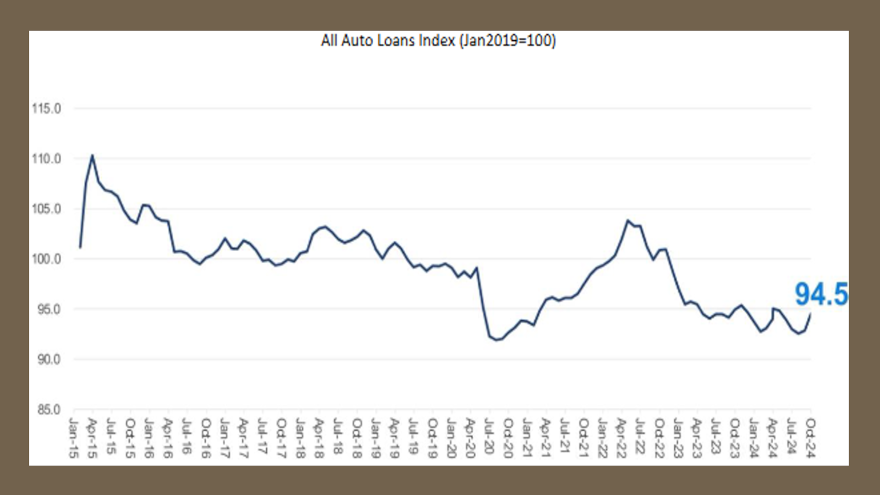

Credit availability eases again in October

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The Dealertrack Credit Availability Index in October posted the largest month-over-month increase in auto credit access since March 2022.

Cox Automotive reported this week that the index reading came in at 94.5 in October, up 2.2% from the September reading and a second consecutive month of easing after tightening through the summer.

While the sequential rise was notable, analysts acknowledge the index is still 2.1% lower than a year ago.

“Certified pre-owned loans loosened the most, while credit availability for used loans loosened the least,” Cox Automotive said in analysis that accompanied the index report. “Consumers financing non-captive new loans and used loans through independent dealers have better access to credit than pre-pandemic levels. Overall, credit access was tighter than a year ago, with new loans showing the least tightening and certified pre-owned loans experiencing the most tightening compared to last year.

“In October, credit availability increased for all lender types,” analysts continued. “Credit unions showed the most significant loosening, while auto-focused finance companies loosened the least. Still, auto-focused finance companies are the only lender type offering more access to credit now than before the pandemic. Compared to the previous year, auto-focused finance companies loosened the most, whereas banks experienced the greatest tightening.”

Cox Automotive then explained how the index got to the latest reading.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Analysts said the average yield spread on auto financing tightened by 52 basis points in October, making auto rates more favorable compared to bond yields. The pointed out the average auto finance rate dropped by 11 basis points from September, while the five-year U.S. Treasury increased by 41 basis points, leading to a smaller yield spread.

Perhaps it’s a trend you’ve noticed in your dealership finance office, too. Cox Automotive said auto finance rates have decreased by 124 basis points since March.

While the approval rate increased by 20 basis points in October compared to the previous month, analysts said they’re off by 2.6 percentage points versus the previous year.

Meanwhile, Cox Automotive said the subprime share increased by 20 basis points in October and by 1.2 percentage points year-over-year.

“This marks the third consecutive rise in subprime share,” analysts said.

Cox Automotive went on to mention the share of contracts with terms longer than 72 months dropped by 30 basis points in October, settling 0.9 percentage points lower than a year earlier.

And what’s been of interest for much of the year, analysts noticed the number of contracts with negative equity decreased by 30 basis points in October, following four months of increases. But the volume of that paper remains 1.6 percentage points higher compared to the same juncture last year.

Analysts added the down payment percentage was flat in October and has either declined or been flat every month since February.

Cox Automotive touched on a few measurements of consumer confidence to round out its update.

“The Conference Board Consumer Confidence Index jumped 9.6% in October, when only a slight increase had been expected, and September’s index was revised higher,” analysts said. “Consumers’ views of both the present and the future improved. Consumer confidence was up 9.7% year-over-year. Plans to purchase a vehicle in the next six months increased substantially to the highest level since December 2019.

“According to the sentiment index from the University of Michigan, consumer sentiment increased 0.6% in October compared to September and was up 10.5% year-over-year,” analysts continued. “Views of the current situation improved, but expectations declined. The median consumer expectation for inflation in a year was stable compared to September at 2.7%, the lowest level since December 2020. The median expectation for inflation in five years declined to 3.0% from 3.1% in September. The consumers’ views of buying conditions for vehicles improved to the best level since April.”

Cox Automotive reiterated each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity, and down payments. The index is baselined to January 2019 to provide a view of how credit access shifts over time.