With trillions of debt outstanding in auto & beyond, 35% of consumers can’t pay on time

Charts courtesy of Achieve Center for Consumer Insights.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

According to Experian’s State of the Automotive Finance Market Q4 2024, the outstanding balances connected to auto financing grew from $1.106 trillion at the close of 2018 to $1.485 trillion at the end of last year.

And to finish 2024, TransUnion reported that outstanding credit card debt hit $1.11 trillion and personal loan commitments reached $251 billion. Furthermore, there is more than $1.6 trillion in student debt currently outstanding, according to the U.S. Department of Education.

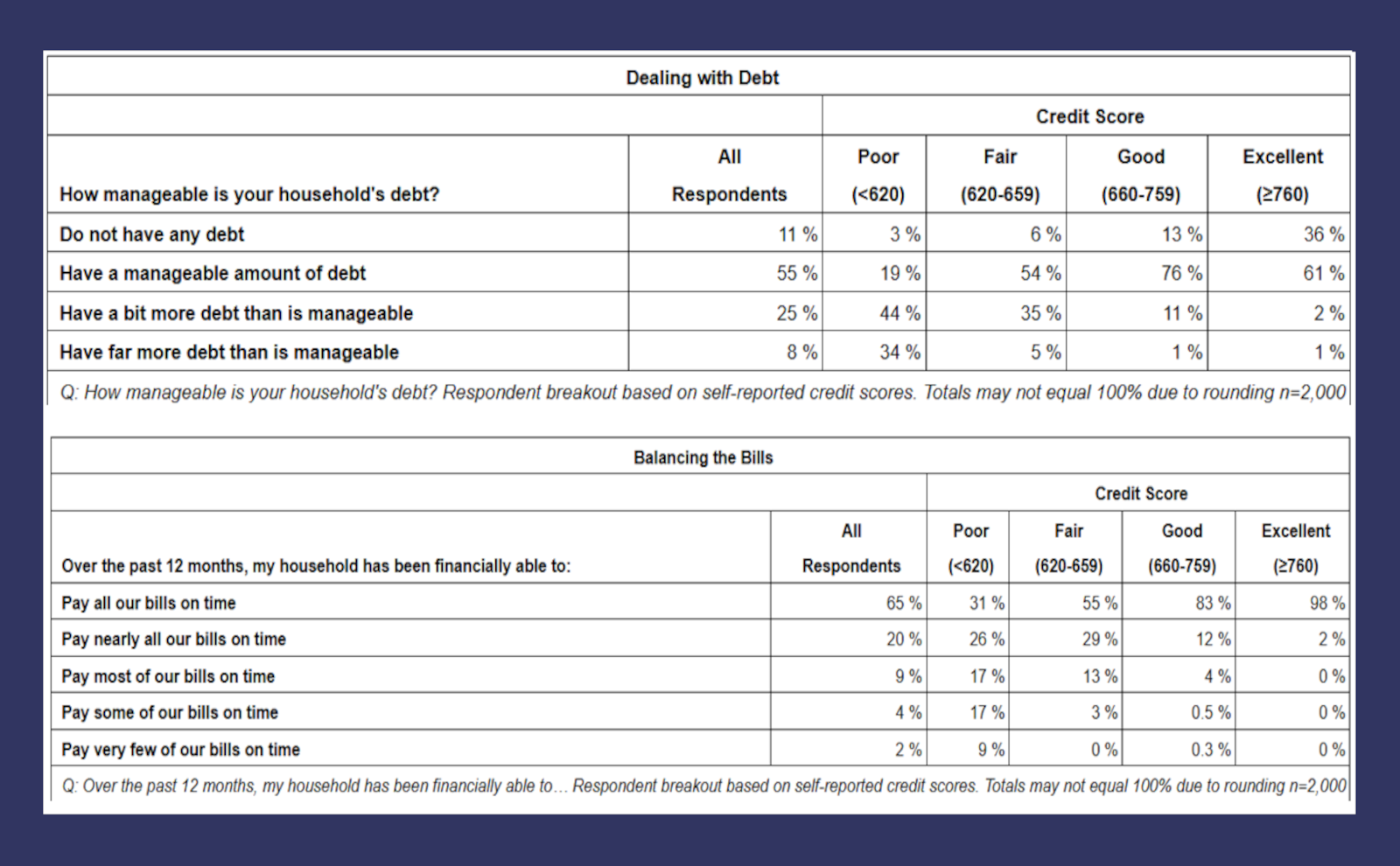

Perhaps it’s no wonder that 33% of consumers have trouble managing their debt and 35% can’t pay all of their bills on time, according to new survey data released Thursday from digital personal finance company Achieve.

The survey was conducted by Achieve’s think tank, the Achieve Center for Consumer Insights, and highlightd the challenges households face with mounting debt.

For example, among consumers with self-reported excellent credit scores (760 and above), researchers found that 36% are debt-free and 61% say their debt is manageable.

Conversely, among consumers with poor credit scores (below 620), just 3% are debt-free and 19% say their debt is manageable, according to the survey.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“When people are overwhelmed and about to miss bill payments, they often don’t know what steps to take — but the right strategy in that moment can make a major difference,” Achieve co-founder and co-CEO Brad Stroh said in a news release. “We want consumers to know they’re not alone, and that help is available.”

As Achieve recently reported, Americans continue to experience financial strain and rising debt.

Researchers found that 26% of consumers saw their overall debt increase in the last three months of 2024, while 57% carry credit card balances to cover essential expenses.

Achieve pointed out that on-time bill payments are a major component of credit score calculations, making this practice essential to maintaining a strong credit history.

While 65% of all survey respondents say they pay their bills on time, that figure jumps to 98% of consumers with excellent credit scores and falls to 31% among those with poor credit scores.

“Financial literacy isn’t just about knowing what a budget is — it’s about having a plan in moments of stress,” Stroh said.

All this debt is being noticed by policymakers, too.

In an appearance earlier this week at the University of Minnesota, Federal Reserve Governor Adriana Kugler acknowledged household balance sheets are much different now than five years ago when COVID-19 surfaced.

“When the pandemic struck and social distancing was common, many households severely curtailed spending. In addition, a historic level of government transfers boosted household income. This combination led the personal savings rate to soar,” Kugler told the gathering in her prepared remarks. “Recent work by board staff suggests that these excess savings accumulated during the pandemic may have reduced the effects of tighter monetary policy over recent years. If households are flush with excess cash, they are less likely to respond to elevated interest rates by curtailing demand. Instead, they may have funds to avoid financing or may feel they are able to afford higher monthly payments.

“Now, some five years after the pandemic began, these excess savings are exhausted,” she continued. “This creates an environment in which monetary policy could be having its average effects on the household sector, although we should consider that the financial health of borrowers with lower credit scores has deteriorated meaningfully in recent years and credit card and auto loan delinquencies are now above pre-pandemic levels. For these households, easing monetary policy may have larger effects.”