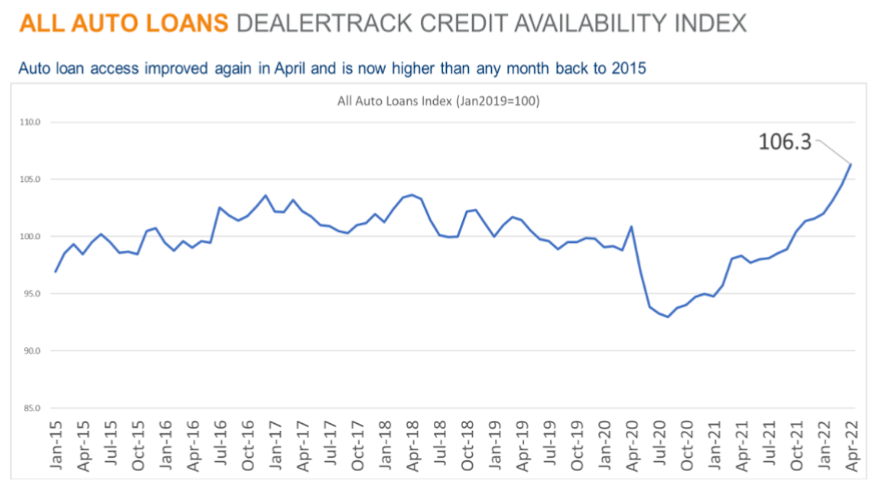

Auto credit availability improves for 11th straight month

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cox Automotive and Comerica Bank each shared upbeat economic and financing trends that should be welcomed by dealerships and finance companies.

First on Tuesday, Cox Automotive said access to auto credit expanded again in April, according to the Dealertrack Credit Availability Index for all types of auto financing.

The improvement stretched the index’s streak to 11 consecutive months of greater credit availability, as Cox Automotive reported the index increased 1.7% to 106.3 in April, reflecting that auto credit was easier to get in the month compared to March.

Cox Automotive noted in the Data Point that contained the newest index update that access was looser by 8.1% year-over-year.

And compared to February 2020, access was looser by 7.2%, according to Cox Automotive, which added that the index in April was the highest recorded in the data series going back to January 2015.

“The majority of inputs into credit availability moved to benefit consumers in April,” analysts said in the report the accompanied the newest index details. “The average yield spread on auto loans narrowed to provide the biggest boost as bond yields moved higher than the rates consumers were seeing on auto loans.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“The average auto loan rate declined by 14 basis points in April compared to March, while the 5-year U.S. Treasury increased by 67 basis points, resulting in lower observed yield spreads,” Cox Automotive continued.

“Credit access also improved across most lender types in April, with banks having loosened the most. All lenders had looser standards on a year-over-year basis, with auto-focused financed companies having loosened the most,” analysts went on to say.

Cox Automotive reiterated that each Dealertrack Credit Availability Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity, and down payments. The index is baselined to January 2019 to provide a view of how credit access shifts over time.

“Across all auto lending in April, the approval rate increased, yield spreads narrowed, terms lengthened, and negative equity grew, and the moves in those factors made credit more accessible,” analysts said. “However, the subprime share declined and down payments grew, so those factors moved against accessibility.”

As far as those contract holders potentially being in position to maintain their monthly payments on that newly originated paper, that’s where Comerica Bank chief economist Bill Adams added his perspectives on Wednesday.

“The economy unexpectedly contracted in the first quarter of 2022, but its underlying momentum remained solid, dispelling fears that it has slipped into recession,” Adams said in the newest installment of Comerica Insights. “The first estimate of real GDP showed a 1.4% annualized contraction in the quarter, after a 6.9% annualized jump in the fourth quarter of 2022.

“The first quarter saw big drags from an increase in the trade deficit, businesses adding more slowly to inventories and lower government spending,” he continued. “The components of final demand that say the most about the economy’s underlying trend, consumer spending and business fixed investment, both grew solidly in the first quarter.

“Real GDP will return to growth in the second quarter as trade, inventories, and government spending become less of a drag. But growth is moderating as the economy transitions from a breakneck-fast recovery in the second half of 2020 and 2021 to a slower expansion in 2022,” Adams went on to say.