Study shows why financial insecurity remains an ‘epidemic’

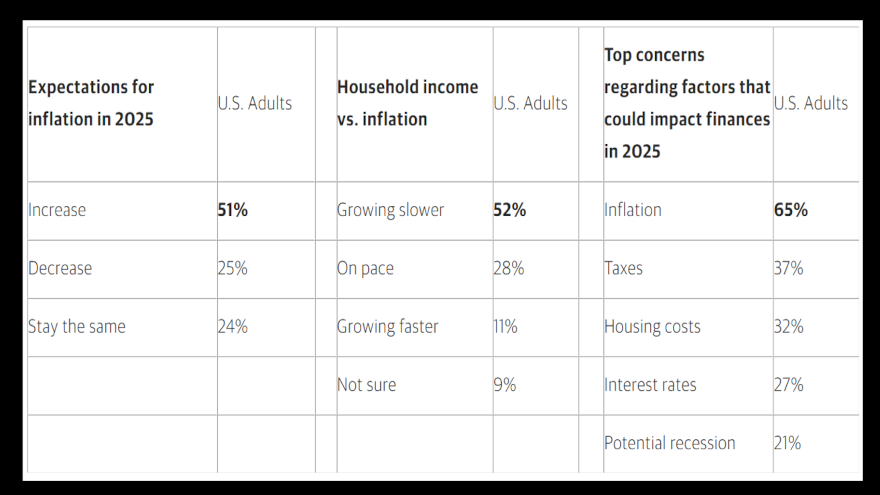

Charts from Northwestern Mutual’s 2025 Planning & Progress Study. Courtesy of the company.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Northwestern Mutual’s 2025 Planning & Progress Study is the company’s proprietary research series that explores Americans’ attitudes, behaviors and perspectives across a broad set of issues impacting their long-term financial security.

It might also be a good look what the consumers currently holding contracts in your auto-finance portfolio are thinking.

The study showed inflation continues to sting in America, with significant numbers of U.S. adults saying elevated prices in the grocery aisles, at the gas pump and elsewhere are having a large impact on their finances.

While concerns over inflation weigh on people’s minds, the study also revealed some bright spots in how people are feeling about the U.S. economy and their personal financial situations.

Expectations that the U.S. economy will enter into a recession over the next year continue to decline — from 67% of U.S. adults believing the country would enter recession in 2023, to 54% in 2024 to 48% this year.

In particular, older adults are feeling better about the direction of the U.S. economy, whereas the majority of younger people still expect recession is coming.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The study showed that just over four in ten (44%) U.S. adults indicate they feel financially secure, which is a slight increase from the 41% who said the same last year but remains lower than the 50% recorded in 2023.

Meanwhile, three in 10 (30%) Americans said they do not feel financially secure. This is a modest improvement over the 33% who said the same last year. But notably, last year’s number represented the highest level of financial insecurity recorded in the study’s history.

The Northwestern Mutual Planning & Progress Study started in 2009 and began measuring financial security using its current methodology in 2012.

“Financial insecurity continues to be an epidemic in America,” Northwestern Mutual chief field officer John Roberts said in a news release.

Part of what’s triggering that epidemic seems to be inflation.

Northwestern Mutual’s 2025 Planning & Progress Study showed that that half (51%) of U.S. adults believe inflation will increase in 2025, more than double the 25% who expect inflation to decrease and the 24% who expect it to stay the same.

Furthermore, two-thirds (65%) of U.S. adults who participated in the study said inflation is the dominant concern that could impact their finances this year, and more than four in 10 (44%) ranked inflation as the No. 1 obstacle to achieving financial security.

For the second year in a row, more than half (52%) of Americans believe their household income is growing slower than inflation. That’s more than four times greater than the 11% who say their income is growing faster than inflation, while three in ten (28%) believe their income is on pace with inflation.

Inflation is impacting everyone, including the wealthy.

The study showed only about one in five (19%) millionaires in America — people with more than $1 million in investable assets — say their income is growing faster than inflation. One in four (40%) millionaires say it’s growing slower and 38% say it’s growing the same as inflation.

Researchers noticed that inflation is hitting people everywhere — from the grocery aisle, to the gas pump, to their childcare expenses and more.

A large majority (84%) of Americans say they have experienced elevated grocery costs in the last three months. Nearly seven in 10 (68%) experienced elevated utility costs, while 60% experienced elevated gas costs, 52% experienced elevated housing expenses and 15% experienced elevated childcare expenses. When considering responses solely from Gen Z and Millennial parents, the childcare price sting percentage jumps to 36%.

Among those who have experienced elevated costs, many say they are having a “large impact” on their finances.

“Houses, kids, groceries and gas: all of these higher prices are having an outsized impact on people’s budgets, and most Americans believe these challenges will grow in 2025,” Roberts said. “Economists often talk about how inflation is ‘sticky,’ meaning it takes time to reverse a broad economic cycle.

“Our study findings show that inflation is sticky at the individual level too — it remains top of mind for people, and they get reminded of it often in their daily lives. Americans can adapt, but it requires financial planning and acting intentionally now, to enjoy today without sacrificing tomorrow’s goals,” Roberts continued.

The complete study can be found here.