Experian: Amount financed for used vehicles slowed in Q3

Chart courtesy of Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

With used-vehicle prices easing a bit, the amount of risk that finance companies are absorbing into their portfolios is starting to abate a bit, too.

According to Experian’s State of the Automotive Finance Market Report: Q3 2022, the average amount financed to deliver a used vehicle during the third quarter came in at $28,506, representing a year-over-year increase of 8.59%.

Analysts said on Thursday that the rise is significantly smaller than the increase they saw at this time last year. In Q3 2021, there was a 21.37% year-over-year increase, reflecting how quickly used-vehicle values rose as new-vehicle inventory declined.

Experian reported the average amount financed for a new vehicle also saw an increase during the third quarter, growing from $37,753 in Q3 2021 to $41,665 in Q3 2022.

“Since the start of the inventory shortage, used vehicle values rose at a staggering rate, and that appears to be slowing, which is a positive sign for consumers looking to purchase a vehicle,” Experian senior director of automotive financial solutions Melinda Zabritski said in a news release.

“While average loan amounts and monthly payments are continuing to grow, there are many contributing factors, such as the rise in interest rates. Leveraging data to better understand these factors will help lenders and dealers make informed decisions in the days to come,” Zabritski continued.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

In the third quarter of 2022, Experian determined the average interest rate was 5.16% for new-model financing, and 9.34% for used-vehicle financing, up from 4.09% and 8.12%, respectively, last year.

Analysts explained the growth in average amounts finance and interest rates were also reflected in average monthly payments, which went from $618 in Q3 2021 to $700 in Q3 2022 for new vehicles, and from $472 to $525 for used vehicles, in the same time frame.

According to the Experian data, the average contract term also increased, from 69.51 months for new vehicles in Q3 2021, to 69.73 months in Q3 2022. The increase was larger for used vehicles, jumping from 66.97 months in Q3 2021 to 68.08 in Q3 2022.

Analysts highlighted credit unions held the largest market share of automotive finance in Q3 2022, surpassing banks, which had long been the largest provider in automotive finance.

Credit unions held 28.44% of vehicle financing this quarter, a 40% year-over-year increase, as they held 20.21% in Q3 2021.

Banks declined in market share, from 32.51% in Q3 2021 to 27.32% in Q3 2022, with similar trends seen for captive lenders, decreasing from 26.64% to 21.89%, year-over-year.

Experian spotted another notable shift in the auto finance market. It’s the significant decline in leasing for new vehicles, which dropped from 27.28% in Q3 2021 to 18.01% in Q3 2022.

Analysts indicated the types of vehicles consumers are looking to lease continues to evolve, with the top 10 models leased comprised of exclusively larger vehicles, such as full-size trucks, and SUVs. Leases often have a lower monthly payment than installment contracts, with the average difference between the payments clocking in at $133 in Q3 2022.

“Opting for a lease is one way that consumers look to manage their monthly payments, which is often how they shop for a vehicle,” Zabritski said. “Affordability will continue to remain top of mind as a decline in leasing, coupled with the lack of new vehicle inventory, will impact availability of used vehicles in a few years.”

Other additional findings for Q3 2022 included:

• Outstanding automotive balances increase from $1.2 trillion in Q3 2021 to $1.3 trillion in Q3 2022.

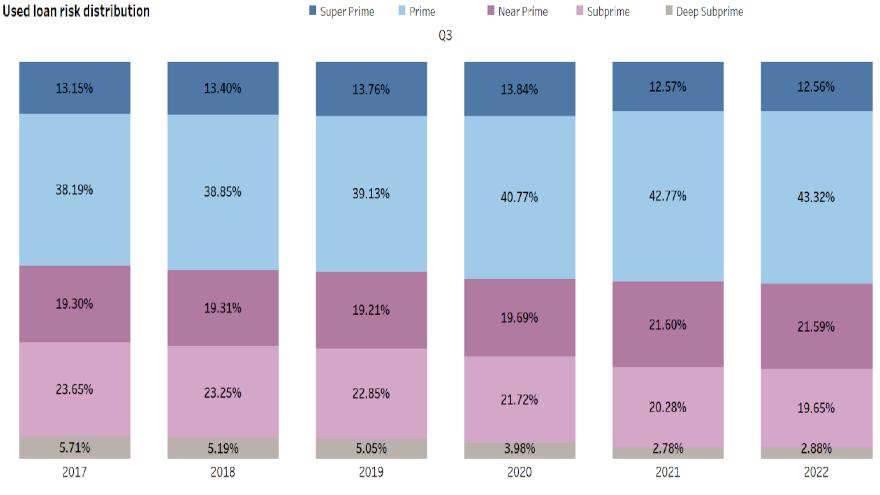

• While most growth was in prime financing (reaching 46.67%), deep subprime financing did increase slightly, from 1.76% in Q3 2021 to 1.85% in Q3 2022.

• Pickup trucks saw an increase in financing, from 15.84% in Q3 2021 to 17.19% in Q3 2022.

• The average credit score for consumers securing financing continued to increase, from 733 to 738 year-over-year for new vehicles, and from 675 to 678 year-over-year for use vehicles.

• Wyoming leads with the largest percentage of financing for used cars in Q3 2022 at 85.4%, while New York has the lowest at 65.5%.