Why credit access reached highest level in 28 months

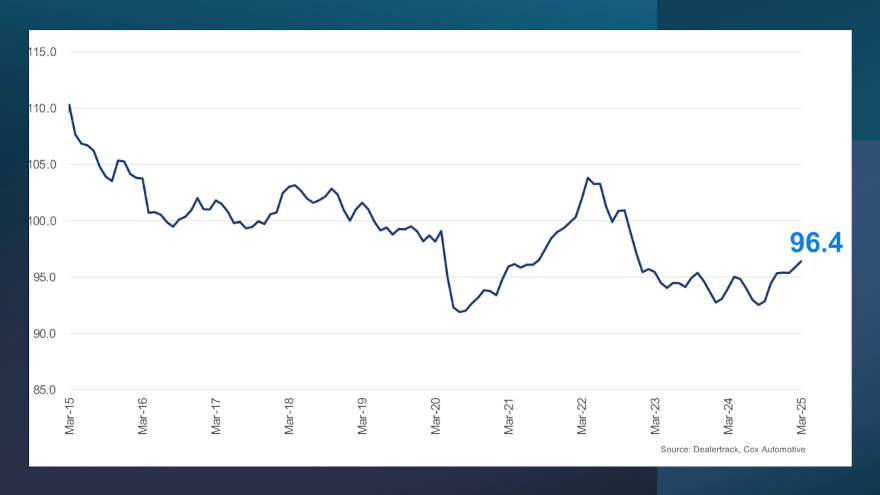

Dealertrack Credit Availability Index for March 2025. Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Anecdotal conversations that Cherokee Media Group shared with Auto Intel Summit attendees last week generally indicated that dealers and lenders are not having too much trouble getting potential vehicle buyers the financing they need to take delivery.

The newest Dealertrack Credit Availability Index released while industry leaders gathered in Cary, N.C., reinforced that conference dialogue.

The March index jumped to 96.4, representing a 3.1% increase year-over-year, and marking the highest level of auto credit access since December 2022.

While not part of the large contingent of Cox Automotive experts in North Carolina for the Auto Intel Summit, Jonathan Gregory, a senior manager on Cox Automotive’s economic and industry insights team, reacted to the index reading and offered these general observations that accompanied the new index.

“Overall, the March Dealertrack Credit Availability Index saw notable improvements in auto credit availability, reflecting both lender behavior and broader economic conditions,” Gregory said in his analysis. “Consumers benefited from higher approval rates and increased access to subprime loans, while lenders navigated a mixed environment with varying credit demand and policies.

“For consumers, the improved access to auto credit is a positive development, particularly for those with lower credit scores,” he continued. “However, the higher yield spreads and down payment requirements mean that borrowing costs may be higher. Consumers should carefully consider the terms of their loans and their ability to manage monthly payments and overall debt.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“For lenders, the increased subprime share and longer loan terms indicate a willingness to take on more risk,” Gregory went on to say. “However, the higher yield spreads and down payment requirements suggest that lenders are also taking steps to mitigate this risk. Lenders will need to balance their risk appetite with prudent lending practices to ensure the stability of their loan portfolios.”

Gregory drilled deeper into the six components that go into how Cox Automotive forms the index, beginning with approval rates.

Cox Automotive reported auto-finance approval rates increased by 150 basis points in March.

“This increase indicates that more consumers were able to secure auto loans, reflecting a more favorable lending environment,” Gregory said. “Higher approval rates can be attributed to lenders’ confidence in the economic outlook and consumers’ ability to repay loans.”

As Gregory referenced, Cox Automotive noticed that the subprime share of loans — representing contracts booked with borrowers who have lower credit scores — soared 220 basis points higher in March.

“This significant rise suggests that lenders are more willing to extend credit to higher-risk borrowers. The increase in subprime lending can be seen as a double-edged sword: while it expands access to credit for consumers with lower credit scores, it also introduces higher risk into the lending portfolio,” Gregory said.

Turning next to auto finance’s connection to federal activities, Cox Automotive found that the yield spread rose 50 basis points in March compared to February.

Specifically, Cox Automotive reported that the contract rate for February came in at 11.34%, and for March, it ticked up to 11.79%. Meanwhile, the five-year Treasury note sat at 4.29% in February and 4.04% in March.

“Higher yield spreads indicate higher costs for borrowers, which could be a response to the increased risk associated with a higher subprime share,” Gregory said. “This trend suggests that while lenders are willing to take on more risk, they are also compensating for this risk by charging higher interest rates.”

Looking at loan terms, Cox Automotive indicated the share of contracts booked for 72 months or longer decreased by 50 basis points in March.

“Longer loan terms can make monthly payments more affordable for consumers, but they also result in higher overall interest costs over the life of the loan,” Gregory said. “The decrease in longer-term loans may indicate that consumers are seeking ways to manage their monthly expenses more conservatively.

Another headwind mentioned by analysts was negative equity share, which represented the proportion of borrowers who owe more on their contracts than the value of their vehicles. Cox Automotive said that share increased by 40 basis points in March.

“This rise is an important indicator of financial stress among borrowers,” Gregory said. “Higher negative equity shares can lead to increased default rates, as borrowers may struggle to keep up with payments on loans that exceed the value of their assets.”

Finally, Cox Automotive pointed out that the average down payment percentage required for loans increased by 40 basis points compared to February.

“Higher down payments can reduce the loan amount and the risk for lenders, but they can also pose a challenge for consumers who may not have sufficient savings. The slight increase in down payment requirements suggests that lenders are taking a cautious approach to mitigate risk,” Gregory said.