Newest eLEND Solutions dealer survey sheds light on top obstacle to deal & pricing clarity

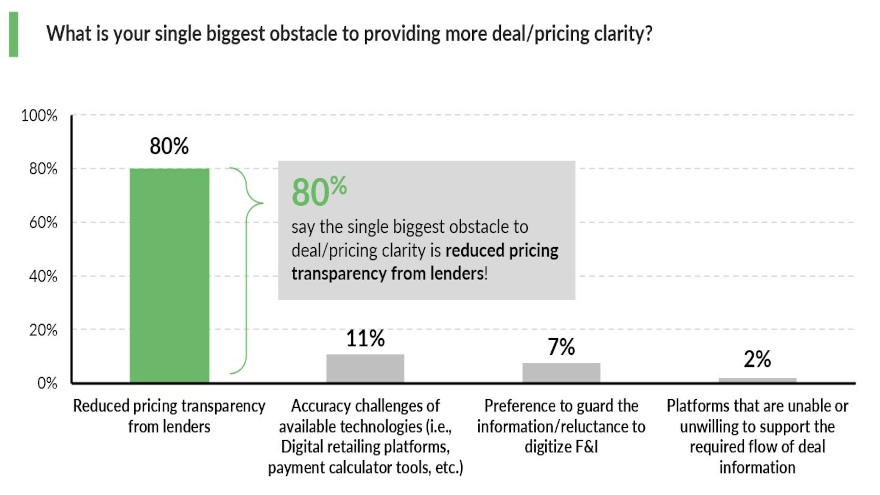

Chart courtesy of eLEND Solutions.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Think of how many times the phrase “trust me” surfaces in a conversation or message exchange with family, friends, or business contacts.

Experts at eLEND Solutions examined that premise for its latest research project and discovered a significant trust and transparency gap between consumers and dealers, especially when it comes to completing the financing for that potential vehicle delivery.

The fintech company found that its findings are partially driven by differences in transaction preferences, but it’s been made problematic by a lack of transparency from finance companies.

Almost universally, eLEND Solutions said dealers see technology as a way to help close the gap and add value to the experience — for customer, dealer and finance company.

In fact, eLEND Solutions insisted its survey confirms that this trust/transparency gap is a major source of friction in the auto sales transaction process, starting with a disconnect in how it is defined.

Results showed 94% of auto dealers surveyed said that consumers and dealers define transparency differently, and 82% of dealers strongly agree that this difference has contributed to a trust gap arriving at the “final” deal.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Reduced pricing transparency from finance companies, thanks to AI and algorithm-based solutions, “is pulling a cloak over what’s arguably the most important part of the buying process,” according to eLEND Solutions, which will explore this topic and more during a session at Used Car Week, which begins on Nov. 6 in Scottsdale, Ariz.

According to the findings, dealers agree there is a trust deficit and understand that consumers want transparency — though many are inhibited from going as far as customers expect them to go, due to concerns about profitability.

Still, eLEND Solutions discovered 95% of dealers find themselves in a difficult balancing act between meeting customer expectations of transparency and protecting the dealership’s bottom line.

“When it comes to transparency and trust, unfortunately, there is friction between dealers and consumers,” said Pete MacInnis, eLEND Solutions CEO and founder. “While this is partly a result of the tug of war between how consumers want to buy and how dealers want to sell, our survey shows that dealers do want to provide transparency to consumers. In fact, most want car buyers to have pricing transparency as early as possible — even before visiting the dealership.”

One of the challenges revealed by the survey is that finance companies are adding to the friction of the process, through their lack of transparency when it comes to financing the deal.

“Reduced pricing transparency from lenders, thanks to AI and algorithm-based solutions, is pulling a cloak over what’s arguably the most important part of the buying process,” MacInnis reiterated in a news release.

Results showed 80% of dealer respondents cited reduced pricing transparency from finance companies as the single biggest obstacle to providing more deal/pricing clarity; that was followed by accuracy challenges of available technologies (11%), and their own reluctance to digitize F&I information (7%).

It’s a finding that “certainly runs contrary to the stereotype of the auto dealer unwilling to leverage digital tools,” eLEND Solutions said.

Dealers in the online survey — fielded by eLEND Solutions in July and August to more than 350 dealers — saw finance companies as an obstacle to trust. The survey found that 84% of dealers felt that they were caught in the middle between customer demand for more transparency and a decrease in pricing transparency from finance companies.

According to the survey, this trust and transparency divide between consumers, dealers, and finance companies is pushing retailers to rely on basic, and frequently inaccurate, payment calculator tools that exacerbate, rather than mitigate, the lack of transparency.

Wanting to meet their customers’ needs, eLEND Solutions said dealers are pushing forward with quotes with 94% saying they quote customer payments before receiving underwriting decisions from the finance company.

And 85% of responding dealers said they quote payments before customers even come into the store.

Lacking finance company information, MacInnis said this often means they are quoting unqualified payment terms, unmatched to finance company programs — “a guessing game that adds friction and perpetuates the trust void during final deal negotiations.

“The reality is that once customers are in the F&I office, they often see payment promises unravel,” MacInnis continued. “That just adds more conflict between dealer and customer. Many dealers want to facilitate pricing transparency early but, without accurate lender quotes, it just becomes another lead generation tactic — and a showdown that can impact both profits and CSI.”

The survey found that the transparency gap is not just driven by finance company preferences.

While dealers say they want to quote payments early, findings showed the vast majority (86%) continue with a “sales first, finance later” process – and 91% of auto dealers say that they work the deal differently for an online shopper versus a shopper in the showroom or on the phone.

Although eLEND Solutions acknowledged this tension between old and new sales approaches certainly adds to issues with trust and transparency, the company said dealers are overwhelmingly interested in finding solutions as 95% see value in a pre-desking tool integrated with lender credit score models to help improve the ability to quote, upfront, more accurate and realistic deal terms — a step that will have a significant and positive impact on dealer/customer/finance company relations.

Among the major findings from the survey, eLEND Solutions mentioned:

—94% of dealers surveyed say that consumers and dealers define transparency differently.

—98% say there is a gap between how dealers want to sell and how buyers want to buy.

—97% agree that there is a trust gap when it comes to arriving at “the” deal; 82% strongly agree it exists.

—95% say that there’s a balancing act between customer expectations of transparency and dealership financial success.

—80% blame reduced pricing transparency from lenders as the single biggest obstacle to providing more deal/pricing clarity.

—7% cite their own reluctance to digitize F&I information as the single biggest obstacle to providing more deal/pricing clarity.

—84% feel caught in the middle between the customers’ increasing demand for deal transparency and the lenders becoming less transparent.

—94% say they quote customer payments before receiving lender loan decisions.

—85% say they prefer to quote payments to customers before they come into the store.

—93% agree that online customers want to know what their monthly payments will be before scheduling an in-store appointment.

—86% continue with a ‘sales first, finance later’ protocol; 7% start finance and sales together at the front of the process.

—91% say that they work the deal differently for an online shopper versus a shopper in the showroom or on the phone.

—90% allow BDC or internet managers to negotiate finance terms with remote customers.

—95% think a pre-desking tool integrated with lender proprietary credit score card models would add meaningful value.

To download the eLEND Solutions’ survey report titled, “Bridging the Trust Gap: The Quest for Transparency in Retail Automotive,” go to this website.