Dealer survey: Majority of stores experiencing data gaps between CRM, DMS & FMS

Chart courtesy of eLEND Solutions

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The majority of dealerships are experiencing data gaps between the core systems that run their operations: customer relationship management, dealer management and finance management systems.

The vast majority are saying that better quality integrations and workflows between website tools and core platforms could improve efficiencies at the dealership by at least 20%.

Those assertions are according to a new snapshot survey from eLEND Solutions, which found that the majority of participants see room for improvement in the quality of the API integrations between their dealerships’ website tools and their core platforms.

While the survey revealed dealerships are experiencing integration challenges that impact sales processes, eLEND Solutions found that the majority agreed that there is a direct correlation between sales processes and profits, underscoring the need for better integrations.

“We were astonished that so many dealerships are suffering from significant data lapses between the three major information systems — lead generation, customer management and finance — that their dealerships run on; after all, dealers cannot sell a car without each of the components these systems provide,” eLEND Solutions founder and CEO Pete MacInnis said in a news release.

“The good news is that dealers are increasingly acknowledging the serious challenges presented by a lack of integration between website tools and their core platforms and the degree to which efficiency, the customer experience and sales process could be improved with better workflows,” MacInnis continued.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The snapshot survey — which was fielded online by eLEND Solutions among dealers in November and December — found that dealerships ranked data accessibility as the biggest challenge to improving the quality of API integrations between their website tools and core platforms, closely followed by data discrepancies and broken and missing workflows.

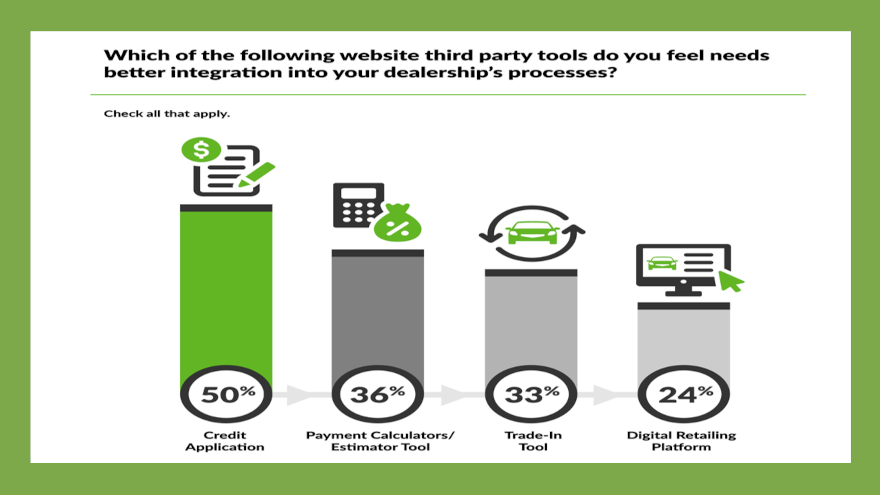

The survey also revealed that credit apps were the No. 1 tool that dealers felt needed better integration into their dealerships processes, followed by calculator tools, trade-in tools and the overall digital retailing platform.

“Once auto dealers are able to stop viewing online credit apps, and other customer-facing website tools, as simply lead-gen opportunities, and start viewing them as an integral part of the sales process, the silos that exist in the sales and finance process will disappear, eliminating the customer friction they cause,” MacInnis said.

“But to do this, auto dealers need solutions that exist in the middle, connecting in-store and online processes, which is precisely the mission of eLEND’s middleware platform,” he went on to say.

To reiterate, eLEND Solutions said the key survey findings included:

—56% of auto dealers surveyed encounter information gaps or discrepancies between their CRM, DMS and FMS over one quarter of the time, with 47% encountering gaps 25 to 50% of the time, and 9% experiencing it over 50% of the time

—95% said that better quality integrations and workflows between their website tools and core platforms would improve efficiencies and buying experiences at their dealerships

—Of those, 83% said that better integrations would improve efficiencies and the buying experience by over 20%, with 31% saying by 30% or more

—67% of dealer respondents say the quality of API integrations between their website tools and core platforms could be improved

—Of those, the number one challenge to integration improvement cited was data accessibility (delayed data synching, access restrictions across teams, etc.), with data discrepancies (incomplete data transfer, data formatting differences, duplicate records, etc.) and broken/missing integrations and workflows tied for second.

—Credit apps were cited as the number one website third party tool that dealers (50%) felt needed better integration into their dealership’s processes.

—96% agreed that “Profits are determined by sales and sales are determined by my sales process,” with 55% strongly agreeing.

eLEND Identity Solutions block $1Billion in potential vehicle purchase fraud in 2024

In other company news, eLEND Solutions announced at the 2025 NADA Show that it has blocked more than $1 billion dollars in potential vehicle purchase fraud in 2024 through its Identity Solutions, representing more than 30,000 red-flagged driver license scans.

With the company saying identity fraud is accelerating at an alarming rate, eLEND Solutions also announced that it has expanded its suite of Identity Solutions to further protect consumers, dealers and finance companies.

Already implemented by more than 1,000 dealerships in the U.S., eLEND’s Identity Solutions encompass document authentication, consumer data verification and proof of presence technologies.

In a 2022 Dealer Survey conducted by eLEND Solutions, 79% of auto dealers reported they experienced an identity fraud-related vehicle loss at their dealership in the past year.

And according to Point Predictive’s 2024 Auto Lending Fraud Trends Report, the industry has an estimated fraud loss exposure of more than $7.9 Billion with a 98% growth in synthetic identity attempts.

“There is no question that vehicle purchase fraud is one of the top challenges facing auto dealerships today, with billions of dollars on the line; yet most dealerships are relying on simple drivers’ license scans unconnected to comprehensive fraud detection,” MacInnis said in another release. “Without validating/authenticating ID documents and buyer identities, dealerships remain incredibly vulnerable, especially as the auto purchase transaction becomes increasingly digitized.

“To help dealers minimize fraud risks, ID verification technologies must include forensic authentication of the driver’s license document, in conjunction with matching data extracted from the document against hundreds of databases, which is exactly what our identity solutions provide.”

The suite of Identity Solutions from eLEND includes:

—ID DRIVE: Consumer driver license data capture. In just 6 seconds, it can perform an average of 35 forensic tests for robust document authentication. Digital data capture and real time CRM export ties the customer, the test-drive vehicle and sales agent together as part of the lead record. ID DRIVE has scanned millions of driver licenses before test-drives and has never provided a “pass” scan result that turned out to be a fraudulent driver license document.

—ID DRIVE MOBILE: For remote test drives and deliveries, where online and remote attempts at vehicle purchase fraud can be thwarted.

—IDENTIFY: Can match up consumer PII data against hundreds of databases including customer residence addresses with local municipal utilities, date of birth with government databases and customer phone numbers with mobile phone carriers. IDENTIFY can establish “proof of presence” with one-time pass code to ensure the identity being used belongs to a real, physically present person.

—DMV DATA MATCH: Can extracts the data from scanned driver license documents and matches them up with official government DMV databases in real time through API’s with participating government agencies.

—700CREDIT IDENTITY VERIFICATION PLATFORM: Integrated with 700Credit, it can delivers identity verification tools to include OFAC Terrorist Search, ID Match, Synthetic Fraud, Military Lending Act, Red Flag and Out of Wallet Questions.

—PRE-SCREEN or PRE-QUALIFICATION Reports: Can be pulled from data extracted from driver license scans, instantly identifying a customer’s buying power prior to the test-drive.

The company said ID DRIVE and ID DRIVE MOBILE are available via subscription with the other tools available as add-ons.

For more information, visit www.elendsolutions.com.