PODCAST: Wolters Kluwer Auto Finance Digital Transformation Index reflects sluggish sales in Q3

Chart courtesy of Wolters Kluwer.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

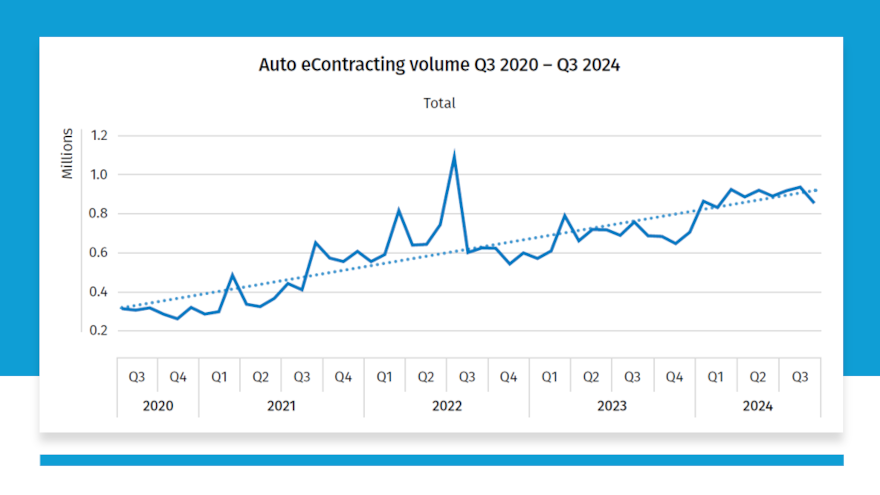

Adoption of digitized contracting and documentation workflows by auto retailers and their financing partners that foster back-office efficiencies continued on an upward trend, according to analysis by Wolters Kluwer Compliance Solutions from its Q3 Auto Finance Digital Transformation Index.

While Q3 adoption compared to Q2 was mostly unchanged at less than 0.5% due to the decreased sales activity, Wolters Kluwer indicated the year-over-year trend was up 28%.

Further, Wolters Kluwer went on to note the four-year trend continued to show digital adoption growth of 131% dating from Q3 2020.

The index tracks the rate at which dealers, service providers and finance companies are seeing growth in the evolution from paper-based finance back-office processes to digital.

“Despite facing headwinds in the sales environment, the auto finance industry has demonstrated remarkable resilience and adaptability,” Wolters Kluwer head of auto strategy Tim Yalich said in a news release.

“While consumer demand softened due to economic pressures, we’ve leveraged this period to accelerate our digital transformation initiatives for auto brands. By implementing advanced workflow automation and data analytics in back-office operations, we’ve uncovered significant efficiency gains across the entire value chain.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Yalich explained that these digital solutions have not only helped the industry weather the current storm but have also positioned Wolters Kluwer partners to emerge stronger and more agile when market conditions improve.

“Our commitment to innovation and operational excellence remains unwavering, ensuring we can continue to deliver value to our customers and stakeholders even in challenging times,” Yalich said.

Wolters Kluwer’s Q3 index also showed that the digitization adoption rate for securitization markets continued to accelerate, with digital auto volume in securitization markets decreasing 10% compared with Q2.

However, Yalich said this decrease was lighter than the 41% decrease reported last quarter.

Over the last four years, Yalich noted digital adoption for securitizations is up 73%, slightly higher than the four-year trend recorded last quarter (70%).

Yalich elaborated more about the index and other trends for an episode of the Auto Remarketing Podcast. Listen to the conversation in the window below.