Current economic sentiments point to positive outlook for vehicle sales

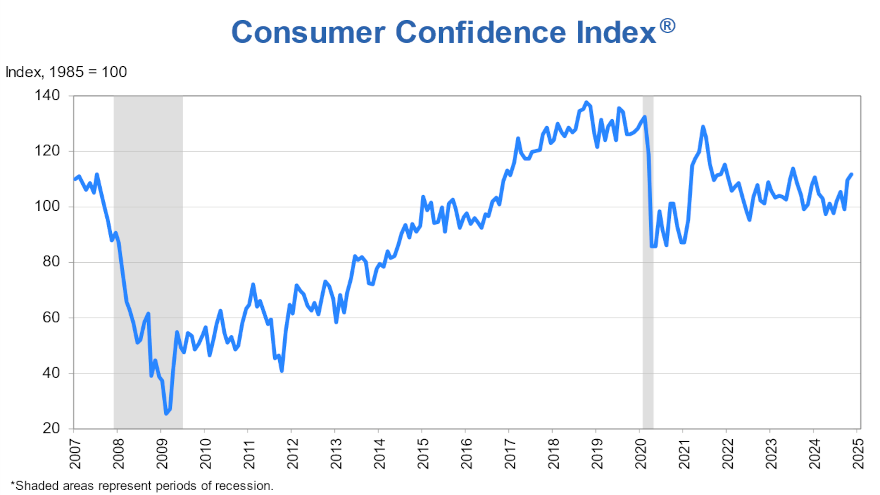

Chart courtesy of the Conference Board.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Perhaps consumers are thankful for more than just the tasty Thanksgiving turkey and navigating through awkward family conversations around the dinner table.

Insight from both the Conference Board and Comerica Bank pointed toward trends that might benefit dealerships and finance companies, as Cox Automotive chief economist Jonathan Smoke indicated that consumer plans to purchase a vehicle in the next six months remained high in November despite a slight decline from October.

“Consumer confidence improved in November, driven by positive views of the present and future economic conditions. This optimism is reflected in continued strong plans to purchase vehicles,” Smoke wrote in an analysis posted on Monday.

The consumer confidence Smoke cited was attributed to the latest update shared by the Conference Board two days before Thanksgiving. The Conference Board reported its Consumer Confidence Index increased in November to 111.7, up 2.1 points from 109.6 in October.

Analysts said their Present Situation Index — based on consumers’ assessment of current business and labor market conditions — increased by 4.8 points to 140.9.

And their Expectations Index — based on consumers’ short-term outlook for income, business, and labor market conditions — ticked up 0.4 points to 92.3, well above the threshold of 80 that usually signals a recession ahead.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Consumer confidence continued to improve in November and reached the top of the range that has prevailed over the past two years,” said Dana Peterson, chief economist at the Conference Board. “November’s increase was mainly driven by more positive consumer assessments of the present situation, particularly regarding the labor market.

“Compared to October, consumers were also substantially more optimistic about future job availability, which reached its highest level in almost three years. Meanwhile, consumers’ expectations about future business conditions were unchanged and they were slightly less positive about future income,” Peterson continued in a news release.

Peterson later added: “The proportion of consumers anticipating a recession over the next 12 months fell further in November and was the lowest since we first asked the question in July 2022. Consumers’ assessments of their Family’s Current Financial Situation fell slightly but optimism for their finances over the next six months reached a new high. (These measures are not included in calculating the Consumer Confidence Index).”

Meanwhile, the economic braintrust at Comerica Bank offered more optimism on Monday.

Chief economist Bill Adams and senior economist Waran Bhahirethan projected that if the economy stay on a positive trajectory — fueled in part by election results —the Federal Reserve will cut the fed funds target three quarters of a percent between now and the end of next year.

“The Republican sweep of the 2024 elections is set to transform the economic outlook,” Adams and Bhahirethan wrote in their analysis. “President-elect Trump will take office with ambitious economic plans: Roll back regulation, cut taxes, raise tariffs, and curb immigration. Republican majorities in the Senate and Congress will help foster his plans to reality. This is a challenging moment to forecast. Specific assumptions about post-election policies are sure to be wrong in some respect, but a forecast that ignores the election entirely is even more likely to miss.”

The experts then explained Comerica’s December forecast lays out one plausible scenario for how policy changes might affect the outlook for the economy and interest rates.

“Our forecast assumes the next Congress passes a major tax bill, combining extensions of some expiring provisions of the 2017 tax cut, reversal of some Biden-era tax increases, and follow-through on some tax-related campaign promises. Fiscal stimulus through tax cuts provides a significant incremental boost to disposable incomes and corporate profits, with pass-through to consumer spending and hiring,” Adams and Bhahirethan wrote.

“These effects become visible in economic statistics well ahead of when the tax cut becomes effective (presumably in 2026). The first surveys conducted after the election show business leaders are upbeat as they look forward to a more business-friendly approach in Washington. ‘Animal spirits’ will likely boost consumer spending and job openings in the first half of 2025 as affluent consumers and businesses act on their good vibes,” they went on to say.