JD Power financing study reinforces value of dealer-lender relationships

Charts courtesy of J.D. Power

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

It might be a cliché, but findings from the J.D. Power 2024 Canada Dealer Financing Satisfaction Study reinforced it.

Relationships matter.

Study orchestrators said this week lenders that are looking to capture a bigger piece of the market should focus on building and cultivating relationships with dealers, especially with Canada’s new-vehicle sales continuing to grow year-over-year.

The study, which measures new-vehicle dealers’ satisfaction with their finance providers, found that dealers who have relationship-based interactions with their lender are 54 points (on a 1,000-point scale) more satisfied than those whose interactions are strictly transactional.

Also, J.D. Power found that relationship-based dealers are 36% more likely to send additional business to the lender in the next 12 months.

“The numbers overwhelmingly show that lenders who build and maintain holistic interactions with dealers are more likely to generate additional business than on deals that only hinge on compensation,” said Patrick Roosenberg, senior director of automotive finance intelligence at J.D. Power.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“A lender’s sales reps play a critical role in nurturing and managing those relationship-based engagements,” Roosenberg continued in a news release. “Lenders should invest in and empower their sales reps to excel and ensure they are provided with the tools to be highly effective in cultivating those relationships. One example is to keep an effective rep-to-dealers ratio.”

With nearly one in five dealers categorized as transactional according to the study, J.D. Power added that lenders have ample organic growth opportunities to expand their business by converting those into relationship-based clients.

So, which lenders are doing well?

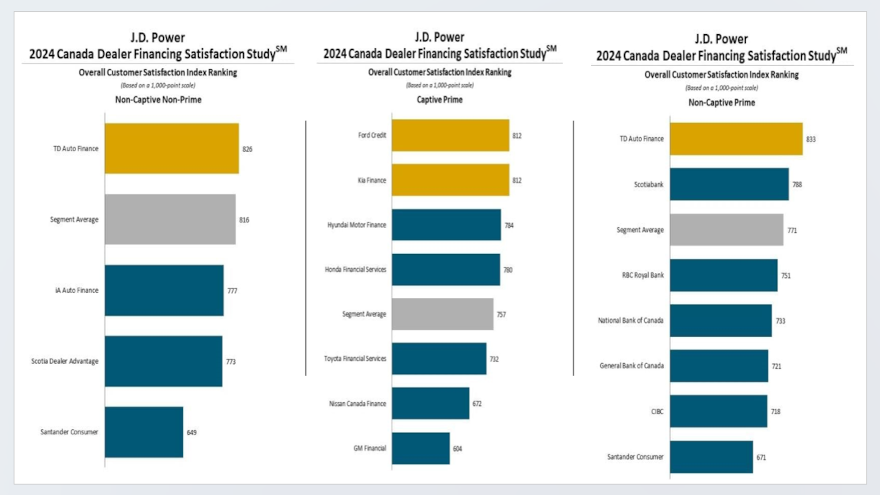

J.D. Power highlighted Ford Credit and Kia Finance ranked highest in a tie in the captive prime segment, each with a score of 812. Hyundai Motor Finance (784) came in third.

In the non-captive prime segment, TD Auto Finance ranked highest with a score of 833. Scotiabank came in second at 788.

In the non-captive non-prime segment, TD Auto Finance topped the chart for the seventh consecutive year with a score of 826.

In a separate news release, Michael McGhee, senior vice president and head of TD Auto Finance Canada, said, “I’m so proud of this team and their relentless commitment to putting the customer at the center of everything we do.”

“Winning this award is an incredible accomplishment, but it’s also a reminder of how much trust and loyalty our customers place in us. On behalf of TDAF, our sincere thanks to all our valued customers for their business,” McGhee continued.

The Canada Dealer Financing Satisfaction Study, now in its 26th year, captured 6,164 finance provider evaluations across three segments, all from new-vehicle dealerships in Canada. The study was fielded in February and March.