Experian launches another cashflow tool to enhance underwriting

Image courtesy of Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Experian on Tuesday launched Cashflow Score in a move to help lenders more easily leverage consumer-permissioned transaction data

The company highlighted this solution is its latest product that may be used to make underwriting decisions because it can provides up to a 25% lift in predictive performance when compared to conventional credit scores.

Experian explained this solution can integrate into existing workflows alongside traditional credit scores — providing finance companies and other lenders with a clearer view of an applicant’s financial behavior, including income, expenses, cash reserves and more.

In addition, Experian said Cashflow Score may be used in first and second-chance credit decisions for individuals with limited or nonexistent credit histories to help improve financial access using only bank account data.

“We believe in a future where the power of credit data can be augmented with cashflow insights to enhance decisions and ultimately bring more consumers — including those who are traditionally underserved — into the financial ecosystem,” said Scott Brown, group president of Experian Financial and Marketing Services.

“We’re committed to leveraging our decades of data and analytics experience to deliver innovative and easy-to-use open-banking solutions to the industry while creating new opportunities for consumers,” Brown continued in a news release.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Experian acknowledged that lenders often hesitate to extend credit to thin file or credit invisible consumers and nearly 20% of American adults don’t have a conventional credit score, according to its research.

However, Experian pointed out that most consumers in the U.S. have a bank account, and cashflow insights has proven to be indicative of credit risk.

“Leveraging these insights can help lenders make more informed decisions, particularly for thin file and credit invisible consumers who have a bank account,” Experian said.

Here’s how Experian’s Cashflow Score is designed to work.

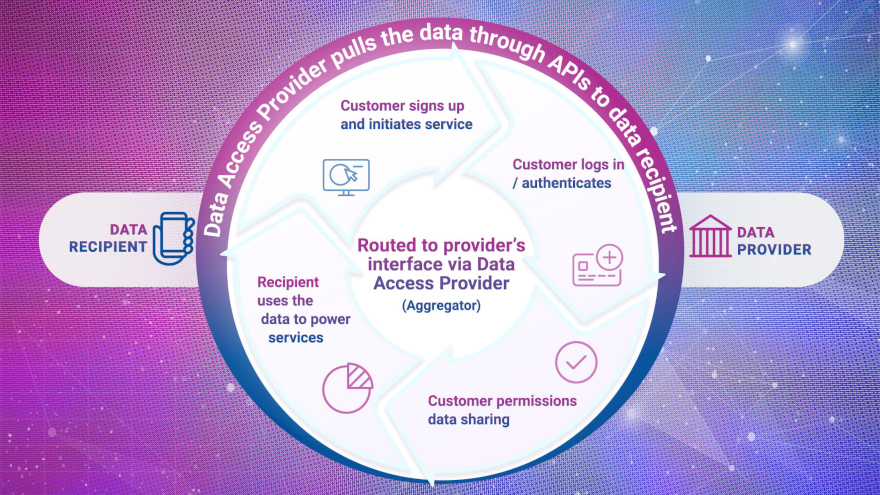

Experian’s Cashflow Score leverages consumer-permissioned transaction data provided by its clients. From there, Experian — acting as a technical service provider on behalf of its clients — can categorize the transaction data and calculate attributes that are used to derive the score, which is delivered back to the lender.

The score ranges from 300 to 850 and can be used to make decisions across credit cards, personal loans, auto financing, and more.

While interest in using banking transaction data in conjunction with credit data for lending decisions is growing, Experian also mentioned many lenders face limited analytics capabilities and resources, highlighting the need for intuitive, easy-to-use scoring solutions that analyze both types of data effectively.

“Those that are leveraging cashflow insights and credit data often face logistical challenges in working with multiple vendors,” Experian said.

“As the only financial services company offering both traditional credit scores and cashflow-based scoring analytics solutions developed in-house, Experian is uniquely positioned to provide credit scores and transaction data insights,” the company continued.

The debut of Cashflow Score is the latest in a string of tools that support more inclusive lending practices, including Cashflow Attributes and its newly launched Cashflow Dashboards for immediate insights into cashflow and traditional credit data.

The solutions are powered by Experian’s categorization model, which is validated on an ongoing basis by expert data science and annotation teams to ensure accuracy and reliability.

To learn more about open banking at Experian, visit https://www.experian.com/business/solutions/data-solutions/open-banking-solutions.