Credit tightens again in July as new-car prices soar to record high

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

As Cox Automotive senior economist Charles Chesbrough noted, credit availability is one of the headwinds against used-vehicle retail sales.

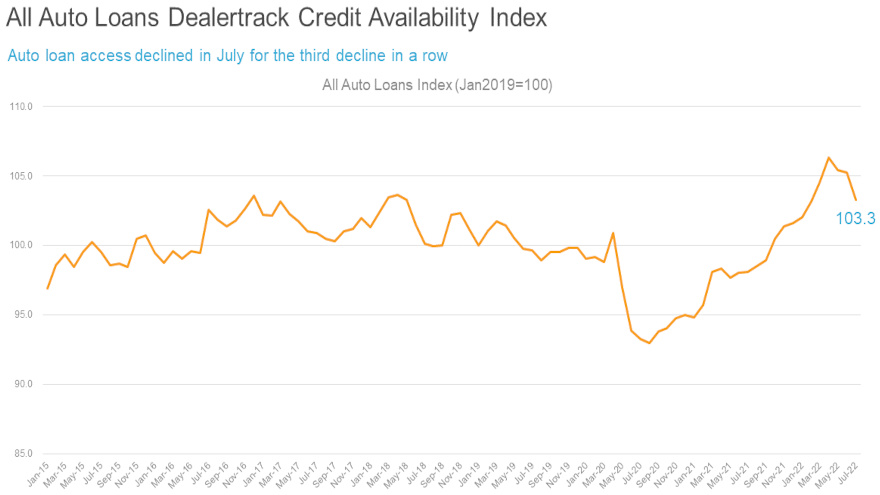

While still more available than this time last year, the Dealertrack Auto Credit Availability Index declined for the consecutive month in July. According to a Cox Automotive Data Point, the index softened by 1.8% to 103.3 in July, reflecting that auto credit was harder to get during the month compared to June.

However, experts pointed out that access was looser by 5.3% year-over-year. And compared to February 2020, they said access was looser by 4.2%.

The downward streak began in April when the index hit the highest recorded in the data series going back to January 2015.

“The credit availability factors mostly moved against consumers in July,” Cox Automotive said in the Data Point. “The average yield spread on auto loans widened, so rates consumers saw on auto loans were less attractive in July relative to bond yields. The average auto loan rate increased by 26 basis points in July compared to June, while the 5-year U.S. Treasury declined by 23 basis points, resulting in a wider average observed yield spread.

“The approval rate fell, and the subprime share declined, which worked against consumer access to credit in July as well,” experts continued. “The only factor to move in support of consumers in July was an increase in contract terms. Negative equity share and down payment size were stable in July relative to June.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Across all auto lending in July, yield spreads widened, the approval rate declined, and the subprime share declined, so those factors moved against accessibility. Terms lengthened slightly and that helped mitigate some of the tightening,” experts went on to say.

Each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details including term length, negative equity and down payments. Cox Automotive reiterated the index is baselined to January 2019 to provide a view of how credit access shifts over time.

Cox Automotive wrapped up its index update by adding that financing for new vehicles from all credit sources tightened the most in July, coinciding with another auto finance reading that showed more headwinds for car retailing.

New-vehicle affordability declined slightly again in July with increases in interest rates and new-vehicle prices reaching a record high, according to the Cox Automotive/Moody’s Analytics Vehicle Affordability Index.

The number of median weeks of income needed to purchase the average new vehicle in July increased to 42.2 weeks from a downwardly revised 42.0 weeks in June.

Experts noted that one element supporting affordability, median income grew 0.4% and incentives increased for the first time in 18 months. Most other factors, however, moved against affordability, according to Cox Automotive.

The average price paid for a new vehicle moved 0.3% higher to a new record of $48,182, according to the latest report of Kelley Blue Book average transaction prices. The average interest rate also moved against affordability, increasing another 19 basis points last month.

As a result of these moves, the estimated typical monthly payment increased 0.9% to $733, which was a record high, according to Cox Automotive.

“New-vehicle affordability in July was much worse than a year ago when prices were lower, incentives were higher, and rates were much lower. The estimated number of weeks of median income needed to purchase the average new vehicle in July was up 15% from last year,” experts said in another Data Point.

The Cox Automotive/Moody’s Analytics Vehicle Affordability Index (VAI) is updated monthly using the latest data from government and industry sources, including key pricing data from Kelley Blue Book.

“This important industry measure will be released at mid-month to indicate if the prices paid for new vehicles are moving out of consumers’ financial reach or becoming more affordable over time,” experts said.

While individuals are committing more to acquire used and new vehicles, Cox Automotive recapped that measures of consumer sentiment improved in July.

Experts noted that the Conference Board Consumer Confidence Index declined 2.7% in July when a smaller decline had been expected, and the June index was also revised down.

“Most of the index decline was driven by a 4.0% decline in expectations,” Cox Automotive said. “Plans to purchase a vehicle in the next six months declined to the lowest level so far this year and were down substantially year over year. The confidence index has not fallen as much as the sentiment index from the University of Michigan, but that series improved in July.”

Cox Automotive mentioned the Michigan index increased 3% from a record low in June, “as it is much more sensitive to inflationary changes and stock market moves.”

Similarly, experts pointed out the Morning Consult Index of Consumer Sentiment increased by 3.3% in July.

“These more inflation-sensitive measures moved higher as gas prices declined 16% by the end of July from the peak in June,” Cox Automotive said.