TransUnion: Modest growth in auto finance coming this year

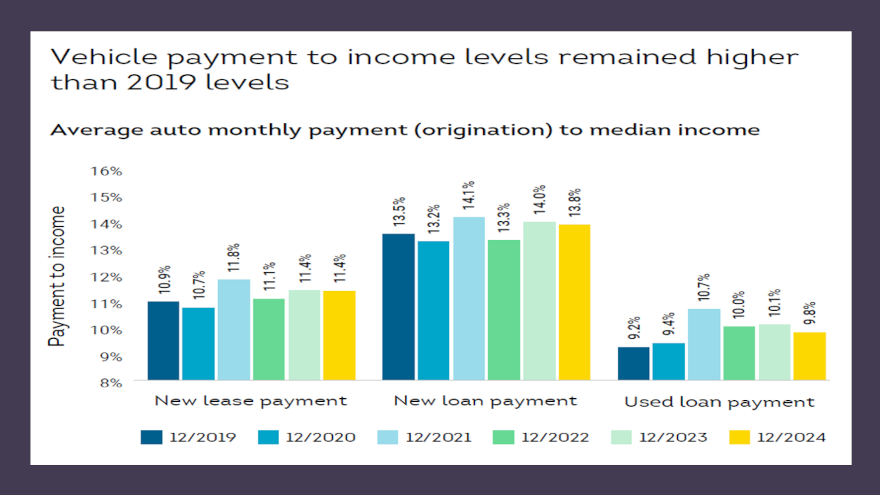

Chart courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

While perhaps not a clip that will set records, TransUnion is expecting some growth in auto financing this year.

Previously held back by stubbornly high inflation, rising interest rates and elevated home and vehicle prices, TransUnion said this week that new auto, mortgage, and unsecured personal loans are expected to see gains in 2025.

A myriad of factors, not the least of which are lenders’ continued caution in their underwriting strategies, will likely temper the overall rate of growth across these products, according to TransUnion, which discussed auto, personal loans and more in its Q4 2024 Quarterly Credit Industry Insights Report (CIIR).

“The Federal Reserve has signaled that it will not rush into interest rate cuts, potentially keeping rates at a level that could give consumers pause,” said Jason Laky, executive vice president and head of financial services at TransUnion.

“However, we still believe that many consumer credit products will have higher originations in 2025. This will range from modest growth in auto and unsecured personal loans to more significant increases in mortgage,” Laky continued in a news release distributed on Thursday.

More data about auto

TransUnion began its auto-finance assessment by reiterating that originations are viewed one quarter in arrears to account for reporting lag.

Originations were up 1.5% year-over-year in Q3 2024, although they still lagged 14.8% below the pre-pandemic volume generated in Q3 2019.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Analysts said super prime borrower originations led the way, climbing 8.5% year-over-over during the quarter. They explained this growth was likely driven in part by increasingly available new-car inventory and increases in incentives.

TransUnion pointed out other risk tiers sustained declines in originations year-over-year. And when compared to 2019 levels, originations remained down across all risk tiers, with subprime posting the largest decline, tumbling by 27.6%.

Likely also driven in part by incentives, TransUnion indicated leasing continued its rebound from its Q4 2022 low of 17% to come in at 24% of new-vehicle registrations in Q4 2024.

On the portfolio-health front, analysts found that consumer-level delinquencies of 60 days or more past due continued to tick up in Q4 2024 to 1.67%. This represented an increase of 6 basis points year-over-year.

TransUnion determined that new-vehicle vintages continued to show delinquency performance in Q4 2024 consistent with pre-pandemic periods of 2018 and 2019.

Used-vehicle vintage delinquencies were slightly improved as compared to the 2022 cohort but remained worse than 2018 and 2019, according to TransUnion tracking.

“Super prime was the underlying driver of auto originations growth in Q4 2024 and will likely continue in 2025,” said Satyan Merchant, senior vice president and automotive and mortgage business leader at TransUnion.

“Affordability continues to be an issue for the used vehicle market and for below prime consumers, impacted by higher rates and cross-wallet inflation. This is unlikely to materially improve until we have more certainty around used vehicle inventory and interest rates,” Merchant continued in the news release.

“Delinquencies have now inched past highs previously seen in 2009, primarily driven by increases among below-prime risk tiers, and we will be monitoring them moving forward,” he added.

Q4 2024 Auto Loan Trends

| Auto Lending Metric | Q4 2024 | Q4 2023 | Q4 2022 | Q4 2021 |

| Total Auto Loan Accounts | 80.4 million | 80.4 million | 80.2 million | 81.4 million |

| Prior Quarter Originations1 | 6.4 million | 6.3 million | 6.5 million | 7.2 million |

| Average Monthly Payment NEW2 | $749 | $751 | $729 | $655 |

| Average Monthly Payment USED2 | $523 | $531 | $527 | $494 |

| Average Balance per Consumer | $24,373 | $23,945 | $22,998 | $21,298 |

| Average Amount Financed on New Auto Loans2 | $42,023 | $41,054 | $41,941 | $40,489 |

| Average Amount Financed on Used Auto Loans2 | $26,135 | $26,380 | $27,442 | $27,346 |

| Consumer-Level Delinquency Rate (60+ DPD) | 1.67% | 1.61% | 1.43% | 1.05% |

1Note: Originations are viewed one quarter in arrears to account for reporting lag.

2Data from S&P Global MobilityAutoCreditInsight, Q4 2024 data only for months of October & November.

Source: TransUnion

Personal loan summary

Like in auto, TransUnion pointed out that personal loan originations are viewed one quarter in arrears to account for reporting lag.

Then analysts said the positive trend in unsecured personal loans continued for another quarter.

TransUnion reported originations for Q3 2024 — the most recent quarter of data available — stood at 5.8 million, an increase of 15% year-over-year. The volume marked the third consecutive quarter of year-over-year growth and the first quarter of double-digit growth in two years; with the last occurrence happening in Q2 2022.

Analysts explained all risk tiers contributed to this expansion, especially the super-prime and the below-prime tiers, which grew around 17% compared to the prior year.

TransUnion highlighted this growth drove records, per Q4 2024 data, in the volume of outstanding loans, in total balances, and in the number of consumers with a balance.

Concurrently, average debt per borrower was lower year-over-year in Q4 2024, driven by the prime and below risk tiers, according to TransUnion.

Furthermore, delinquencies of 60 days or more past due fell year-over-year in Q4 2024 to 3.57%. That’s 33 basis points below the same quarter of 2023.

Analysts noted the decline was due to risk-mix shift as lower risk super prime borrowers continued to grow as a share of total loans, as well as from delinquencies among subprime borrowers which fell 136 basis points year-over-year.

“The unsecured personal loan market continued its rebound with originations growing year-over-year across risk tiers, and with strong double-digit growth for most of them,” said Liz Pagel, senior vice president of consumer lending at TransUnion.

“Additionally, borrower-level delinquencies still saw declines year-over-year. This was due to loans being issued across the credit spectrum — especially super prime — and from the subprime delinquency rate continuing to fall even as lending has opened back up to this segment,” Pagel continued.

“With the growth to date and optimism from lenders, we expect to see this as the beginning of a period of expansion,” she went on to say.

Q4 2024 Unsecured Personal Loan Trends

| Personal Loan Metric | Q4 2024 | Q4 2023 | Q4 2022 | Q4 2021 |

| Total Balances | $251 billion | $245 billion | $222 billion | $167 billion |

| Number of Unsecured Personal Loans | 29.6 million | 28.1 million | 27.0 million | 22.8 million |

| Number of Consumers with Unsecured Personal Loans | 24.5 million | 23.5 million | 22.5 million | 19.9 million |

| Borrower-Level Delinquency Rate (60+ DPD) | 3.57% | 3.90% | 4.14% | 3.00% |

| Average Debt Per Borrower | $11,607 | $11,773 | $11,116 | $9,622 |

| Average Account Balance | $8,496 | $8,704 | $8,195 | $7,328 |

| Prior Quarter Originations* | 5.8 million | 5.0 million | 5.6 million | 5.1 million |

1Note: Originations are viewed one quarter in arrears to account for reporting lag. Source: TransUnion

Closing thoughts

Michele Raneri, vice president and head of research at TransUnion, rounded out the overall assessments contained in the Q4 2024 Quarterly Credit Industry Insights Report (CIIR) with this comment.

“In Q4 2024, we saw several signals inching towards a return to more typical patterns within the consumer credit market,” Raneri said. “Originations ticked up across mortgage and auto and saw more significant growth in unsecured personal loans.

“In contrast, delinquencies presented more of a mixed bag, seeing increases in auto and mortgage, while at the same time decreasing for unsecured personal loans and credit cards. We will be looking for additional signs of improved performance in these markets moving forward,” she went on to say.