Canadian wholesale values show slower decline

Image courtesy of Canadian Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

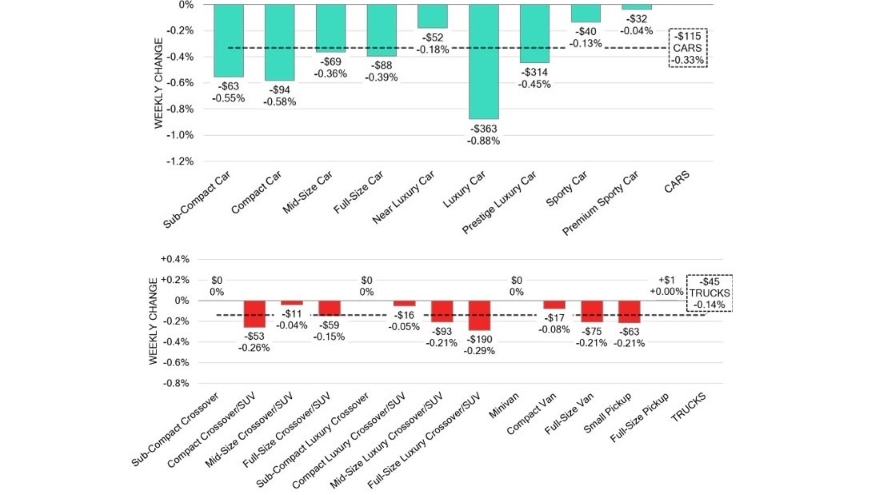

Canadian Black Book’s weekly Market Insights report for the week ending May 25 showed a slower rate of decline than recent weeks, as Canadian wholesale prices fell by 0.23% following a 0.38% drop the week before.

Only one segment recorded a gain: full-size pickups were up $1. And three other truck/SUV segments (subcompact crossovers, subcompact luxury crossovers and minivans) were flat week-over-week.

Overall, truck/SUV segment values declined by 0.14%, led by full-size luxury crossover/SUVs (0.29%) and compact crossover/SUVs (0.26%).

Cars were down 0.33%, with luxury cars taking the biggest loss of the week both in dollars ($363) and percentage (0.88%), compact cars falling 0.58% and sub-compacts dropping 0.55%. The smallest declines were recorded by premium sporty cars (0.04%), sporty cars (0.13%) and near luxury cars (0.18%).

Conversion rates improved from recent weeks with an average of 30-50%. Sell rates ranged from a low of 9% to a high of 66%.

The 14-day moving average retail listing price for used vehicles gained back the $100 it lost the previous week and stands at $33,900, based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

CBB analysts said preliminary data is showing overall retail sales in Canada are expected to have surged by 0.7% month-over-month in April. That would be the sharpest increase in retail turnover in a year.

In the U.S., CBB said, the market continues to report “normalcy,” with overall declines on pace with pre-pandemic behavior. Values fell 0.15% overall, with truck/SUV segments down 0.19% and cars down 0.06%.

“However,” the analysts said, “the trends aren’t one size fits all, with the trends of auction inventory and conversion rates varying from lane to lane depending on the seller’s strategy and offered inventory.”