More insight from Equifax & TransUnion about Q3 delinquency

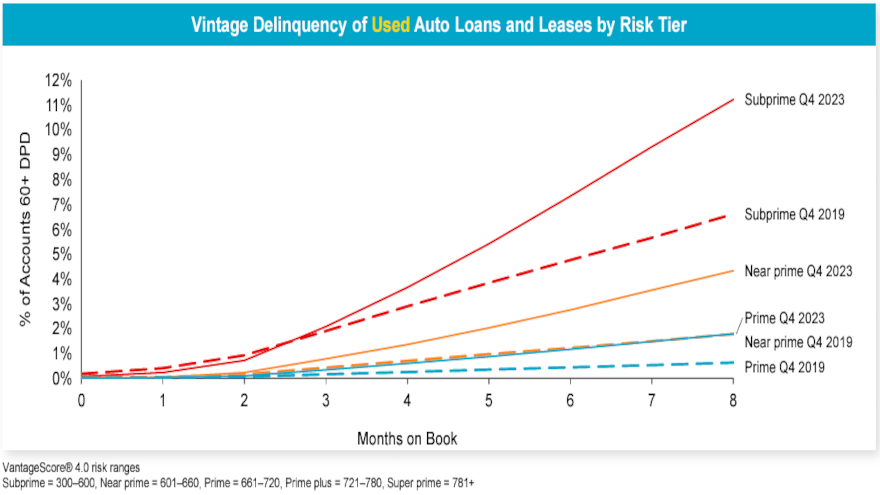

Chart courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Both Equifax and TransUnion discussed delinquency in auto finance this week, with one of the credit bureaus highlighting the rate associated with subprime used-car paper booked less than a year ago.

TransUnion indicated that serious consumer-level delinquency rates — contracts that are 60 days or more past due — stood at 1.6% overall in Q3.

Drilling deeper into the auto portion of its Q3 2024 Quarterly Credit Industry Insights Report (CIIR), TransUnion also reported that specific delinquency rate for independent finance companies stood at 3.25%.

That rate was lower for banks (1.64%), credit unions (0.88%) and captives (0.84%), according to TransUnion.

Analysts also examined payment deterioration eight months after origination while still controlling for credit risk. They found that more than 11% of subprime accounts for used cars booked in the fourth quarter of last year were 60 days or more past due as of Q3.

The next highest mark in TransUnion report was subprime accounts originated in Q4 2019. About 5% of those accounts were 60 days or more past due eight months after they were booked.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Meanwhile, Equifax’s latest Market Pulse report, powered by credit trends data from October, showed the severe delinquency rate — the share of balances 60 days or more past due — has increased to 1.55%, which is 9 basis points higher than September of last year.

Additionally, Equifax said auto write-offs have risen to 24.8 basis points, up from 22.2 basis points in the previous year.