What consumers think about auto financing as next potential interest rate move nears

Graphic courtesy of Santander.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

As the Federal Reserve approaches its next opportunity to modify interest rates on Wednesday, findings from a new survey orchestrated by Santander Holdings USA perhaps reinforced perceptions already held by auto finance leaders.

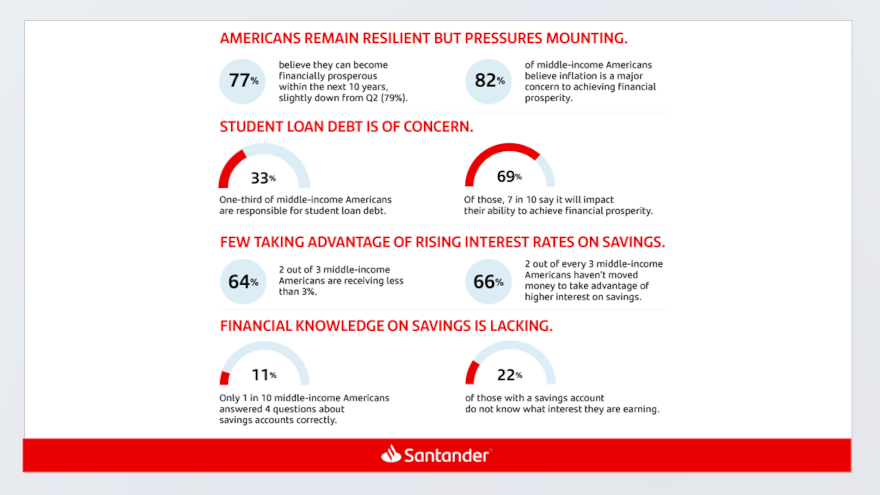

Santander reported on Monday that American consumers are optimistic about their futures despite mounting financial pressures. The survey results found 68% of middle-income households believe they are on the right track toward achieving financial prosperity, which remains unchanged from Q2.

When looking closer at auto finance, Santander indicated the majority of middle-income Americans — 76% to be precise — rely on a vehicle for their work commute.

However, gas prices and higher cars prices have made vehicle access more difficult, according to the survey.

To maintain access to their vehicles, seven in 10 (69%) are willing to sacrifice other budgetary items.

While half of respondents said they delayed purchasing a vehicle in the past year due to cost, Santander noted that demand persists with 41% considering purchasing a vehicle over the next 12 months.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The survey went on to mention a quarter would be more likely to purchase a vehicle in the year ahead if they are able to secure financing.

However, Santander said prolonged inflation and the resumption of federal student loan payments are clear economic stressors for middle-income households.

More than seven in 10 say they are unable to save as much as a result of inflation, which remained the number one obstacle to achieving prosperity.

Approximately a third of respondents — across all generations — are responsible for student-loan debt, with 69% of this group stating that the resumption of federal student-loan payments is a challenge to achieving financial prosperity.

The study also revealed that many middle-income Americans are missing out on an opportunity to offset these inflationary pressures by earning more on their savings.

Santander pointed out that interest rates on savings have climbed steadily to the highest levels in decades, yet two-thirds (66%) of middle-income Americans have not moved money into higher-yielding accounts to take advantage of these rates since the beginning of 2022.

“A lack of financial knowledge may be a contributing factor to the inertia,” the bank said in a news release.

Just one in 10 respondents (11%) could answer four questions about savings accounts correctly.

Those who responded to all correctly (41%) were more likely to have moved money to take advantage of higher rates versus those who answered all questions incorrectly (25%).

“Having the information needed to make important financial decisions is crucial for reaching one’s financial goals,” Santander US chief executive officer Tim Wennes said in the news release. “At Santander, we recognize our important role in providing customers with the support and guidance they need — in a way that is simple and easy to understand — so they can take control of their decision-making. Conducting this research each quarter provides us with essential insights, so that we can best meet our customers where they are in their journey to financial prosperity.”

Santander explained the study, which built upon research conducted in the first and second quarters, assessed middle-income Americans’ current financial state and future aspirations, with a focus on how current economic conditions have impacted their households.

It also identified areas for economic growth and demand, including entrepreneurship, financial education and vehicle ownership.

So how might Fed chair Jerome Powell and his fellow policymakers influence what Santander or other banks and economic researchers find next? Experts from another institution — Comerica Bank — offered their projection on Monday.

Bill Adams is chief economist and Waran Bhahirethan is senior economist at Comerica Bank.

“The Federal Open Market Committee is likely to hold the federal funds rate steady for a second consecutive decision at the conclusion of their next meeting on (Wednesday), at a range of 5.25% to 5.50%,” Adams and Bhahirethan said. “At an Oct. 19 speech, his last before the media blackout that precedes the Fed meeting, chair Powell repeated the Fed’s forward guidance from September: They will ‘proceed carefully’ in adjusting monetary policy near-term, likely meaning no change to rates barring a major upside surprise in inflation or wage growth, or a downside surprise from economic growth.

“The 10-year Treasury note yield rose briefly to 5% in late October, the highest since 2007, and many Fed officials have said that higher longer-term interest rates mean less pressure on the Fed to raise the policy rate. The Fed is also attentive to downside risks to growth from spillover from the Israel-Hamas war and the UAW strike,” Adams and Bhahirethan went on to say.