Survey: Despite notable lack of emergency funds, majority of Americans feel confident about handling unexpected expenses

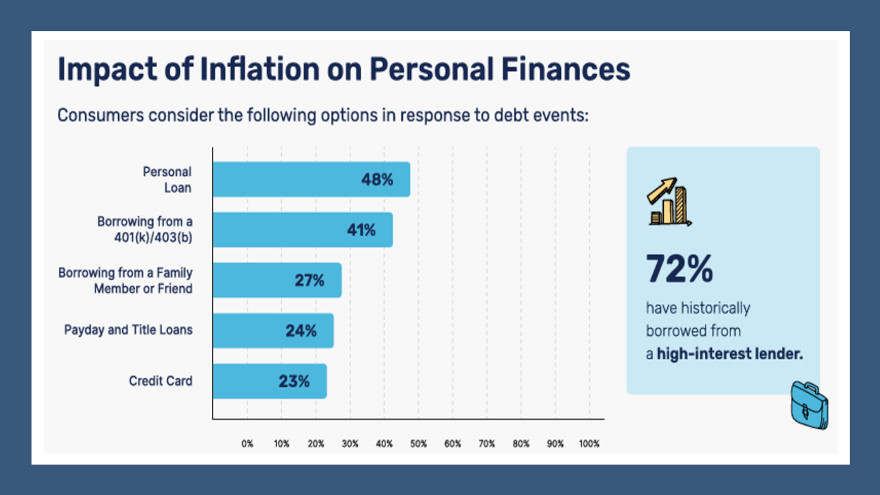

Chart courtesy of Kashable.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

More evidence surfaced last week about how stretched family budgets are nowadays, with a survey by Kashable indicating more than 80% of Americans do not have an emergency fund.

But the fintech platform that provides “socially responsible credit” and financial wellness solutions as an employer-sponsored voluntary benefit also found 59% of respondents still feel confident in their ability to handle unexpected financial expenses, while 22% feel “unsure” about their ability.

The findings are part of Kashable’s State of Consumer Finance Report, which included survey data collected in mid-June through mid-July.

Over the past year, Kashable reported nearly two-thirds (63%) of respondents feel that their financial situation has negatively impacted their mental and/or physical health.

Inflation (36%), lack of emergency savings (29%), and credit card debt (22%) are the top factors causing financial stress and uncertainty, according to the survey, which also suggested that many Americans are struggling to cope with the rising costs of living expenses and may face difficulties in meeting their financial goals and obligations.

Einat Steklov, co-founder and co-CEO at Kashable, acknowledged the impact of financial stress can extend beyond the wallet and could affect an individual’s mental and physical health.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Over the past year, Steklov pointed out the the strain of managing finances has taken a toll on overall well-being. The uncertainty and pressure from factors such as inflation and credit card debt contribute to this sentiment of financial instability, according to Kashable research, which also found that 81% of respondents reported paying off debt as their top financial concern, followed by handling emergency or unplanned expenses (54%), building savings (41%), retirement planning (27%), and medical expenses (21%).

“This lack of a financial safety net leaves many Americans vulnerable to financial instability, especially when unexpected costs arise. Debt repayment continues to be a primary concern, overshadowing other financial priorities such as saving for the future, planning for retirement, and covering medical expenses,” Steklov said.

Perhaps weary consumers might get a reprieve courtesy of the first cut in interest rates in more than a year.

Cox Automotive’s Jonathan Smoke emphasized that it might take time for the move by the Federal Reserve to influence auto financing, the company’s chief economist sees potential benefits coming sooner in other areas of consumer credit.

“Consumers should see more immediate changes in the rates charged on credit cards, which should help improve the financial status of consumers who have built up balances to maintain spending,” Smoke wrote in a blog post immediately after the Fed’s announcement last week.

“This cut will be a positive change that will eventually help bring auto loan rates down. Interest expense on credit cards has been crowding out spending on goods and services and has likely contributed to delinquencies and defaults on credit cards and auto loans. With rate declines starting, this negative pressure should decline and start a more virtuous cycle for consumer credit,” he continued.

“As accumulating credit card interest expense declines and record balances retreat, consumer attitudes, credit performance, and spending should all improve,” Smoke went on to say.