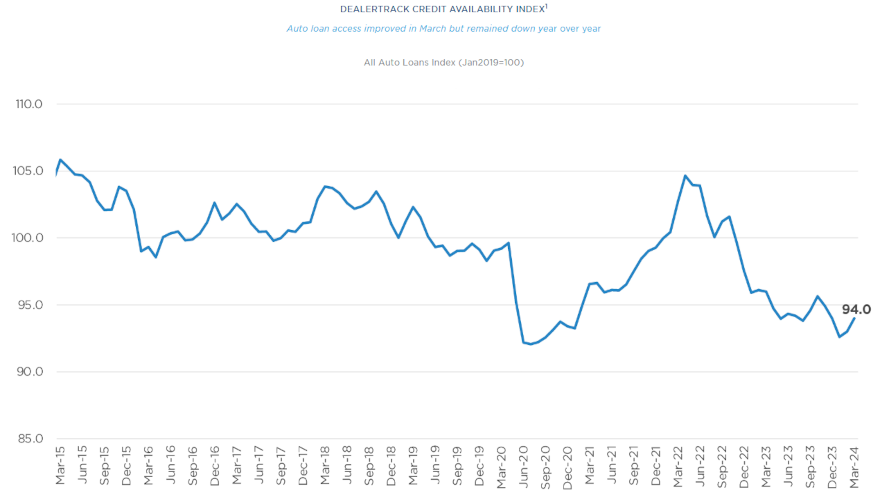

Cox Automotive: Credit availability improved again in March

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

A spring thaw happened in many locations during March, including the auto-finance market.

Cox Automotive reported on Wednesday that access to auto credit improved last month. The Dealertrack Credit Availability Index increased to 94.0 in March, improving for the second month in a row and 1.1% on a sequential basis.

But the new reading fell 1.5% lower than a year ago, according to a Cox Automotive Data Point that highlighted the latest index.

“Credit availability factors mostly moved against consumers in March,” analysts said. “Yield spreads widened, term length shrank, and those moves reduced credit access for consumers. Meanwhile, the subprime share of loans increased, and approval rates increased, which were moves that showed improvement for consumers. The down payment share was unchanged but at the highest level in the history of the data series.

“By channel, used loans through independent dealers saw the least loosening while certified pre-owned loans saw the most amount of loosening. On a year-over-year basis, most channels were tighter, except used loans from independent dealers loosening. Among lenders, auto captive companies loosened the most in March, while auto-focused finance companies loosened the least year over year,” Cox Automotive went on to say in the index update.

Cox Automotive explained the average yield spread on auto financing booked in February widened by 47 basis points, so rates consumers received were less attractive in March relative to bond yields.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Analysts indicated the average auto finance rate increased by 48 basis points in March compared to February, while the five-year U.S. Treasury increased by 1 basis point, “resulting in a wider average observed yield spread.”

Cox Automotive went on to note the approval rate increased by 8 basis points in March but was down 2.5 percentage points year-over-year.

Analysts added the subprime share increased to 13.0% in March and was up 1.1% year-over-year.

Furthermore, Cox Automotive noticed the share of contracts with terms longer than 72 months decreased by 2 basis points in March, softening 0.8 percentage points year-over-year.

“All channels saw improved credit availability in March. Used certified pre-owned loans saw the most loosening in credit access during the month, while used loans from independent dealers saw the least loosening. On a year-over-year basis, all channels were tighter with used loans having seen the most tightening,” analysts said.

“Credit availability also improved in March across all lender types,” Cox Automotive continued. “Auto captive companies saw the most loosening while auto-focused finance companies loosened the least. On a year-over-year basis, credit access was tighter across all lender types except for auto-focused finance companies, while banks tightened the most.”

Cox Automotive reiterated each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity, and down payments.

The index is baselined to January 2019 to provide a view of how credit access shifts over time.