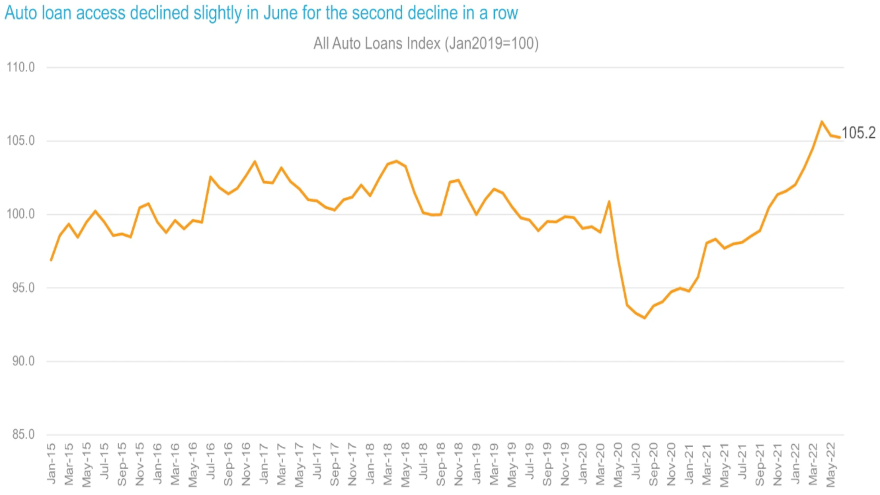

Dealertrack Credit Availability Index sags again from record high

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

While declining now for two months in a row, Cox Automotive reiterated that the streak connected with the Dealertrack Credit Availability Index began with the measurement at its all-time high.

A Cox Automotive Data Point distributed this week showed the Dealertrack Credit Availability Index ticked lower by 0.1% to 105.2 in June, reflecting that auto credit was slightly harder to get in the month compared to May.

Still, Cox Automotive explained that credit access was looser by 7.4% year-over-year. And compared to February 2020, analysts determined access was looser by 6.1%.

Cox Automotive pointed out that the index in April had been the highest recorded in the data series going back to January 2015.

“The credit availability factors were mixed in June, with some moving to help consumers and others moving against access,” analysts said in the Data Point that recapped the latest Dealertrack information. “The average yield spread on auto loans narrowed, so rates consumers saw on auto loans were more attractive in June relative to bond yields.

“The average auto loan rate increased by 21 basis points in June compared to May, while the five-year U.S. Treasury increased by 32 basis points, resulting in a narrower average observed yield spread. Also helping consumers was lengthening in terms and decline in average down payment size,” they continued.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Each Dealertrack Credit Availability Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity and down payments. The index is baselined to January 2019 to provide a view of how credit access shifts over time.

“Credit access saw more movement by lender types in June, with banks and captives tightening the most but auto-focused finance companies loosening,” analysts said. “On a year-over-year basis, all lenders had looser standards, with auto-focused financed companies having loosened the most.

“Across all auto lending in June, yield spreads narrowed, terms lengthened and the down payment percentage declined slightly, and the moves in those factors made credit more accessible,” analysts continued. “However, the approval rate declined, negative equity declined, and the subprime share declined, so those factors moved against accessibility.

“Working against consumers was a lower approval rate, declining negative equity share and a declining subprime share,” they went on to say.

Cox Automotive wrapped up this look at auto financing by noting that measures of consumer sentiment declined again in June.

Analysts recapped that the Conference Board Consumer Confidence Index declined 4.4% in June when a larger decline had been expected, but the May index was also revised down. They explained most of the index decline was driven by a 9.9% decline in future expectations as views of the present situation were barely changed, down 0.2% from May.

“Plans to purchase a vehicle in the next six months increased but remained down year over year,” Cox Automotive said. “The confidence index has not declined as much as the sentiment index from the University of Michigan, which declined 14.4% in June to a record low.

“The Michigan index is much more sensitive to inflationary pressures and stock market volatility as its questions focus on personal financial conditions, whereas the confidence survey focuses more on business conditions,” Cox continued.

“The Morning Consult Index of Consumer Sentiment declined 4.5% in June, but it improved modestly in the final week of the month as gas prices came down slightly,” Cox went on to say.