PODCAST: TransUnion highlights how EVs are recharging leasing market

Chart courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Here’s some positive news for captives and other finance providers that offer leasing as well as dealership used-car managers looking for inventory down the road.

Consumers are beginning to turn to auto leasing once again

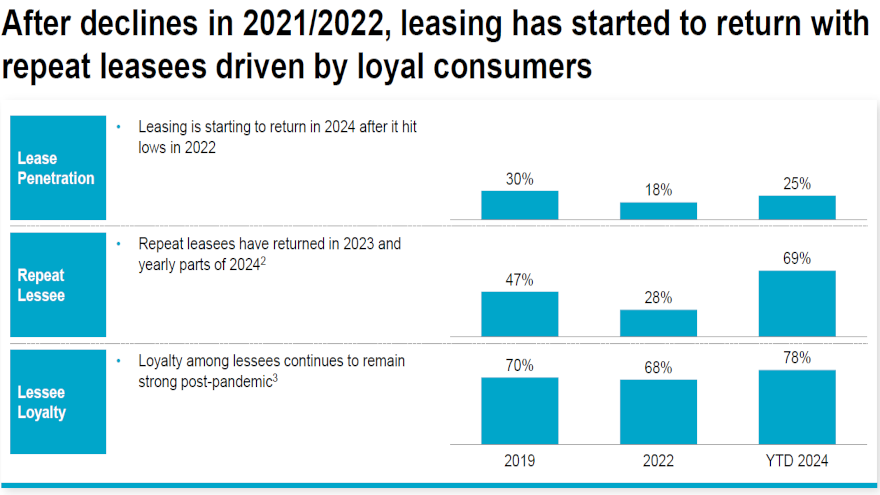

That’s the primary finding from a new TransUnion study. Analysts found that electric vehicles (EVs) are playing a key role in helping to drive the reemergence of this market, following an extended period of decline in the auto leasing market triggered by the pandemic.

The study titled, “The State of Auto Leasing: Current Trends and How to Leverage Them In the Future,” explored emerging trends in auto leasing ranging from volume to loyalty measures to vehicle types, in addition to the credit profiles of those who leased and financed.

The study also showed that the ratio of installment contracts to leasing deals is beginning to look more like that which was seen in 2020 as opposed to the post-pandemic lows of late 2021 and 2022.

In fact, TransUnion reported that from Q1 2023 to Q1 2024, leasing volumes increased from 539,000 to 714,000, a figure much more in line with the 781,000 observed in Q1 2020.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The research uncovered a corresponding regression in installment contract originations as consumers are considering their choices with leasing options now available.

“Consumers are once again returning to leasing as an attractive and affordable alternative to financing new vehicles. This allows them to have the features they want at a subscription-like payment model they have become familiar with across products and services today,” said Jason Laky, executive vice president and head of financial services at Transunion.

“This upward trend also offers benefits to dealers as it means more consumers coming back to their showrooms, and also a return to a steady supply of gently used vehicles for the pre-owned market,” Laky continued in a news release

The study also looked at the credit profiles and activity among those consumers who terminated a lease to gain insights into what those consumers did next.

TransUnion found that 38% leased another vehicle while a combined 28% financed one, whether their existing lease via a buyout, a new vehicle, or a used vehicle.

The credit scores (VantageScore 4.0) among all of these groups were similar, within approximately a 30-point range, according to the study.

TransUnion noticed each group saw a similar payment increase over their previous payment. Those who leased a new vehicle saw an increase in of $120 a month as opposed to their previous vehicle, while those who financed a different new or used vehicle saw increases of $213 and $62, respectively.

However, as monthly lease payments are typically lower, analysts discovered individuals who leased continued to see lower average payments ($707 per month for non-luxury financed vehicles vs. $517 per month for non-luxury leased vehicles).

Incentives and increased options fuel EV leasing

TransUnion determined the overall percentage of leases that could be attributed to electric vehicles has also seen a significant increase in recent years.

In Q2, the percentage of leases connected to EVs was at 16.5%, compared to 11.0% in Q2 2022.

Analysts explained that among the driving factors in the rapid growth of EV leasing are:

—A stabilization, and then increase, in the inventory levels of EVs at dealerships

—An increase in dealer lease incentives among EVs

—The application of IRA tax credits towards leased EVs beginning in January 2023

—More EV options at lower leasing price points for consumers

—An increased preference for a lower or maintenance-free leasing option for EVs

Satyan Merchant, senior vice president and auto and mortgage line of business leader at TransUnion, pointed out through the news release that this increase has gone a long way in reshaping the EV origination market as more consumers are now leasing their EVs rather than financing them.

In Q2 2024, Merchant mentioned nearly 50% of all EV originations were as the result of a lease, more than double the percentage that could be found three years prior.

At the same time, the percentage of EV originations that were financed was down from more than half in Q2 2021 to barely one-third in Q2 2024, according to TransUnion tracking, which Merchant attributed to an increased popularity in auto leasing.

“Auto leasing has been up overall in recent quarters, but nowhere more so than in the EV market, where leasing has now surpassed financing as the preferred option among consumers,” Merchant said in the news release.

“Multiple factors have contributed to this, but two of the most significant include an increase in lower-priced models being introduced, as well as more new dealer leasing incentives on EVs,” he added.

TransUnion acknowledged that not all was quite as rosy when it came to study results.

The findings showed dealers still have work to do when it comes to enticing first time lessees to engage in the market.

In fact, year-to-date in 2024, TransUnion said only 30% of lessees are leasing for the first time, down from 33% in 2019.

“Fewer consumers are choosing to become first-time leases,” Merchant said. “This ultimately decreases the lifetime value of those consumers and limits opportunities for dealers, so that’s an area of concern.

“But it’s also a real growth opportunity for dealers moving forward, as many consumers who may be looking for a pre-owned vehicle later in 2024 and into 2025 may find fewer lease returns resulting in a smaller inventory. That’s a group that dealers should consider trying to turn into first-time leasees and should aggressively market towards,” Merchant went on to say.

Merchant elaborated about the study findings and more for an episode of the Auto Remarketing Podcast. You can listen to the episode in the window below.