Consumers’ financial stress drops overall but climbs in swing states

Financial burden lessens nationally, anxieties increase in battleground states

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

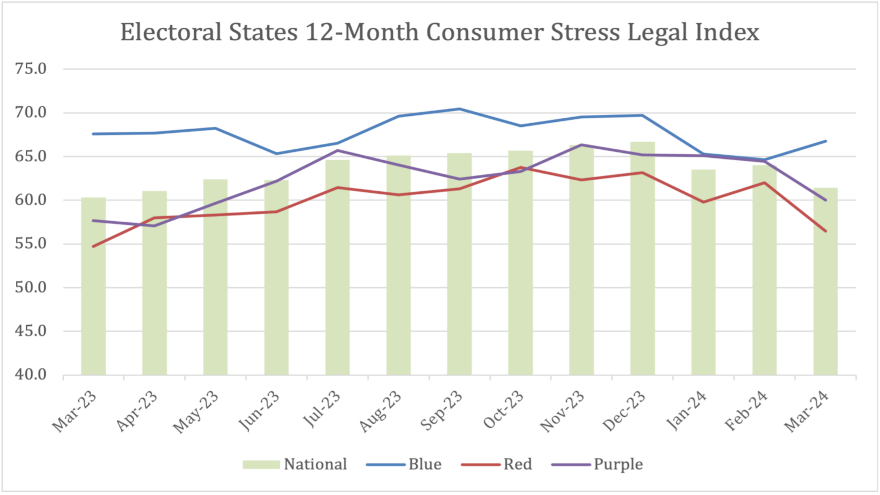

While the overall reading dropped to its lowest level in 12 months, LegalShield’s March Consumer Stress Legal Index (CSLI) is starting to exhibit a pattern seen in the past five presidential election cycles.

Researchers explained the relationship of swing-state stress as measured in LegalShield’s CSLI is relative to the national average and echoes the results of the 2008, 2012 and 2020 presidential elections.

Nationally, the CSLI fell to its lowest level in 12 months, dropping 2.6 points to 61.4. All three sub-indices that make up the flagship index — bankruptcy, consumer finance and foreclosure — declined in March.

The Consumer Finance Index, which tracks approximately 60 areas of law related to personal finances, is down 1.2 points to 99.7, its lowest level since January 2020, just before the COVID-19 pandemic started.

But like what always seems to happen, bring in politics and it gets complicated.

For the first time, LegalShield broke out consumer stress levels on a politically geographic basis, separating red, blue, and purple swing states.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

For the purposes of the current data view, LegalShield classified states based on the outcome of the 2020 election. Swing states in March’s study are Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania and Wisconsin.

The data revealed a noticeable jump in stress in blue states to 10 points higher than red states. Stress in red and purple states fell in March.

Researchers determined consumer stress rose in blue states that voted Democrat in 2020 by 2.4 points to 66.8, above the national level and 10.3 points (18%) higher than red states. The blue states have exhibited higher stress than red and swing states every month since October 2006.

In contrast, red states experienced stress relief in March by 5.5 points to 56.5, below the national index, according to LegalShield.

Researchers added that swing states also reported a drop in stress of 4.5 points to 60.0, just slightly below the national index.

“The trend suggests that when ‘swing state’ consumer stress, as measured by more than 150,000 consumer legal inquiries we field each month, dips below national stress average in October and November, conditions favor a Democratic win,”, LegalShield senior vice president of consumer analytics Matt Layton said in a news release. “That’s where we are now; we’ll be watching this relationship closely.

“When stress in swing states rose above the national index, a Republican was elected. We’ll watch to see how the data moves between now and November,” Layton added.

LegalShield’s CSLI was launched in 2018 and is based on a dataset of more than 35 million consumer requests for legal assistance since 2002. On average, LegalShield receives approximately 150,000 contacts each month from consumers seeking legal help in more than 90 areas of law, including key consumer issues.

LegalShield CEO Warren Schlichting shared his perspective when looking at the data through the political prism.

“LegalShield’s CSLI tracks consumer actions as opposed to polling data or sentiment surveys, providing a unique view of the economic experience in red, blue and purple states,” Schlichting said in the news release.

“These potential voters are calling our provider attorneys because they need help, and it’s striking to see that blue states have a noticeably higher stress level, red state a lower level, and swing states track closely to the national level. And in March we see the lines diverge to a pronounced split,” he went on to say.