Pandemic pushes ACH activity 7.9% higher in Q2

Graphic courtesy of Nacha.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

HERNDON, Va. –

Last week, Nacha highlighted how much electronic financial transactions jumped year-over-year during the second quarter, triggered in part by the coronavirus pandemic.

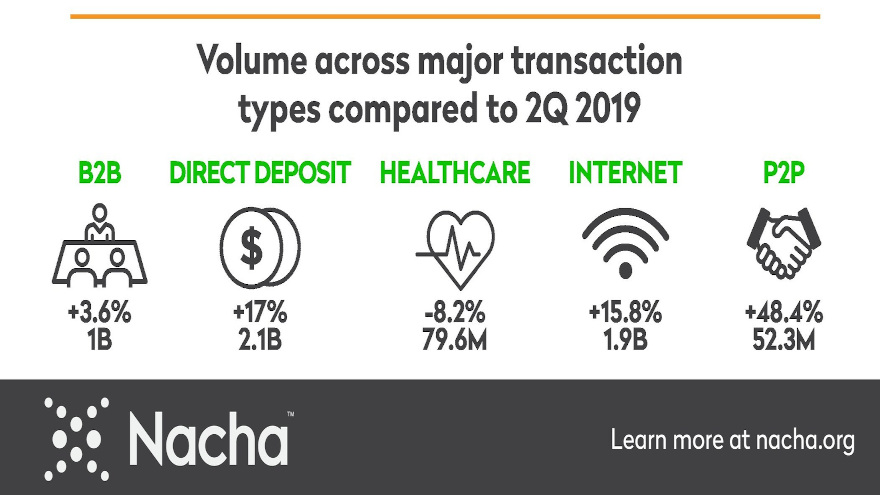

The steward of the ACH Network, a payment system that universally connects all U.S. bank accounts and facilitates the movement of money and information, reported that Q2 ACH payment volume grew 7.9% compared to the same period a year earlier, reflecting the use of the ACH Network to deliver economic assistance to individuals and businesses, as well as an acceleration in the shift from paying by paper check to paying electronically.

Officials determined there were 6.6 billion payments made on the ACH Network during the quarter, representing a value of $14.7 trillion. Nacha indicated direct deposit payments rose 17%, due in part to federal and state assistance payments made to Americans in need.

“Direct deposit is the best way to reliably deliver pay and assistance to the vast majority of Americans,” Nacha president and chief executive officer Jane Larimer said in a news release. “All Direct Deposits are delivered on time and paid on the intended date. With same day ACH, urgent direct deposit payments can be initiated, and funds made available all within a single day.”

Nacha also noted Internet-initiated payments, which include primarily online bill payments and account-to-account transfers, increased by nearly 16%. Person-to-person transfers rose 48%. Officials explained both results are consistent with people making more payments remotely and shifting from paper checks to electronic payments.

Nacha went on to mention the pandemic’s impact was also apparent in some payment volume declines. Most dramatically, check conversion payments — in which a consumer’s paper check is processed electronically as an ACH payment — declined by 24%. At the point-of-sale, check conversion volume declined by approximately 45%.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Furthermore, officials pointed out a 4% decline in a recurring bill payment category is reflective of some disruption to certain types of monthly bills, such as mortgages, rent and loans, as well as the deferral of the federal tax payment deadline. Healthcare claim payments to medical and dental providers fell 8% from the second quarter of last year as many practices were shut.

Nacha closed its update by indicating same day ACH volume climbed 37% over a year earlier, with 81.6 million payments. The average dollar amount of a same day ACH payment increased by 33% in the second quarter, compared to the first quarter of 2020, as Nacha increased the allowable same day ACH transaction size to $100,000.

“ACH payments are for every day. As people, businesses and governments adapt to new conditions, they can rely on the ACH Network to deliver pay and benefits on time, to pay their bills, and so much more,” Larimer said.