Invesco Advisers study dissects impact AI now has on investors

Chart courtesy of Invesco Advisers.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Investors not only are pushing resources into fintechs fueled by artificial intelligence. They’re now using AI more often to make their financial decisions with the expectation the usage will intensify.

Those assertions and more surfaced on Monday when Invesco Advisers released findings of its eighth annual Invesco Global Systematic Investing Study, which is based on the views of 130 institutional and wholesale investors that collectively manage $22.5 trillion in assets.

The study also found a growing consensus that systematic tools can help investors navigate key challenges, such as volatile markets and imperfect data.

The project revealed that half of systematic investors surveyed have already integrated AI into their investment process and highlighted a widespread expectation that AI tools will transform portfolio management in the years to come.

The majority of respondents — 62% to be exact — anticipate that AI will be as important as traditional investment analysis within a decade.

And 13% expect it to become more important.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Invesco Advisers pointed out that systematic investors are already using AI across a range of core functions.

For example, respondents reported harnessing AI to better understand the market environment and identify macroeconomic turning points: (46%) are using AI to identify patterns in market behavior, and (38%) are using it for portfolio allocations and risk management.

Investors appreciate AI’s ability to help mitigate human biases and forecast the unexpected, according to Invesco Advisers.

While a significant minority (29%) already use it to develop and test investment strategies, the vast majority (76%) anticipate doing this in future.

Additionally, while 20% of survey participants currently use it to monitor and adjust investments positions in real-time, more than half (55%) expect to do so moving forward.

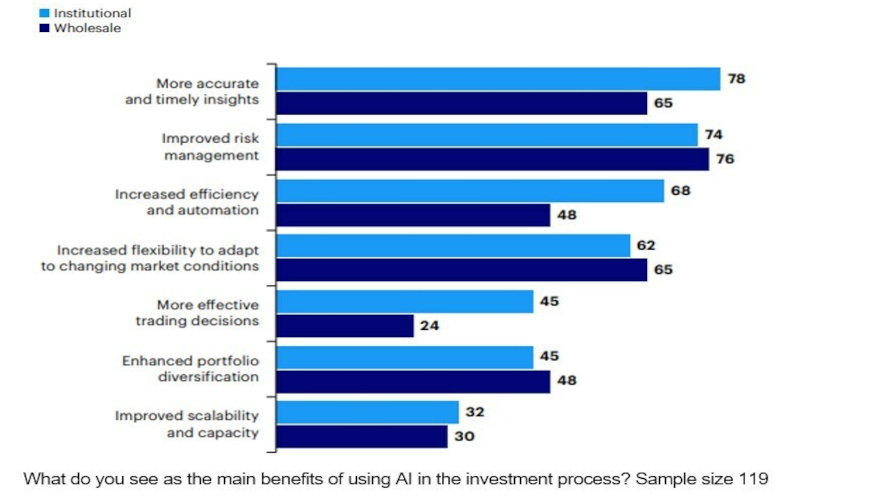

Wholesale investors identified improved risk management as the main benefit of AI, cited by 76% of respondents, followed by the flexibility to adapt to changing market conditions, which was mentioned by 65% of participants.

However, Invesco Advisers acknowledged challenges remain, as wholesale respondents cited the cost of implementation (64%) and the complexity and interpretability of AI models (61%) as the main obstacles to adoption.

“AI driven-portfolio strategies certainly present a new opportunity when used correctly,” Invesco head of solutions Mo Haghbin said in a news release. “Firms need to adapt quickly to leverage this technology as we see increasing interest in AI-driven models moving forward, especially among younger investors.”

Institutional investors instead see accurate and timely insights (78%) as the most compelling benefit of AI, followed by improved risk management (74%) and increased efficiency and automation (68%). Their primary concerns are complexity (78%) and data quality and completeness (51%).

“Managing stakeholders and providing transparency is a key challenge for institutional investors,” Haghbin said. “Investors need to be prepared to clearly articulate how AI models are being used in portfolios to justify their use and value add.”

Factor investing has historically been the cornerstone of systematic investing, but Invesco’s study revealed a far larger toolkit of systematic strategies that have helped investors navigate the key challenges of recent years.

Tools to decipher the macroeconomic environment have become especially important, and the ability of systematic approaches to help mitigate market risks was a key theme in this year’s study.

The majority — 63% — of investors agreed that systematic strategies helped them manage market volatility in the past year, according to the study.

Moreover, nearly 60% of respondents said that the new higher inflation market regime was supportive of the systematic approach, with only 6% of institutional investors and 10% of wholesale investors disagreeing.

For three-quarters of respondents, Invesco Advisers found that dynamic asset allocation has become a core component of their approach, helping them to rebalance and adjust their portfolios in response to the market environment.

Invesco Advisers added that systematic tools have helped investors identify and characterize the underlying macroeconomic regime, allowing them to make inferences about its impact on different asset classes, factors, regions, and sectors.

“Investors are rethinking the way they approach portfolio construction in an environment with macro uncertainty,” Haghbin said. “Respondent data showed investors want to move beyond strategic factors as they try to determine the best way to position portfolios across asset classes and styles.”