Santander survey uncovers more positive impact of auto financing & future prospects

Chart courtesy of Santander Holdings USA.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

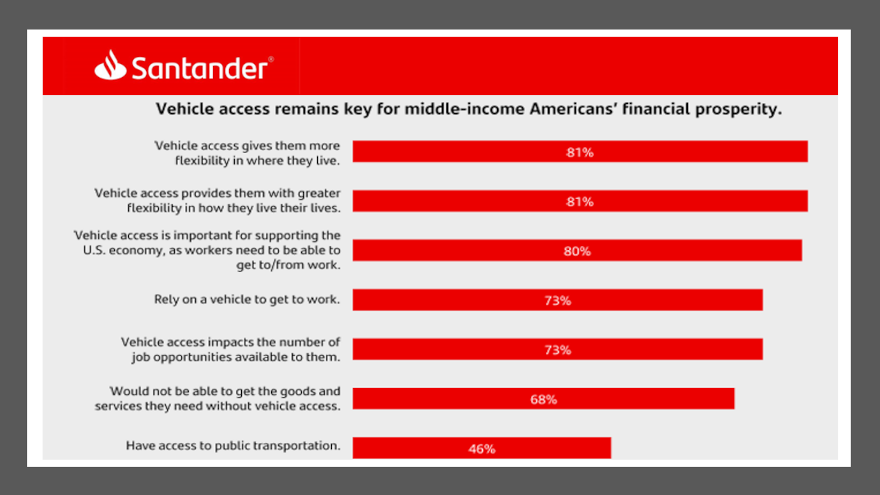

The newest research by Santander Holdings USA reinforced a long-held belief by auto finance companies, especially ones that work with consumers who might not be the wealthiest or have softer credit backgrounds:

Access to a vehicle remains essential to financial prosperity.

Santander made that assertion last week after its new survey findings showed middle-income consumers are feeling optimistic about the economy and their own financial prospects in 2025.

Furthermore, 81% of survey participants said access to a vehicle provides them flexibility in how and where they live, and the overwhelming majority (73%) rely on a vehicle to get to work.

At the end of 2024, Santander indicated strong pent-up demand for vehicles remains with nearly half (45%) considering buying a vehicle this year and one in three intending to purchase.

“Many have already taken steps toward a vehicle purchase,” Santander said in a news release.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Of those considering purchasing a vehicle this year, the survey indicated 65% have started researching options and 46% have already visited a dealership.

“Potential auto buyers indicate that decreases in cost of living and auto prices would be the biggest factors impacting the likelihood of making a vehicle purchase in 2025,” Santander said.

Researchers shared specific findings from the survey about those factors with cost-of-living decreases mentioned by 35% of participants and lower vehicle prices noted by 34%.

Other factors mentioned by surveyed consumers that could impact vehicle-purchase decisions this year, according to Santander, included:

—Current vehicle becomes unreliable: 30%

—More confidence in the economy: 22%

—Ability to secure financing: 20%

The survey also showed that expectations of a recession this year dropped 17 percentage points in the past year, while nearly two-thirds of middle-income households (64%) believe the job market will be stronger in 2025 and six in 10 expect inflation to improve.

Researchers explained the bullishness about the economy is translating into consumer confidence in 2025, with 76% of middle-income households expecting their financial situations to improve and 74% believing they are on the right track.

“The consumer enters 2025 increasingly optimistic with a sharp rise in confidence in the economy, supported by expectations for a stronger job market and lower inflation,” Santander US CEO Tim Wennes said in the news release.

“Our research has shown a resilient consumer over the past few years, as households make necessary tradeoffs and prudent financial decisions to navigate financial pressures. As optimism spreads among households, we hope to see this translate into prolonged economic growth and improved consumer outcomes,” Wennes continued.

While displaying great resilience, Santander acknowledged inflation has and continues to be the No. 1 obstacle to financial prosperity.

In fact, 85% of survey participants reported taking some action in Q4 to manage inflation, with a majority (53%) scaling back on retail spending.

As a result of making tradeoffs, Santander determined three in four middle-income households have remained current on their bills, and nine in 10 made progress toward their financial prosperity in 2024.

Looking forward, 95% of survey participants plan to proactively improve their financial situation in 2025, including paying down debt (45%) and saving or investing more (44%).

The Q4 Santander US study, which builds upon previous research, assessed middle-income Americans’ current financial state and future aspirations, with a focus on how current economic conditions have impacted their households.

It also explored their financial relationships with previously identified drivers of prosperity.

This research on financial prosperity, conducted by Morning Consult on behalf of Santander US, surveyed 2,213 Americans who are bank and/or financial services customers, ages 18 to 76.

Survey participants are employed or looking for work, own or use at least one financial product and are the primary or shared decision-maker on household finances with household income in the “middle-income” range of approximately $50,000 to $148,000.

This Q4 study was conducted Dec. 5-8.

The complete survey findings can be found here.