be optimistic about when looking to key auto metrics this quarter,” Merchant said in a news release. “Delinquencies, while still increasing, are growing more slowly. However, this does continue to impact loan availability. That said, interest rate declines along with more normal inventory levels and reduced prices could provide relief to consumers in this market.

Leasing appears to be gaining popularity again, likely driven in part by the return of dealer incentives. This leasing option, along with the stabilization of monthly payments for new and used cars, will play key roles in solving the affordability challenges faced by many when car shopping,” continued Merchant, who is among the experts set to appear during Used Car Week, which begins on Monday in Scottsdale, Ariz.

Looking at personal loans

TransUnion reported unsecured personal loans continued to trend positively with accelerating growth in originations and declining delinquencies.

According to the most recent quarter of data available, analysts determined that originations for Q2 stood at 5.4 million, which represents a 5.4% lift year-over-year.

While this level still remains the 6.0 million level recorded in Q2 of 2022, TransUnion said it is the second highest Q2 on record.

Analysts noticed that super prime originations grew 13.4% year-over-year, continuing to be the highest-growth risk segment.

Subprime and near prime had their second quarter in a row of growth after five quarters of declines year-over-year, according to TransUnion tracking.

Despite this growth, delinquencies that are 60 days or more past due came in lower for the second consecutive year, down 25 basis points to 3.5% in Q3.

Liz Pagel, senior vice president of consumer lending at TransUnion, explained this change was driven by a mix shift and improvement in subprime delinquencies, which fell to 11.9% from 12.9% a year ago, while super prime delinquency ticked up.

“The unsecured personal loan market continues to be a bright spot in the consumer lending market, showing growth with declining delinquencies,” Pagel said in a news release. “The performance improvement was driven by better subprime performance even as lenders begin to cautiously open their buy boxes. It is worth watching to see if this trend continues as lenders return to growth across risk tiers in the new year.”

Overall views of credit market

TransUnion determined consumer credit balances continued to grow across all credit products during the third quarter, but in many cases, that growth has slowed.

The report showed that after a period of rapid balance growth across a range of credit products, in particular credit cards and unsecured personal loans, balance growth has slowed.

While both credit products saw year-over-year growth of approximately 15% in Q3 of 2023, year-over-year balance growth for Q3 of this year was only 6.9% for credit cards and 3.6% for unsecured personal loans.

“The moderated growth in balances is likely the result of a number of factors in combination,” said Michele Raneri, vice president and head of U.S. research and consulting at TransUnion. “For example, looking at credit cards, lenders in many cases have tightened underwriting standards which may have resulted in lending to borrowers less likely to grow balances quickly.

“In addition, as inflation has returned to more normal levels in recent months, it has also meant consumers may be less likely to rely on these credit products to make ends meet,” Raneri added.

TransUnion is hosting a free webinar at 2 p.m. (ET) on Friday to discuss the report in more detail. Registration can be completed here.