Canadian wholesale market found stability in July

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

For a month, at least, the Canadian wholesale used-vehicle market stabilized.

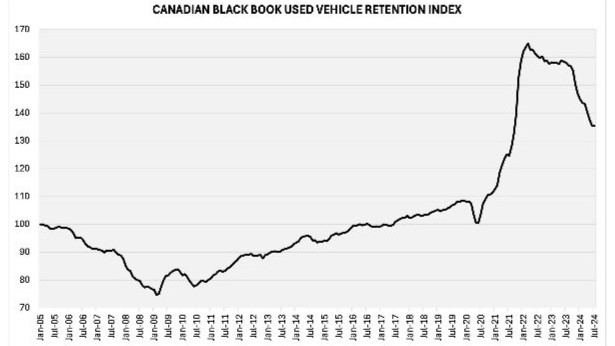

Canadian Black Book said its Used Vehicle Retention Index for July was 135.4 points, almost identical to the 135.3 recorded in June

That hasn’t been the case in the past year. Since July 2023, the index, calculated using CBB’s published wholesale average value on 2-6-year-old used vehicles as a percent of original typically equipped MSRP, has plummeted by 14.4%.

“Used wholesale value decline has slowed due to a weakening Canadian dollar bringing increased export activity,” said David Robins, CBB’s senior manager and head of Canadian vehicle valuations, in an analysis. “At the same time, declining interest rates are increasing consumer confidence in the economy and their personal finances.”

The index peaked at 165 in March 2022, capping a run of unprecedented growth in used values that began in late summer 2020 after the COVID pandemic had sunk it to a low of 100.5 points.

Weekly Market Insights

In its Market Insights report for the week ending Aug. 10, CBB noted the wholesale market fell 0.23%, with truck segments down 0.26% and cars down 0.20%.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Eight of the nine car segments lost value, led by subcompacts at 0.53% and full-size cars at 0.49%. The only car segment with a gain was compact cars, which were up $2.

Trucks had four segments in positive numbers, but none gained more than the $51 (0.08%) rise in full-size luxury crossover/SUV values. Midsize crossover/SUVs were up $1. Meanwhile, three truck segments — midsize luxury crossover/SUVs (down $222, 0.53%), full-size vans ($221, 0.64%), and compact luxury crossover/SUVs ($160, 0.55%) — fell more than $150.

CBB analysts said the market is continuing its “steady gradual decline,” with fewer than 23% of market segments showing an average value change of more than $100, Monitored auction sale rates showed a wide variation, from 12% to 96%, which CBB said is a result of a continued drop in floor prices.

Retail prices held steady, the report said, with a 14-day moving average of $34,400.

In the U.S., CBB said “the depreciation rate for August has started higher than pre-pandemic norms, but the overall market is currently depreciating at a much lower rate than at the beginning of July.”

As an example, the report noted the depreciation rate for the week ending July 12 was 0.60%, compared to 0.32% for the week of Aug. 10, which included a 0.33% drop among truck segments and 0.30% for cars.