‘Buckle up’ amid volatility in labor market & elsewhere

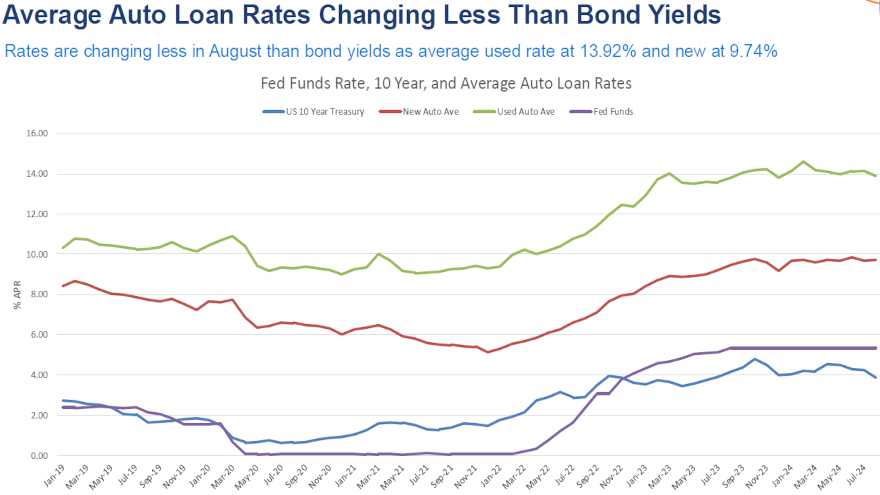

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Twice during a nine-minute video presentation this week, Cox Automotive chief economist Jonathan Smoke suggested auctions, dealerships, finance companies and other operations involved with cars nowadays should “buckle up.”

Especially considering the soft metrics coming from the labor market, with one research firm discussing “functional unemployment,” it’s likely prudent advice.

The Conference Board said the U.S. economy needs 4.6 million additional workers per year to maintain current levels of supply, demand and population balance. That figure amounts to 2% of the U.S. population, according to the organization.

But the labor market is not on that trajectory. Comerica Bank chief economist Bill Adams and senior economist Waran Bhahirethan recapped the federal employment data that surfaced this week.

“The July jobs report was considerably weaker than expected,” Adams and Bhahirethan wrote in an economic commentary. “Employers added just 114,000 nonfarm payroll jobs, the unemployment rate rose to 4.3%, and average hourly earnings growth slowed to 3.6%. That gave July the highest unemployment rate and slowest wage growth since 2021.

“Other labor market data released after the jobs report emphasize how the job market is softening,” the Comerica Bank experts continued. “The Bureau of Labor Statistics’ annual preliminary benchmark revision revised down the level of employment in March 2024 by 818,000, implying that job growth in the 12 months through July was just 164,000, less than shown in the monthly report.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“And the mid-August release of state-level data on employment and unemployment showed that July’s weakness wasn’t just in Texas, where Hurricane Beryl was a huge disruption, but spread across a number of states on the East Coast, Midwest and High Plains,” they went on to say.

In his video presentation, Smoke recapped more federal data that showed new initial unemployment claims in July were at the highest level in a year and remain higher than they were before the pandemic. Smoke said unemployment claims are currently concentrated in New Jersey, California, Rhode Island, Minnesota and Connecticut with 40 states sustaining an increase unemployment claims during the past four weeks.

“The labor market is clearly weaker than a year ago and earlier this year,” Smoke said.

Along with those specific states, the labor market continues to be challenging for Black and Hispanic workers, with rising functional unemployment rates fluctuating at levels well above the overall average, according to the latest True Rate of Unemployment (TRU) by the Ludwig Institute for Shared Economic Prosperity (LISEP).

LISEP said its TRU is designed to provide a more comprehensive view of labor market conditions. By accounting for underemployment and other factors, TRU’s data suggests a worsening situation for low-income workers, according to LISEP chairman Gene Ludwig.

“Our data consistently indicated a troubling labor market long before the recent uptick in the official unemployment rate,” Ludwig said in a news release. “When individuals are working for poverty wages, they are essentially ‘functionally unemployed.’ The current situation may represent a shift from underemployment to outright unemployment.”

The TRU measures the “functionally unemployed,” defined as the jobless plus those seeking, but unable to find, full-time employment paying above poverty wages ($25,000 a year in 2024 dollars) after adjusting for inflation.

While July’s overall TRU remained unchanged at 24.5%, Ludwig said the labor market experience varied significantly across demographic groups.

Ludwig noted Black workers faced heightened challenges, with their TRU rising from 26.9% to 27.6%.

Ludwig went on to mention Hispanic workers experienced an even-steeper increase of 1.2 percentage points, from 26.8% to 28%. In contrast, White workers saw an overall improvement, dropping from 23.8% to 23.1%.

LISEP noted the TRU for both men and women remained relatively unchanged, with the rate for men increasing 0.1 percentage points to 20.3% and the TRU for women dropping 0.2 percentage points, to 29.2%.

Among education categories, those with advanced degrees continue to maintain the lowest TRU at 12.9%, according to LISEP, a 0.8 percentage point improvement, but those with no high school diploma struggled with their July TRU climbing to 52.6%, 0.1 percentage points above its June level.

“Workers at the lower end of the earnings scale have always been the most vulnerable, even in the most robust economy; and here, we are seeing families continue to struggle. The truth is, they never fully recovered from the Great Recession in 2007,” Ludwig said in the news release.

“We must stop using the stock market and broad, outdated economic indicators as the sole measure of our national economic health. They just don’t accurately reflect the reality for a majority of American households,” Ludwig added.

Smoke tied together the trends and analysis through the prism of automotive.

“August started with massive volatility in the stock market,” Smoke said. “But more than halfway through the month, we are seeing strength in the retail vehicle market.

“Rates are little changed but sales estimates indicate a continuation of the positive trend we had before the DMS disruptions to reporting in June and July. Supply is close to normal but relatively tight in both new and used,” he continued.

“A tightening wholesale market is leading to higher wholesale prices that have not yet cascaded into retail. Keep your seat belts buckled as the election, geopolitics and the Fed are all likely to create more volatility over the next several weeks,” Smoke went on to say.