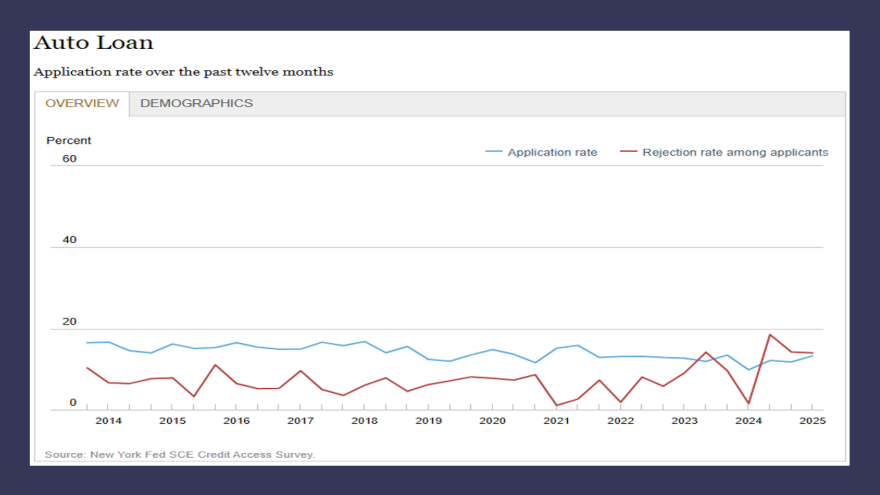

Consumers’ anticipation of being rejected for auto finance at highest level ever

Chart courtesy of the Federal Reserve Bank of New York’s Center for Microeconomic Data.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cox Automotive recently reported that access to credit in the auto-finance market improved in February, reaching the highest level since December 2022.

But the February Survey of Consumer Expectations from the Federal Reserve Bank of New York’s Center for Microeconomic Data showed individuals aren’t necessarily experiencing, nor anticipating, that level of openness by finance companies.

In fact, data from the New York Fed indicated the average perceived probability of a rejection of an auto-finance application reached 33.5%, the highest level since the start of the series 15 years ago.

The Credit Access Survey also pointed to an expected future tightening in credit conditions, which New York Fed researchers said is consistent with the February core Survey of Consumer Expectations. The share of respondents reporting that they expect it to be harder to obtain credit a year from now jumped to 46.7%, the highest since June.

Furthermore, researchers indicated the share of discouraged borrowers — defined as respondents reporting that they did not apply for any credit because they did not think they would get approved despite reporting a need for credit — reached 8.5%, the highest level since the start of the survey in October 2013.

The New York Fed also mentioned its data showed that the average likelihood of consumers being able to come up with $2,000, if an unexpected need arose within the next month, declined to 62.7%, a new series low.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

And researchers added consumers’ year-ahead expectations about their households’ financial situations deteriorated considerably in February. The share of households expecting a worse financial situation one year from now rose to 27.4%, its highest level since November 2023.

The New York Fed went on to note that the average perceived probability of an individual missing a minimum debt payment over the next three months increased by 1.3 percentage points to 14.6%, its highest level since April 2020.

Two other findings from the survey included:

—Median inflation expectations increased by 0.1 percentage point to 3.1% at the one-year horizon and were unchanged at 3.0 percent at the three-year- and five-year-ahead horizons.

—Mean unemployment expectations — or the mean probability that the U.S. unemployment rate will be higher one year from now — jumped up by 5.4 percentage points to 39.4% in February, its highest reading since September 2023.

Researchers reiterated the Survey of Consumer Expectations contains information about how consumers expect overall inflation and prices for food, gas, housing, and education to behave. It also provides insight into Americans’ views about job prospects and earnings growth and their expectations about future spending and access to credit.

The project also provides measures of uncertainty regarding consumers’ outlooks. Expectations are also available by age, geography, income, education, and numeracy.